2025 was a year of a major crypto drop, especially toward the end. Zcash, Monero, and $OKB were among the coins that outperformed the market and closed 2025 with significant gains.

That said, two privacy coins and an exchange token dominated 2025’s leaderboard. We tried to compile a concise look at how much each coin climbed this year, why it moved, and how traders reacted to it. However, if you’re more into the future rather than the past, please read our 2026 crypto predictions.

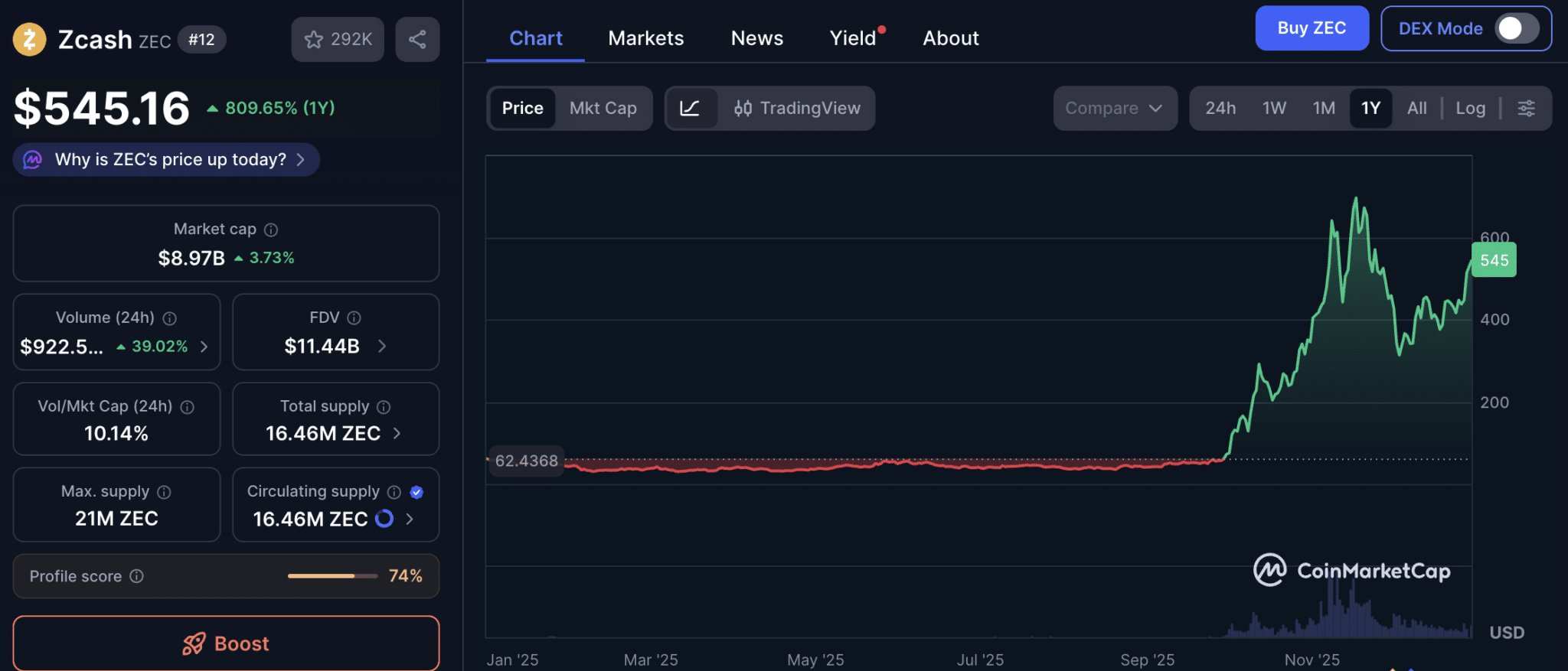

Zcash ($ZEC): over 800% YTD

Quick context: Zcash was launched in 2016 by Electric Coin Company. Zk-SNARKs, a core cryptographic technology behind the project, enable optional private transactions. 2025 momentum reflected a broader “privacy comeback.”

According to CoinMarketCap, $ZEC $541.3 24h volatility: 2.0% Market cap: $8.91 B Vol. 24h: $900.12 M is up roughly +800% year-to-date after an extraordinary September–November repricing. Monthly data shows a massive spike of over 400% in October alone. Despite the early December correction, the gains continued into late December.

$ZEC price in 2025 | Source: CoinMarketCap

A broad rotation into privacy tokens, high-profile endorsements, and renewed on-exchange interest moved the price. Coverage through the fall documented $ZEC’s surge past $500 and its return to large-cap territory, placing it in the 12th place on CoinMarketCap’s top 100 cryptos. In addition to X endorsements from analysts and crypto influencers, ZCash received support from its early supporter, Naval Ravikant, and BitMEX co-founder Arthur Hayes.

Bitcoin is insurance against fiat.

ZCash is insurance against Bitcoin. https://t.co/rqMrR3bW7O

— Naval (@naval) October 1, 2025

$ZEC became one of Coinbase’s most-searched assets in November. Its derivatives/spot activity spiked as the rally accelerated. In a nutshell, a classic “old-guard (‘dino’) sector” rotation that traders chased across privacy coins.

Monero ($XMR): over 120% YTD

Quick context: Monero was one of the early coins launched in 2014. It has default privacy (ring signatures, stealth addresses) and persistent community support, which helped it rebound despite past delistings.

According to CMC, $XMR $442.8 24h volatility: 2.8% Market cap: $8.17 B Vol. 24h: $92.41 M gained about 129% year-to-date. It recovered from early-year softness to print new-cycle highs in Q4.

Monero price in 2025 | Source: CoinMarketCap

There were two major catalysts for the Monero (XRM) price surge:

- An April price shock linked to a massive swap of 3,520 $BTC (circa $330 million at the time) into $XMR that turbocharged volumes.

- A mid-May continuation supported by improving privacy-feature narratives and possible relisting rumors.

On-chain sleuths, including ZachXBT, helped trace the $BTC-to-$XMR flow that triggered a short, thin-liquidity squeeze. It resulted in a transaction from a social engineering attack held by Somalians who operated a call scam centre in the UK. The victim was reportedly an elderly individual in the US.

Update: It is confirmed to be a social engineering theft from an elderly individual in the US.

— ZachXBT (@zachxbt) April 30, 2025

$OKB: over 110% YTD

Quick context: The exchange utility token for OKX, $OKB, was initially used for fees, launches, and ecosystem access. However, it’s now tied more closely to OKX’s X Layer network after 2025’s tokenomics overhaul.

Per CMC, $OKB finished the year with a 115% gain, despite heavy retracements after an August spike. The December correction did not wipe out much of the price either.

$OKB price in 2025 | Source: CoinMarketCap

A spike in August was caused by a promise to burn of 65.26 million $OKB (around $7.6 billion), halving the supply and fixing the total at 21 million, alongside upgrades to OKX’s X Layer (zkEVM) stack. The supply shock more than doubled the price intraday (from $46 to $105) and briefly sent volumes up 13,000% before settling.

The burn produced a textbook supply-side squeeze that spot traders and fast-money funds chased across majors and perps. Liquidity and volumes ballooned during and immediately after the announcement window.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

coinspeaker.com

coinspeaker.com