Although the cryptocurrency market has had a rough run in 2026 so far, several digital assets are showing the potential to attract increased buying pressure.

Indeed, this momentum could elevate them to potentially reach a $100 billion market capitalization by the end of 2026.

To this end, Finbold has highlighted the following two such assets, supported by network upgrades, institutional interest, and expanding on-chain activity.

Solana ($SOL)

At the moment, Solana ($SOL) controls a market cap of about $49 billion, trading at $86 as of press time, down 3.87% in the last 24 hours.

To reach $100 billion from current levels, Solana would need to more than double in value. Based on an estimated circulating supply of about 570 million tokens, that would translate to a price near $175 per token.

Several market players remain bullish on the asset. For instance, analysts at Standard Chartered project Solana could reach $250 by the end of 2026, citing its positioning in stablecoin micropayments and continued infrastructure upgrades.

One of the most anticipated developments is the Alpenglow consensus upgrade, designed to improve transaction speeds and reduce finalization times, potentially strengthening adoption across decentralized finance and non-fungible token markets.

Although recent declines in decentralized exchange volumes suggest short-term selling pressure, Solana is hovering near technical support around $80, a level analysts view as critical for a potential rebound if broader sentiment improves.

Tron ($TRX)

For Tron ($TRX) to reach a $100 billion valuation, the token would need to surge roughly 3.7 times from current levels. Given its estimated circulating supply of 94.5 billion $TRX, that target would imply a price of about $1.06 per token.

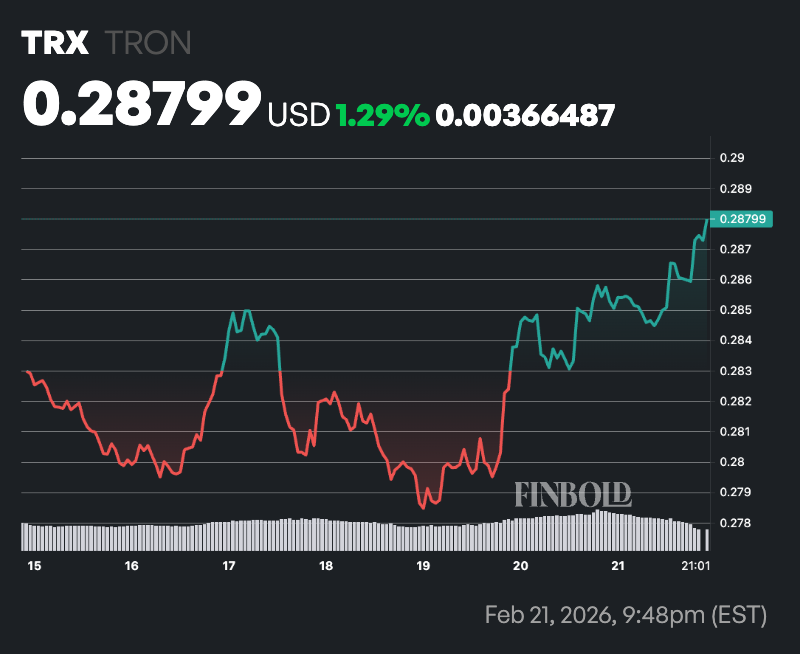

At present, TRON is trading at $0.28, down 0.3% over the last 24 hours, with its market capitalization standing near $27 billion.

Market projections suggest TRON could climb as high as $0.516 by year-end, supported by expanding total value locked and continued dominance in TRC-20 USDT transaction volumes.

At the same time, clearer regulatory frameworks in major markets and broader institutional participation in staking are viewed as additional upside catalysts.

Meanwhile, recent treasury purchases totaling more than 177,000 $TRX have helped solidify support around the $0.27 level. A sustained move above the $0.30 resistance zone would likely signal a fresh wave of upward momentum.

finbold.com

finbold.com