Welcome to our institutional newsletter, Crypto Long & Short. This week:

- David Mercer of LMAX Group on tokenization and capital markets that won’t sleep.

- Andy Baehr looks ahead to crypto’s “sophomore year”

- Top headlines institutions should pay attention to, curated by Francisco Rodrigues

- “Bitcoin & Gold: Correlation Turns Positive for First Time in 2026” in Chart of the Week

-Alexandra Levis

Expert Insights

2026 Marks the Inflection Point for 24/7 Capital Markets

- By David Mercer, CEO, LMAX Group

Capital markets still operate on a century-old premise: access-driven price discovery, batch settlement and collateral that sits idle. That premise is breaking down. As tokenisation accelerates and settlement cycles compress from days to seconds, 2026 will mark the inflection point where continuous markets shift from theoretical to structural.

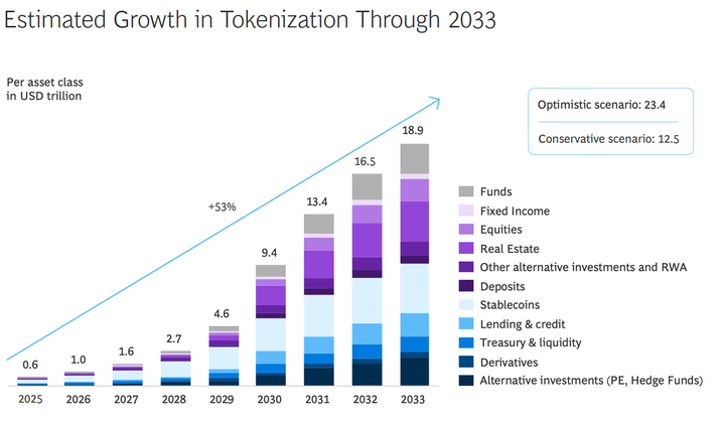

The predictions alone imply that this is inevitable, yet vary in their ambition. By 2033, market players have projected tokenised asset market growth to surge to $18.9 trillion. This represents a significant compound annual growth rate (CAGR) of 53% [see chart below]. This isn't speculative and is modest in my view — but it’s a logical milestone following three decades of efforts to reduce friction in capital markets, from electronic trading and algorithmic execution to real-time settlement. I believe, however, that once the first domino falls, there is the potential for 80% of the world’s assets to be tokenised by 2040. S-curves don’t merely compound at 50% per annum — think mobile phones or air travel.

What changes in a 24/7 market isn't just trading hours. It's capital efficiency. Today, institutions pre-position assets days in advance. Moving into a new asset class requires onboarding plus collateral positioning and can take five to seven days at minimum. Settlement risk and pre-funding requirements lock capital into T+2 and T+1 cycles (i.e., transactions settle either one or two days later), creating drag across the entire system.

Tokenized asset market growth forecast (Ripple, BCG)

Tokenization removes that drag. When collateral becomes fungible and settlement happens in seconds rather than days, institutions can reallocate portfolios continuously. Equities, bonds and digital assets become interchangeable components of a single, always-on capital allocation strategy. The weekend distinction disappears. Markets don't close, they rebalance.

This has second-order effects on liquidity. Capital trapped in legacy settlement cycles gets unlocked. Stablecoins and tokenised money-market funds become the connective tissue between asset classes, enabling instant movement across previously siloed markets; order books deepen, trading volumes rise and the velocity of both digitised and fiat money accelerates as settlement risk falls away.

For institutions, 2026 is the year operational readiness becomes urgent. Risk, treasury and settlement operations teams must shift from discrete batch cycles to continuous processes. That means round-the-clock collateral management, real-time AML/KYC, digital custody integration and acceptance of stablecoins as functional and fluid settlement rails. Institutions that can manage liquidity and risk continuously will capture flows others structurally cannot.

The infrastructure is already forming with regulated custodians and credit intermediation solutions moving from proof-of-concept to production. The approval by the SEC to grant the Depository Trust & Clearing Corporation (DTCC) approval to develop a securities tokenisation program that records ownership of stocks, ETFs and treasuries on the blockchain signals that regulators are contemplating this fusion seriously. Further regulatory clarity remains essential before full-scale deployment, but institutions that begin building operational capacity for continuous markets will now be well-positioned to move quickly when frameworks solidify.

Markets have always evolved toward greater access and lower friction. Tokenisation is the next step. By 2026, the question won't be whether markets operate 24/7, but whether your institution is able to. If you can’t, then you may not be part of this new paradigm.

Headlines of the Week

- By Francisco Rodrigues

While the U.S. and U.K. hit regulatory roadblocks over the past week, global adoption has been accelerating as South Korea unlocked corporate treasuries, a major brokerage integrated stablecoin funding and the Ethereum network saw adoption rise.

- Here's why Coinbase and other companies soured on the major crypto bill: A major piece of U.S. crypto legislation hit a wall in the Senate Banking Committee over stablecoin yield, a friction point that sees traditional banks and non-bank issuers collide.

- Interactive Brokers starts accepting $USDC deposits: Interactive Brokers (IBKR), a titan of electronic trading, launched a feature allowing clients to deposit $USDC (and soon Ripple’s RLUSD and PayPal’s PYUSD) to fund brokerage accounts instantly, 24/7.

- South Korea lifts 9-Year ban on corporate crypto investment: South Korean regulators lifted a nearly decade-long ban, now allowing public companies to hold up to 5% of their equity capital in crypto assets, limited to top tokens like $BTC and $ETH.

- UK lawmakers push to ban crypto political donations over foreign interference fears: Senior Labour MPs are urging UK Prime Minister Keir Starmer to ban cryptocurrency donations to political parties, citing concerns about foreign interference in elections.

- More people are using Ethereum for the first time, data shows: Ethereum has seen a significant increase in new addresses interacting with the network, indicating fresh participation.

Vibe Check

2026 - Crypto's Sophomore Year?

- By Andy Baehr, Head of Product and Research, CoinDesk Indices

A year has passed since Donald Trump's second Inauguration Day. For crypto, that day represented the hope (and expectation) of a new era in which regulatory ambiguity and clampdowns would be replaced by legislative and structural progress.

That's why 2025 struck me as a freshman year for crypto — the first year of matriculation in the premier institution of higher capitalism and finance, the United States.

That would make 2026 a sophomore year — a year to build, grow and specialize, now that first-year prerequisites have been satisfied and the surroundings are familiar. (Does this metaphor make it obvious that I have high-school aged children?)

The report card

So, how did freshman year go? Before we even begin, let us remember the mighty and “breadthy” rally (of prices, volume and volatility) that followed what was not a particularly surprising Election Day result. Think of Election Day as the "Congratulations! You're accepted" email (in my day, a "fat envelope") that caused an instant, jubilant, and carefree revelry. That party continued, with a few brief breathers, until Inauguration Day, when bitcoin made an all time high.

What followed, as we discussed in our 2025 Quarterly Review, were four quarters distinct in mood and outcome. Like most bright-eyed frosh, crypto got taught its first lesson early, ending the orientation honeymoon. The Tariff Tantrum and resulting hangover knocked bitcoin below 80,000 and $ETH clear down towards $1500.

By the second quarter, a rehydrated and caffeinated market found its rhythm, scoring well on its Circl (CRCL) IPO case and preparing to hand in its GENIUS Act project in early the third quarter. As the quarter progressed, everything fell into place, with ATHs, rich DATs, and stablecoins everywhere.

That's why the fourth quarter hurt so bad. A heartbreaking half semester marked by an F on the Auto-Deleveraging midterm — a real confidence killer. There was no recovery.

In the end, it matters how you perform.

Avoiding a Sophomore Slump

We (at CoinDesk Data & Indices) have rarely anticipated an upcoming quarter with as much energy and excitement as we do today, with a mighty slate of client launches and a rich pipeline of game-changing products. Yet we realize that to avoid the notorious "sophomore slump," crypto has to get a few things right in 2026.

Legislate and regulate. The CLARITY Act faces a tough road ahead, with stablecoin rewards controversy complicating an already difficult timeline. Small points must be put aside and compromise must be made to advance this critical legislation.

Figure out distribution. Crypto's most fundamental challenge remains building meaningful distribution channels beyond self-directed traders. Until crypto reaches retail, mass affluent, wealth and institutional segments with the same incentives for allocation as other asset classes, institutional acceptance won't translate to institutional performance. Financial products must be sold to be used.

Focus on quality. Last year's relative performance of CoinDesk 20 to the mid-cap CoinDesk 80 demonstrates that larger, higher-quality digital assets will continue to prevail. Twenty top names — currencies, smart contract platforms, defi protocols, infrastructure mainstays — provide plenty of breadth for diversification and new themes without cognitive overload.

Sophomore year can be daunting and unforgiving, but it can also be unforgettably productive and successful. This year offers crypto the chance to "declare a major" and begin a more meaningful contribution to multi-asset portfolios and global markets trading and risk management.

Off we go.

Chart of the Week

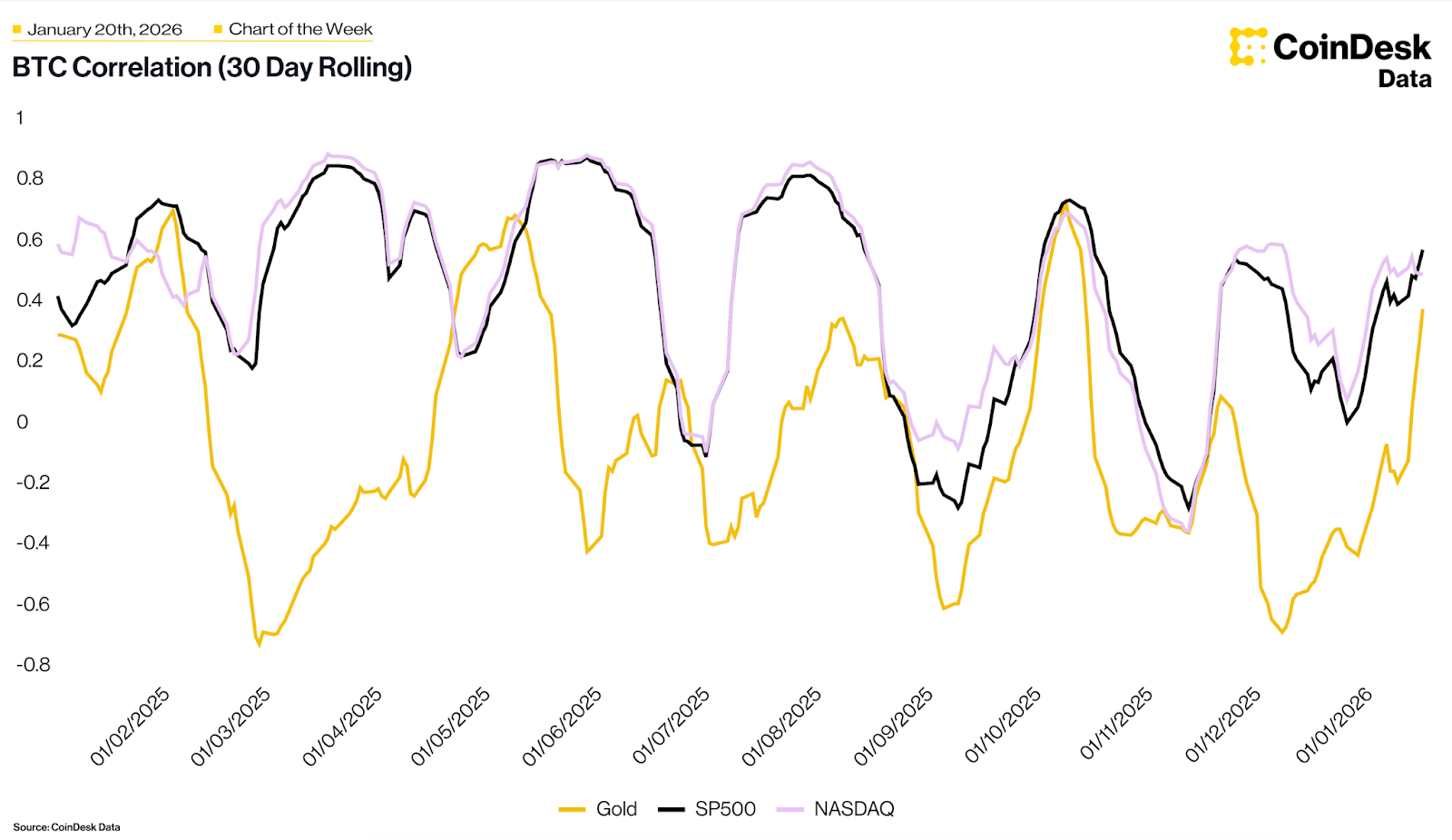

Bitcoin & Gold: Correlation Turns Positive for First Time in 2026

While gold hits new all-time highs, bitcoin’s 30-day rolling correlation has flipped positive last week for the first time this year to 0.40. Despite this shift, $BTC remains technically heavy, failing to reclaim its 50-week EMA after a 1% weekly dip. The core thing to monitor now is whether a sustained gold uptrend will provide a medium-term lift for bitcoin or if $BTC’s persistent price weakness confirms a decoupling from traditional safe-haven assets.

Listen. Read. Watch. Engage.

- Listen: "$15,000 $ETH by Year-End?" — Etherealize founders Vivek Raman and Danny Ryan join Jennifer Sanasie for a 2026 Ethereum Outlook.

- Read: In Crypto for Advisors, Michael Carbonara, candidate for the United States House of Representatives, explains how blockchain can provide transparency in government operations. Then, Alec Beckman answers questions on government use cases.

- Watch: Join Business Television for, “Understanding the Shape of Crypto” with Andrew Baehr, CFA.

- Engage: Consensus Miami is heating up with a great speaker line-up including Paul Atkins, Alex Rodriquez and Mike Novogratz. View the agenda and register today.

Looking for more? Receive the latest crypto news from coindesk.com and market updates from coindesk.com/indices.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.

coindesk.com

coindesk.com