Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

2025 closed as a watershed year for Europe’s digital asset ecosystem: legislative clarity arrived globally at scale, institutional rails matured, and market participants, from native crypto firms to traditional banks, accelerated pilots and product launches. But clarity breeds competition and complexity.

- 2025 marked Europe’s regulatory and institutional turning point for digital assets, with MiCA implementation, stronger market infrastructure, and steady institutional participation — but also more competition, complexity, and lingering risk sensitivity.

- Traditional finance moved from pilots to production, increasingly favoring partnerships over rebuilding, as tokenisation and stablecoins proved real efficiency gains while time-to-market became a decisive advantage.

- 2026 shifts the focus to execution, where winners will be firms that convert licences and pilots into scalable products, navigate overlapping regulation, build liquidity for tokenised assets, and meet rising standards for custody, resilience, and transparency.

In 2026, we believe Europe will move from regulatory implementation to greater certainty, and the real questions will be about operational execution: Who can convert licences, pilots, and whitepapers into safe, scalable products that win customers and preserve capital?

This piece looks back at 2025 briefly, then examines stablecoins, tokenisation, the digital-euro landscape, and pragmatic routes for traditional finance to mobilize rapidly without trying to rebuild the industry from scratch.

Introduction

In 2025, Europe finally reached a level of regulatory maturity that institutions had been waiting for. Markets in Crypto-Assets Regulation moved from concept to practical implementation, giving firms a unified set of rules on issuance, custody, and service provision. Regulators spent the year translating that framework into day-to-day supervision, aligning it with older financial legislation and forcing businesses to tighten processes as they prepared for scale.

Market infrastructure also took meaningful strides. Custodians expanded their services, prime-brokerage became more institutional in design, and euro-denominated stablecoin rails grew more credible. Central banks deepened their digital-currency pilots, and institutional flows across exchanges and OTC venues shifted from intermittent to steady.

But the path forward has not been frictionless. Licensing overlap between MiCA and existing payments regulation created operational bottlenecks, stablecoin governance faced heightened scrutiny, and tokenisation pilots exposed just how complex real-world integration really is. Beneath the surface, the psychological aftershocks of Terra, Celsius, and FTX still shape industry behaviour, keeping risk appetite in check even when fundamentals improve.

Overlaying this was a global narrative twist driven by the U.S. political transition. The change in administration at the start of 2025 initially injected optimism into the digital-asset sector, as many expected a more constructive regulatory tone. But optimism collided quickly with disruptive tariff policies that hit risk assets broadly and sent volatility across global markets. For crypto, it felt like escaping one set of constraints only to be confronted with another.

So although much of what was predicted at the end of 2024 has indeed materialised, not least the continued rise in adoption and institutional engagement, the mood has remained unsettled. As the year closes, that mix of real progress and shifting policy winds sits against a backdrop of widening macro uncertainty, causing end-of-year nerves to creep in across all markets.

Bitcoin (BTC) volatility is calculated using the percentage between its high and low price for the year in relation to its open price.

| Year | Open price | Low price | High price | Difference | % |

| 2010 | 0.06 | 0.05 | 0.46 | 0.41 | 683% |

| 2011 | 0.30 | 0.25 | 35.88 | 35.63 | 11877% |

| 2012 | 4.61 | 3.77 | 17.76 | 13.99 | 303% |

| 2013 | 13.55 | 11.59 | 1,156.14 | 1,144.55 | 8447% |

| 2014 | 754.97 | 289.30 | 1,017.12 | 727.82 | 96% |

| 2015 | 320.44 | 171.51 | 495.46 | 323.95 | 101% |

| 2016 | 430.72 | 354.91 | 979.40 | 624.49 | 145% |

| 2017 | 963.66 | 755.76 | 20,089.00 | 19,333.24 | 2006% |

| 2018 | 14,112.20 | 3,191.30 | 17,712.40 | 14,521.10 | 103% |

| 2019 | 3,746.71 | 3,391.02 | 13,796.49 | 10,405.47 | 278% |

| 2020 | 7,194.89 | 4,106.98 | 29,244.88 | 25,137.90 | 349% |

| 2021 | 28,994.01 | 28,722.76 | 68,789.63 | 40,066.87 | 138% |

| 2022 | 46,311.74 | 15,599.05 | 48,086.84 | 32,487.79 | 70% |

| 2023 | 16,547.91 | 16,521.24 | 44,705.52 | 28,184.28 | 170% |

| 2024 | 42,280.24 | 38,521.89 | 108,268.45 | 69,746.56 | 165% |

| 2025* | 93,425.10 | 74,436.68 | 126,198.07 | 51,761.39 | 55% |

* To mid-December 2025

Source: statmuse

TradFi is coming

Traditional finance has accelerated its shift into digital assets, and 2025 marked the first year in which this transition felt structural rather than experimental. The momentum is unmistakable: Banks, asset managers, and market infrastructure providers across Europe are now actively exploring tokenisation and on-chain settlement, spurred on by regulatory clarity under MiCA and the rapid rise of regulated stablecoins as credible tools for value transfer. What once sat on the periphery is now crossing into the core of treasury, trading, fund distribution, and collateral management.

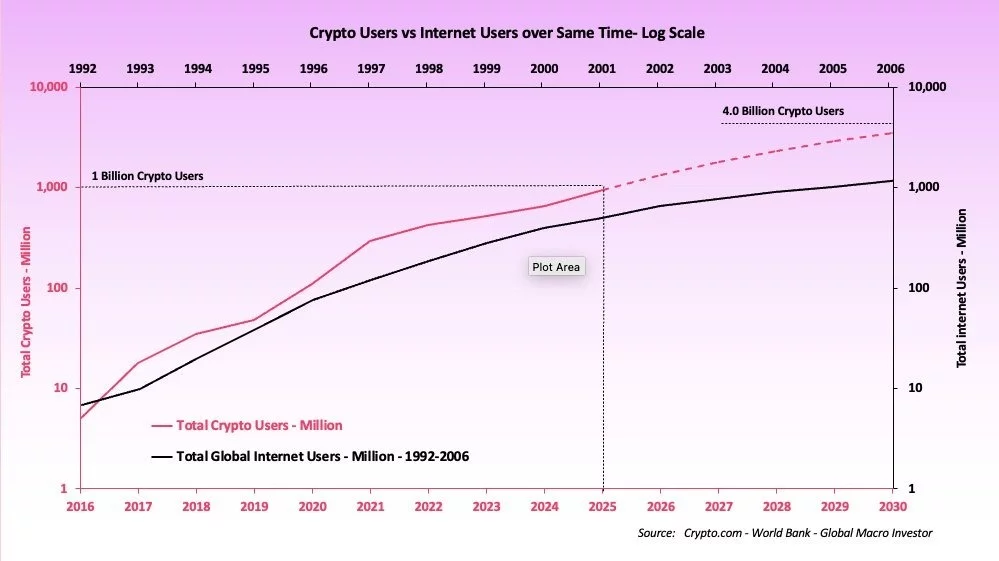

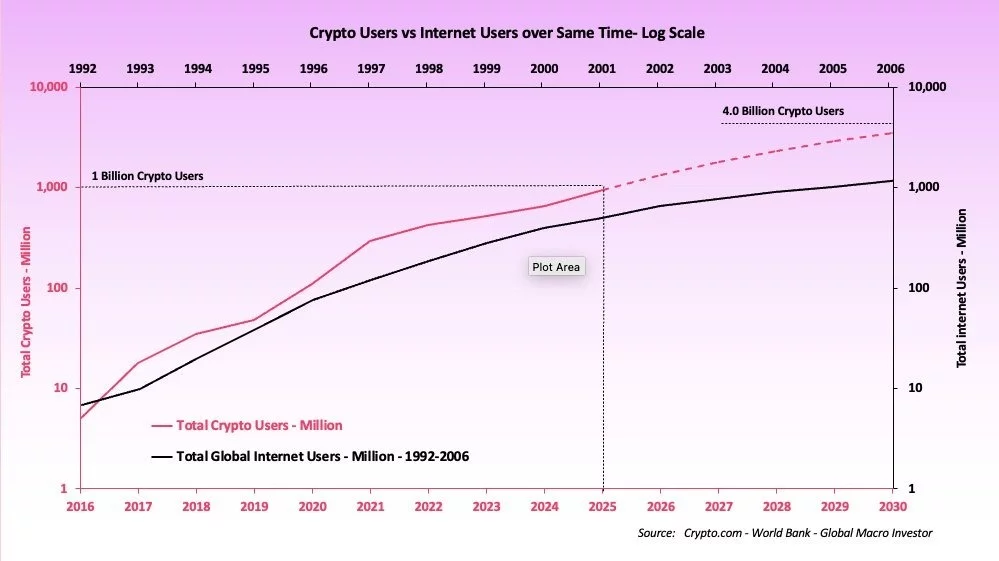

But as enthusiasm grows, a fundamental constraint becomes clear. Legacy institutions excel at risk management, client stewardship, and balance-sheet operations, yet their engineering stacks, onboarding frameworks, and product-development cycles are often not built for the pace and iteration that define blockchain-native markets. Attempting to reinvent every component internally is slow, costly, and risks producing isolated “crypto pockets” that never integrate cleanly with the rest of the organisation. You only have to look at the rate of adoption of digital assets, in particular stablecoins and crypto in general, to understand why TradFi is taking note (see the charts below):

This is why many of the most successful players are choosing pragmatism by partnering with proven infrastructure providers rather than trying to rebuild the entire vertical. Custodians, regulated stablecoin issuers, and prime-brokerage specialists already operate secure, audited systems that meet institutional expectations. By integrating rather than replicating these primitives, banks can move quickly while retaining governance through service-level agreements, regulatory oversight, and on-chain transparency. We are seeing this first-hand: Modular APIs, regulated custody, and secure trading solutions remove large sections of engineering, security, and compliance burden, allowing institutions to focus their internal resources on where they add the most value.

Where direct ownership matters, acquisition or white-label solutions give institutions a faster route to market without compromising the client relationship, and internally, banks are concentrating their build efforts on the layers that differentiate them — client journeys, KYC/AML orchestration, margin and collateral management, risk engines, and treasury optimisation — while allowing specialised providers to handle custody, settlement, and tokenization rails.

The shift towards tokenisation makes this model even more compelling. As more assets move on-chain, from short-dated credit instruments to tokenised money-market funds, institutions are realising tangible benefits: faster settlement cycles, improved transparency, and greater efficiency in treasury workflows. Tokenised fund issuance alone has grown meaningfully, with on-chain money-market products now representing a multi-billion-dollar segment — an early signal of how capital-market infrastructure may be reshaped.

Time-to-market is becoming a key competitive advantage. In 2025, we saw a stark divergence: Firms that partnered with infrastructure providers could launch quicker, iterate with real client usage, and scale with confidence while minimising delays, rework, and regulatory friction. We believe that pattern will only accelerate in 2026 as the ecosystem matures and the opportunity cost of moving slowly becomes harder to justify.

The TradFi train has left the station — but the firms most likely to arrive successfully at “destination crypto” are those embracing collaboration over reconstruction, focusing on their strengths while leveraging the infrastructure already purpose-built for the digital-asset era.

Tokenization of real-world assets is moving from concept to deployment

Tokenization is no longer a theoretical efficiency exercise — it is now pulling traditional finance directly onto blockchain rails. Throughout 2025, we saw an acceleration in the use of tokenised real-world assets as acceptable forms of collateral, particularly in short-dated credit, fund interests, and high-quality liquid assets. By representing these instruments on-chain, firms are gaining the ability to move value with far greater speed and precision. Settlement windows, which once relied on cumbersome batch processes, are tightening, real-time margining is becoming feasible, and capital that was previously trapped in operational pipelines is being unlocked.

A major advantage lies in provenance. Once an asset is tokenized, its ownership, movement, and encumbrances become easier to verify, reducing settlement risk and enabling new types of secured lending markets. This transparency is helping to stimulate fresh sources of yield, as institutions can lend and borrow tokenised assets with confidence. Moreover, the product-development cycle for issuers is compressing: Auditability, compliance hooks, and reporting workflows can be embedded at the protocol level, allowing new funds and structured products to reach the market more quickly while remaining securely custodied throughout their lifecycle.

Stablecoins will continue to expand — but Euro-denominated options may still lag behind

Stablecoins remain the most widely adopted blockchain-based financial instrument, powering global value transfer, cross-border settlement, and 24/7 treasury operations. Regulatory frameworks such as MiCA in Europe, the GENIUS Act in the U.S., and frameworks emerging across the Middle East and Asia have provided a clearer foundation for compliant issuance and reserve management. This has supported the rapid growth of the market, with over $305 billion now circulating on public blockchains.

However, a bifurcation is emerging. While USD-denominated stablecoins dominate global volumes and liquidity, euro-denominated stablecoins are still in the early stages of development. Despite MiCA creating a formal category for e-money tokens, practical adoption has been constrained by a combination of regulatory ambiguity, uneven supervisory interpretations, and the operational burden placed on issuers. Key areas — such as reserve requirements, interaction with payment-services rules, and interoperability between jurisdictions — still require refinement before euro stablecoins can scale meaningfully.

As a result, most on-chain settlement activity in Europe continues to rely on dollar-based stablecoins, even for euro-area institutions. Without clearer pathways and lighter frictions under MiCA, we expect EUR stablecoins to struggle to evolve from niche instruments into deep-liquidity settlement assets.

That said, the direction of travel is encouraging. Multiple regulated fintechs, payment providers, and, increasingly, traditional banks are preparing to issue or integrate stablecoins as they recognise the structural advantages: faster settlement, programmable cashflows, reduced reconciliation overhead, and continuous liquidity. The more the underlying infrastructure matures, the more capital will flow — faster, cheaper, and around the clock.

But for Europe to fully participate, MiCA must evolve, and the region must foster an environment where euro-denominated stablecoins can achieve the same robustness, utility, and liquidity as their dollar counterparts.

So what’s in store for 2026?

As the industry moves into 2026, the priorities for senior leaders are becoming clearer: We believe this is the year where operational discipline, regulatory alignment, and real institutional use-cases will matter more than headline narratives. Custody and resilience remain at the top of the agenda, with regulators expecting firms to demonstrate uncompromising standards around asset segregation, continuity planning, and independent verification. Robust audits and credible proof-of-reserves may shift from differentiators to baseline requirements, reflecting a broader push toward institutional-grade infrastructure across digital assets.

Regulatory mapping will likely become a core strategic exercise. MiCA, payments directives, and local licensing regimes now overlap in ways that force early decisions about where to seek full authorisation, where to partner, and where to streamline product scope. Cross-border firms will need clearer licensing blueprints and governance structures to bring new services to market without accumulating unnecessary regulatory debt. Those already operating under high-standard supervisory regimes will find themselves with a structural advantage as institutions look for partners that can scale compliantly across multiple jurisdictions.

Liquidity for tokenized instruments is another major theme for 2026. As more securities and funds move on-chain, issuers and asset managers may demand certainty around settlement, collateral mobility, and market-making support. Efficient connectivity to financing providers, market makers, and off-exchange settlement networks will determine how quickly tokenised markets mature. The firms best positioned will be those that can offer custody, settlement, and credit intermediation in a tightly integrated way — giving institutions confidence that these assets can trade with predictable spreads and operational reliability.

Stablecoins will likely continue to expand in both scope and scrutiny. With global regulatory clarity improving and usage accelerating, the market may face new expectations around reserve segregation, transparency, and redemption management. Institutions would be incentivized to evaluate stablecoin providers based on the quality of their attestations, the governance of their reserves, and their ability to withstand redemption shocks with minimal contagion risk. Providers that can demonstrate strong controls and clear reporting will be well-positioned to shape the next phase of growth.

These shifts could create meaningful commercial opportunities. Corporates and asset managers are beginning to use regulated e-money tokens and on-chain settlement to streamline treasury operations and reduce cross-border friction. Tokenized fund distribution is opening private markets to a broader investor base through fractionalization. Traditional financial institutions are seeking integrated custody, settlement, and reporting solutions rather than patchwork setups. And financed trading built around tokenised collateral is rapidly emerging as a frontier where liquidity networks, credit intermediation, and secure asset servicing converge.

Taken together, we believe 2026 will not be defined by a single technological breakthrough but by the industry’s ability to operationalise regulation, integrate new rails, and turn pilots into production-level workflows. Europe’s improved regulatory clarity, continued progress in programmable money, and maturing institutional infrastructure create a supportive backdrop.

The organizations best positioned to win will be those that execute: Companies that combine compliance discipline with product agility, partner where it makes sense, and design systems that account for multiple settlement paths and legal outcomes. In a market of rising institutional expectations, advantage will accrue to firms capable of delivering safe, integrated, and compliant on-chain experiences at scale.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, BitGo does not warrant its completeness or accuracy.

Brett Reeves is the Head of Go Network and European Sales at institutional digital asset infrastructure provider BitGo. Prior to joining BitGo, Brett was Head of Business Development at Bequant, a leading, regulated digital asset Prime Broker. Brett was responsible for driving global revenue growth and strategic relationship management with leading providers in the digital asset ecosystem. Brett had spent the previous 19 years working for various global investment banks within their Prime Brokerage and OTC Clearing sales teams. These included roles in London for Citibank and Nomura, and more recently Standard Chartered Bank in Singapore, where he spent 8 years building their FX and Interest Rates Prime Brokerage platform, where he ran sales across MENA and ASEAN. Across all of his roles, Brett has worked in a multi-functional capacity, helping build business and relationships across multiple stakeholder groups. This has involved engaging with regulators across the Middle East and Asia, ensuring adherence to complex cross-border considerations. Setting client and product strategies to ensure target returns and capital requirements are met whilst creating a culture to foster growth and an open and collaborative environment.