Despite recent recovery signs, Cardano price faces key resistance that must be broken to test its 3-month high.

Cardano (ADA) price action has shown a pronounced downtrend, with ADA retreating from a high of around $0.47 on November 20, to bottom around $0.39 the next day. The 24-hour range, which fluctuated between $0.4065 and $0.4274, indicates that despite some brief intraday bounces, ADA is still facing resistance in its attempt to reclaim higher levels.

In the larger timeframes, the market sentiment around ADA has turned increasingly bearish. The broader 7-day and 30-day performance highlights a deeper corrective phase, with losses of 10.5% and 26.1%, respectively.

Cardano’s market cap has also dropped to $15.28 billion. This performance, which now looks indecisive, leaves market watchers with a question: Will Cardano bulls prove their strength, or will the bears paint it further red?

Cardano Price Analysis

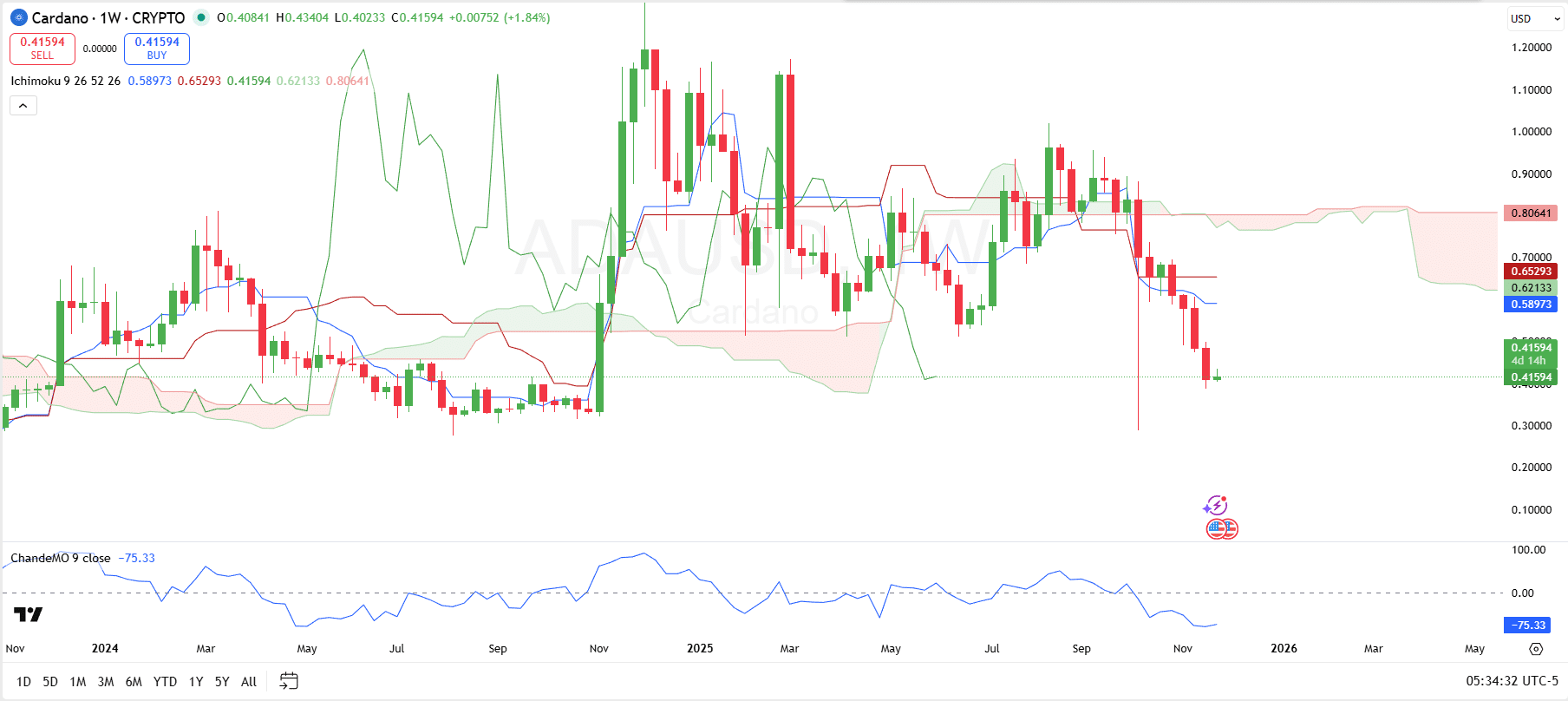

Cardano’s weekly chart shows a bearish continuation, as the price struggles below key resistance levels. The Ichimoku Cloud indicators highlight the overall weakness in the market, with the price well below the cloud.

For instance, the Tenkan-sen, at $0.59, and Kijun-sen, at $0.65, lies in a bearish cross, further signaling a negative market structure. These levels will also serve as immediate resistance in case the bulls strike.

For Cardano to shift its momentum and target the $1 liquidity zone, it must first break above the cloud, specifically around the $0.75 range. If the bears continue their action, support levels like $0.29 could be tested.

Meanwhile, the Chande Momentum Oscillator (CMO) adds to the bearish sentiment, with its value currently deep in negative territory at -75.33, although signs of consolidation are visible.

While the current price is trying to hold above the support zone, the CMO reading suggests that Cardano is still struggling to find bullish traction. The market’s inability to close above the cloud or generate momentum on the oscillator points to a continued cautious outlook for ADA.

Cardano’s Rising Social Dominance

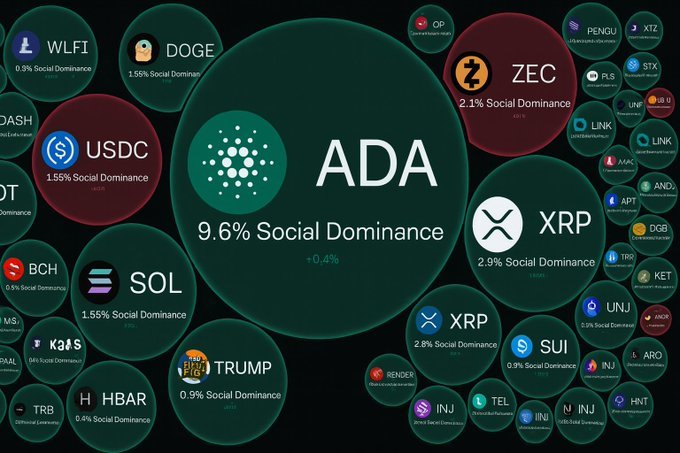

On the fundamental end, Cardano’s 9.6% social dominance stands out, particularly when compared to other major chains, according to a snapshot by Mintern. For instance, XRP comes in at 2.9%, while Solana (SOL) holds 1.55%, and USDC has 1.55% as well.

These figures indicate that while other chains like XRP and Solana have a solid presence in social media discussions, Cardano’s dominance is much more pronounced. This could suggest a more passionate and active base of users and investors surrounding Cardano, which is often an indicator of potential price movements driven by sentiment.

thecryptobasic.com

thecryptobasic.com