The week is turning out to be great for spot Bitcoin ETFs as they started the week with a $520 million inflow on Monday and recorded another strong inflow of $577 million on Tuesday. The massive inflow came on the back of BlackRock iShares Bitcoin ETF witnessing an inflow of $520 million alone, pointing out high odds of $BTC price rally to $60,000.

BlackRock Leads Spot Bitcoin ETF Inflow

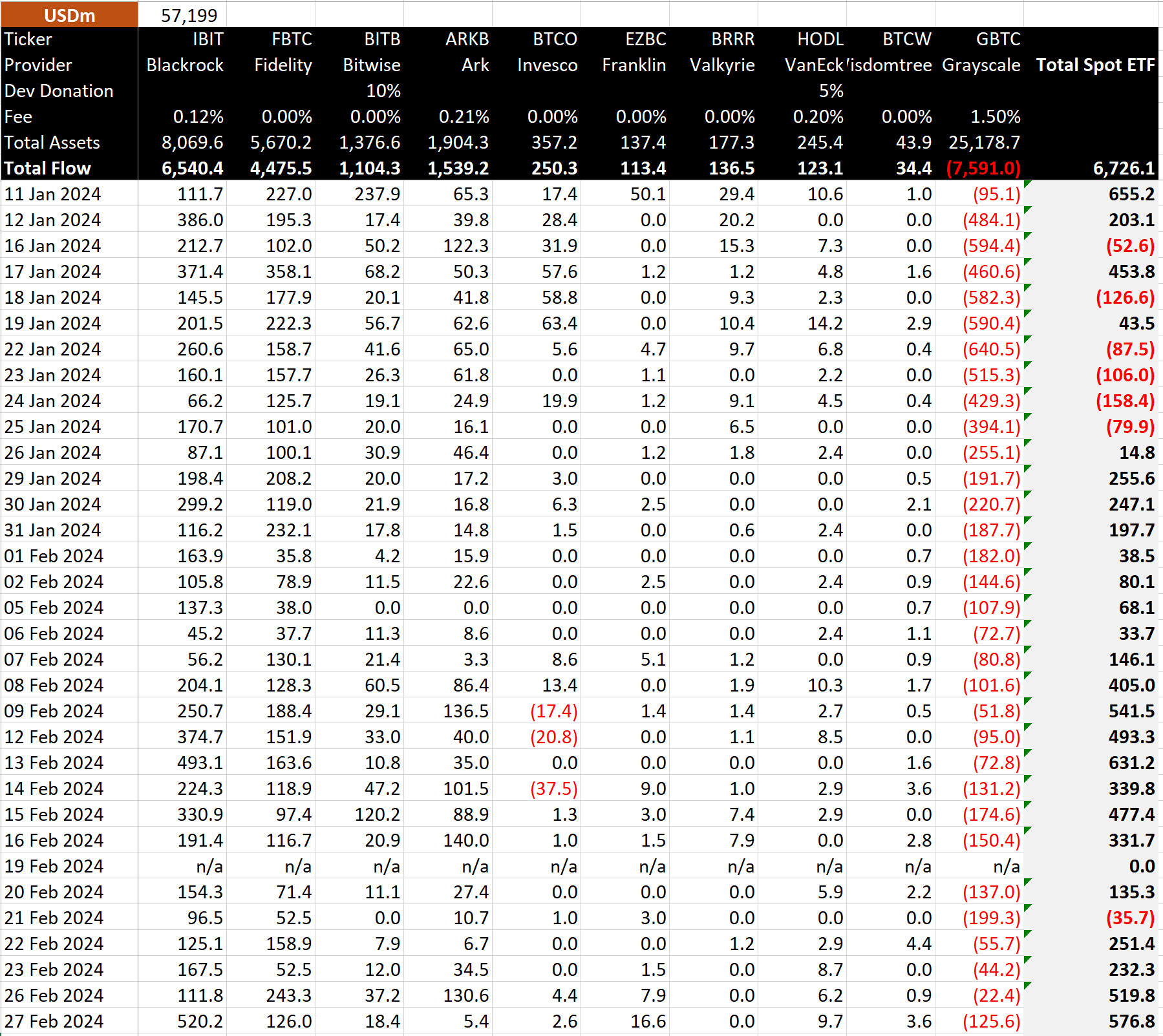

Spot Bitcoin exchange-traded funds (ETF) witnessed $577 million net inflow (or 10,167.5 $BTC net inflow) on February 27, according to data by BitMEX Research. This was the third-largest inflow until launch, as all nine spot Bitcoin ETFs recorded massive trading volumes. However, Grayscale’s GBTC outflow increased again on Tuesday after dropping to $22.4 million a day before.

BlackRock iShares Bitcoin ETF (IBIT) saw over $520 million, breaking its largest inflow to date record. IBIT also saw a record $1.3 billion trading volume, exceeding the daily trade volume of most large-cap US stocks. Following the latest inflow, BlackRock’s net inflow hit over $6.5 billion and asset holdings jumped over 141,000 $BTC.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL), and others spot Bitcoin also saw substantial inflows, indicating strong bullish sentiment among retail and institutional investors.

Notably, GBTC saw a $125.6 million outflow, an increase from Monday’s $22.4 million outflow, setting aside hopes of a paradigm shift. Bloomberg senior ETF analyst Eric Balchunas said the daily trading volume of nine new spot Bitcoin ETFs except GBTC exceeded $2 billion for the second consecutive day as $BTC price holds strongly above $57K.

Also Read: Sam Bankman-Fried’s Defense Counsel Proposes 6 Year Sentence or Less

$BTC Price Breaks Above $59,000

Crypto Fear & Greed Index has reached a 4-year high value of 82 today, with the market sentiment currently in the ‘Extreme Greed’ zone. The FOMO reaches into Wall Street as traders’ interest in $BTC is extremely high. Experts predicted $BTC price to hit $60,000 before bitcoin halving.

$BTC price skyrocketed to $59,000, less than 15% away from the $68.6K high established 27 months ago. The 24-hour low and high are $56,219 and $59,000, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating interest among traders.

Good morning,#Bitcoin is above $58K, where funding rates are going through the roof.

Astonishing strength, definitely areas to start looking for profits. pic.twitter.com/WXRzkEkaBA

— Michaël van de Poppe (@CryptoMichNL) February 28, 2024

Also Read: US SEC Request Judge Torres to Extend Remedies Briefing Deadlines in Ripple Case

coingape.com

coingape.com