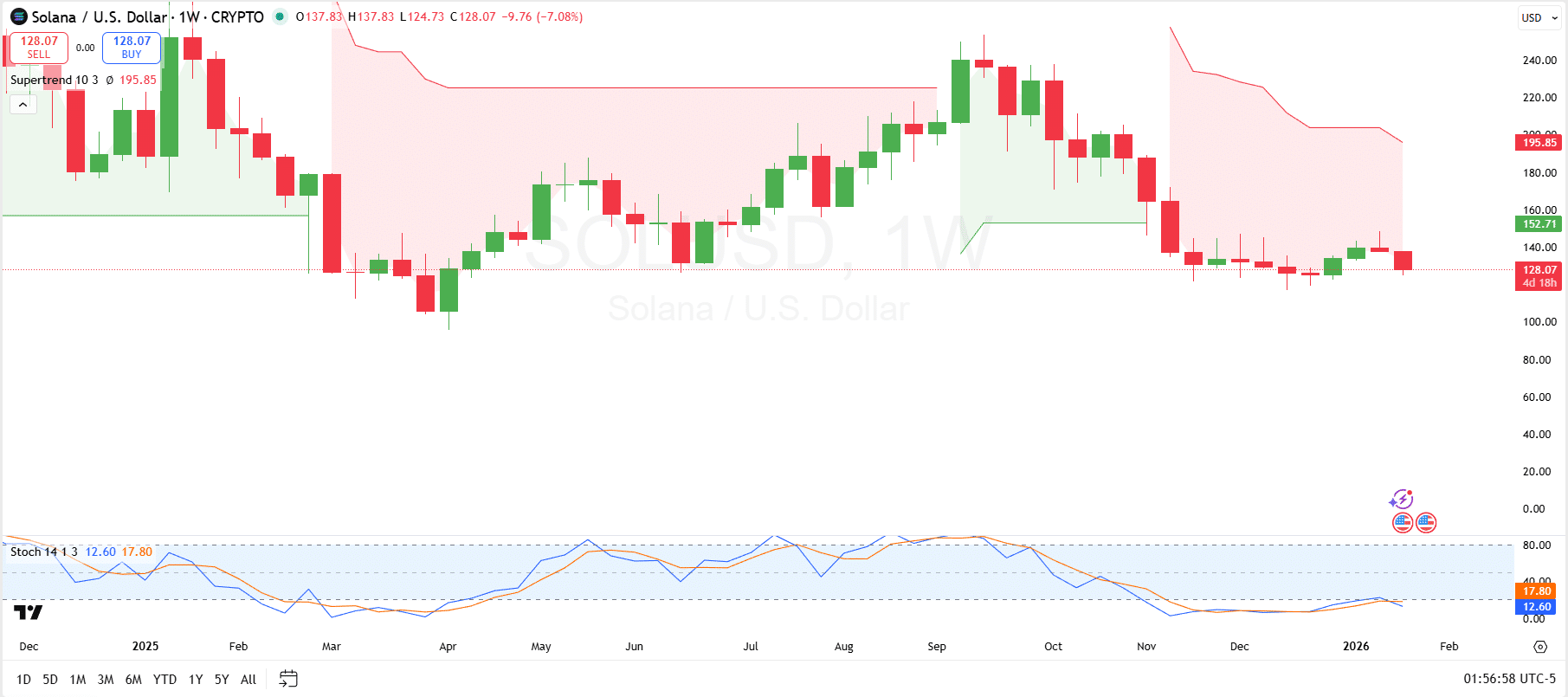

Solana is showing mixed technical signals, with ongoing pressure from the Supertrend indicator and potential for a short-term bounce from support.

Today, Solana ($SOL) trades for $128.29, reflecting a 2.6% decrease in the past 24 hours. The daily range has fluctuated between a bottom of $125.78 and a peak of $131.77, showing increased intraday volatility. The price saw a noticeable pullback during the day, but it has regained some ground, closing above the $128 mark, which suggests some buyer resilience at this level.

In terms of weekly performance, Solana is still down 11.4%, indicating that the recent dip has been persistent. Despite this recent pullback, Solana has remained relatively strong over longer timeframes, with a modest 1.5% increase over the past 30 days. However, the market will be watching closely to see if $SOL can regain its upward momentum.

How Strong Can $SOL Get?

While Solana has demonstrated resilience over 30 days, its weekly technical indicators present mixed signals. Specifically, the Stochastic Oscillator indicates oversold conditions, suggesting the potential for a short-term rebound or consolidation at lower levels.

However, the Supertrend indicator remains firmly in the bearish zone, with Solana trading below the red trend line, signaling continued pressure.

For Solana to regain strength, the price needs to break above key resistance areas, particularly the Supertrend’s level at $195.85, and hold above these levels. A breakout above these zones would suggest a potential trend reversal towards higher levels above $220.

Further, the chart shows that the %K line is trending below the %D line, which is a clear indication of ongoing bearish momentum. For the momentum to reverse, the %K line would need to cross above the %D line.

Solana Breaks Important Support Trendline

On the social commentary side, analyst Alek highlights that Solana has recently broken its critical support trendline, which has triggered a notable price drop. Following this breakdown, the price is now moving towards the next support zone around $126, where a potential short-term bounce could occur.

This level is key for traders to monitor as a potential point for price stabilization. On the other hand, the resistance at $148 remains significant. If Solana manages to bounce from the support, this could be a liquidity zone to potentially test.

thecryptobasic.com

thecryptobasic.com