Blackrock’s spot bitcoin exchange-traded fund (ETF) has had a second consecutive record-breaking day with over $1.3 billion in trading volume. The world’s largest asset manager’s Ishares Bitcoin Trust (IBIT) also saw a record net inflow on Tuesday. The fund’s total bitcoin holdings have now surpassed 141K bitcoins.

Another Record Day for Blackrock’s Bitcoin ETF

Nine recently launched U.S. spot bitcoin exchange-traded funds (ETFs) experienced another high-volume trading day on Tuesday. Leading the surge, Blackrock’s Ishares Bitcoin Trust (IBIT) broke its personal record yet again with $1.357 billion in trading volume. IBIT also saw massive inflows on Tuesday, totaling $520.2 million. On Monday, IBIT’s trading volume was $1.292 billion.

Bloomberg ETF analyst Eric Balchunas explained on social media platform X Tuesday that IBIT’s inflow is the “biggest haul” for a bitcoin ETF ever and the second most of any ETF. He noted that only Ishares Core S&P 500 ETF (IVV) took in more cash.

Whoa.. $IBIT took in $520 million all by itself yest, biggest haul for a btc ETF ever and 2nd most of any ETF yesterday, only $IVV took in more cash.. it is now $8b in aum, top 5% among all ETFs. This means a good portion of that massive volume was new buying vs arb/algo. pic.twitter.com/tnq7SaN2di

— Eric Balchunas (@EricBalchunas) February 28, 2024

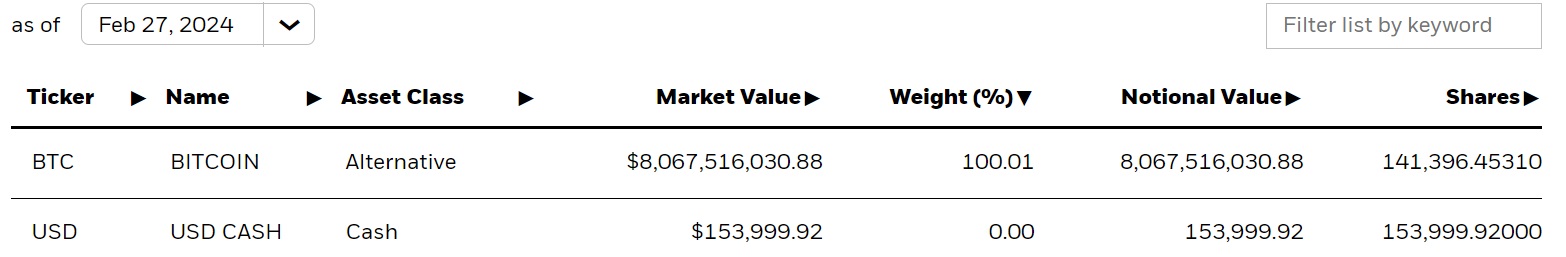

Balchunas added that Blackrock’s total bitcoin holdings now stand at more than $8 billion, which is the top 5% among all ETFs. “This means a good portion of that massive volume was new buying” as opposed to arbitrage or algo-trading, he opined.

IBIT also established a new personal best in trading volume, reaching $1.357 billion on Tuesday. Collectively, the nine recently launched spot bitcoin ETFs surpassed $2 billion in trading volume on the same day. Balchunas opined:

Another intense volume day for the nine [ETFs] with well over $2b traded. IBIT broke its personal record again w/ $1.3b (for context that’s more than most large cap U.S. stocks trade).

Besides IBIT, the nine spot bitcoin ETFs are Fidelity Wise Origin Bitcoin Fund (FBTC), Ark 21shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Invesco Galaxy Bitcoin ETF (BTCO), Wisdomtree Bitcoin ETF (BTCW), Vaneck Bitcoin Trust ETF (HODL), Franklin Bitcoin ETF (EZBC), and Valkyrie Bitcoin ETF (BRRR). They began trading on Jan. 11 after the U.S. Securities and Exchange Commission (SEC) approved them the previous day.

“Also interesting IBIT saw over 100,000 individual trades today. It was doing 30-60k the whole time up until Tuesday. It’s like it found a new gear over Pres Day wknd. I thought maybe it was just pent up volume due to long wknd but it did even more today so there goes that theory,” Balchunas pointed out on Tuesday.

What do you think about Blackrock’s spot bitcoin ETF breaking inflow and trading volume records? Let us know in the comments section below.

news.bitcoin.com

news.bitcoin.com