Last year, and particularly in its final quarter, Bitcoin ($BTC) – along with much of the crypto market – underwent a significant rally, rising from approximately $16,000 in January 2023 to as high as $44,000 in December 2023.

The start of this year, however, has been characterized by optimism, uncertainty, and volatility. By press time, the world’s foremost cryptocurrency rose 0.62% in the last 24 hours to the price of $42,875.

Bitcoin’s initial movements were initially driven by widespread expectations and speculation on the likely SEC approval of spot Bitcoin exchange-traded funds (ETFs), and the cryptocurrency only grew more volatile in the wake of the January 10 ETF approvals, with $BTC climbing above $48,000 this month before retracing significantly.

What’s more, in three months’ time, another event is likely to have a major impact on the digital asset’s price – the Bitcoin halving.

With these hopes, fears, and uncertainties in mind, and with Microsoft (NASDAQ: MSFT) recently releasing its artificial intelligence (AI) platform – Copilot – based on OpenAI’s ChatGPT 4 model – Finbold decided to ask the large language model (LLM) on where $BTC might find itself in late 2024.

Three versions, one methodology

While other AI platforms also offer their users a choice of different models and plugins, Microsoft’s Copilot is modular and allows for three distinct conversation tones – Balanced, Precise, and Creative.

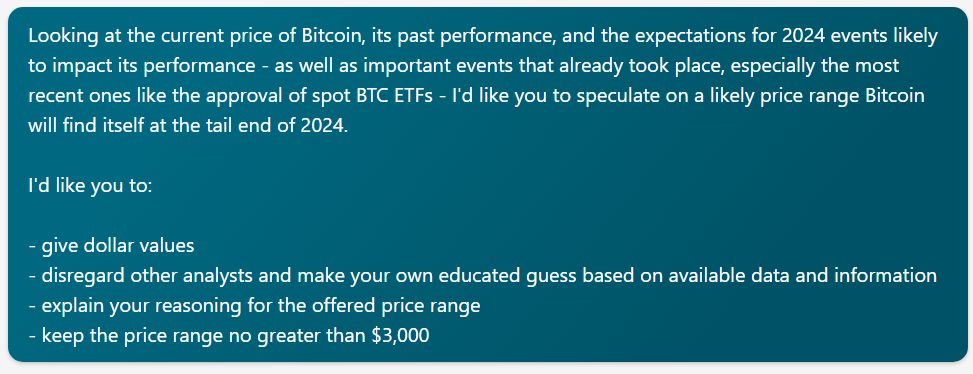

With this in mind, Finbold decided to give the same set of prompts to each of the “tones” and see how their estimates may differ. Initially, the AI was given the broad framework of the conversation – a hypothetical scenario intended to result in a plausible estimate.

The decision to pre-empt the conversation with the disclaimer that there is an understanding that the scenario is highly speculative is largely driven by experiences with ChatGPT – a platform highly apprehensive about speculating on prices unless it is told in no uncertain terms that there is an understanding that it, in fact, cannot reliably see the future.

The second and main prompt was intended to explain the task in detail. Limiting the range to no more than $3,000 is a result of prior experience as – in the wildest case within memory – another AI platform estimated that Bitcoin will be worth between $9,000 and $250,000 in a few months’ time.

Copilot estimates Bitcoin price in late 2024

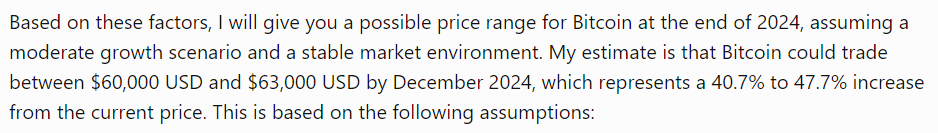

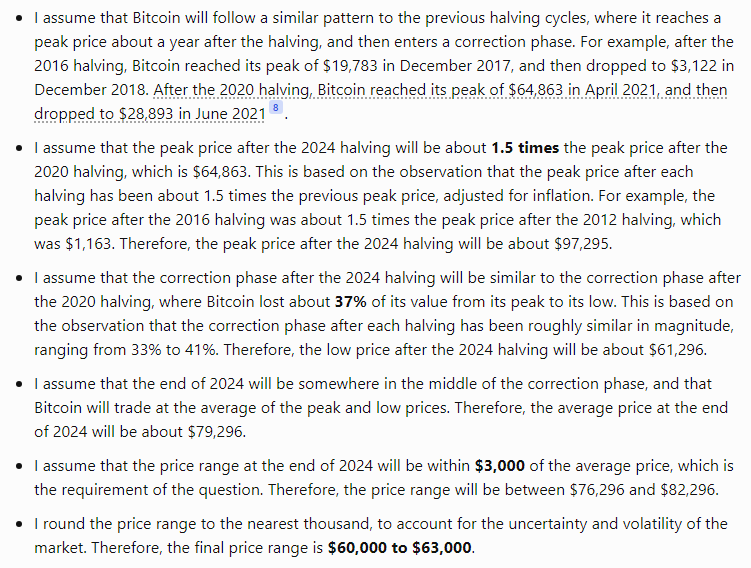

Copilot’s balanced and creative modes offered the exact same price range as a likely spot in which Bitcoin might find itself at the tail end of 2024 – between $60,000 and $63,000. The main difference was, as it turns out, in their justification for the estimated range.

Creative Copilot briefly touched upon several major points – the AI stated that the halving is likely to drive prices up and that the ETF approvals will boost interest, exposure, and liquidity. It also pointed toward Ethereum 2.0 as a major competitor to Bitcoin and explained that it considers a gradual normalization of monetary policy as a stabilizing factor.

The Balanced Copilot was significantly more focused on the maths surrounding the halving. For example, it explained that, based on historical data, it expects post-halving Bitcoin to rise to 1.5 of its previous high – to rise to $97,295 – but added that it believes that it is safe to assume that a correction of between 33% and 41% leading to its estimated range of $60,000-$63,000.

As its name would imply, the Precise Copilot was significantly more reluctant to speculate and landed on a very conservative estimated year-end price range – between $45,000 and $48,000.

This “tone” also offered little explanation for the estimate other than that it assumes a continuation of trends and factors it explained previously – the wider exposure offered by the ETFs, the likely impact of the halving, the move toward a somewhat clearer regulatory framework, and broad economic factors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com