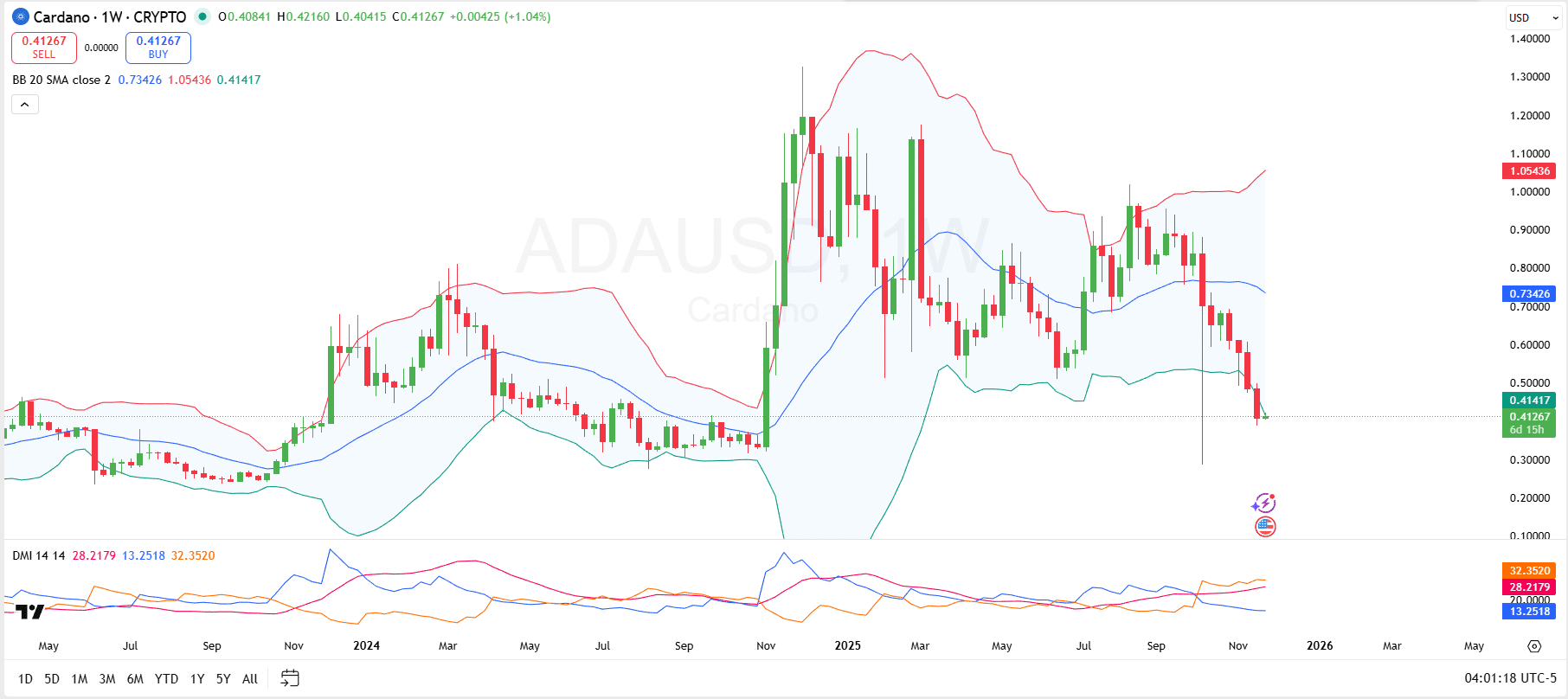

Cardano trades near its weekly lower Bollinger Band, signaling strong downside pressure with the mid-band acting as key resistance.

Cardano is trading around $0.4124, edging up about 0.6% over the past 24 hours as short-term traders test support near the $0.40 mark. The 24-hour range between $0.4059 and $0.4202 shows intraday volatility, while market capitalization sits near $15.1 billion with roughly $825 million in daily trading volume.

Zooming out, however, the picture is far less stable. ADA is down about 16.7% over the past week, 30.0% in the last two weeks, and 36.7% during the last month. Its one-year performance shows a decline of more than 60%. This sharp drawdown, set against a modest 24-hour bounce, raises key questions about whether Cardano is forming a short-term base or simply pausing before another leg lower.

Cardano Price Analysis

On the weekly Cardano chart, Bollinger Bands highlight how aggressively the trend has turned lower. Specifically, ADA is trading below $0.41, almost exactly on the lower band around $0.414, after sliding from the mid-range just a few weeks ago. The mid-band (20-week simple moving average) is around $0.73, and could serve as an initial resistance zone.

Any rebound will likely meet resistance first at the mid-band and then near the upper band around $1.05. The broadened bands reflect elevated volatility and may eventually be followed by contraction if Cardano begins to consolidate.

Elsewhere, the Directional Movement Index (DMI) reinforces this bearish picture. The ADX line is holding at 28, signaling a strong, established trend, while the negative directional index (-DI) around 32 stands well above the positive index (+DI) near 13.

This confirms that downside momentum is dominant and that selling pressure has been sustained rather than a brief shakeout. Until +DI begins to rise and crosses back above -DI, the indicator set continues to frame Cardano’s structure as a live downtrend rather than a completed correction.

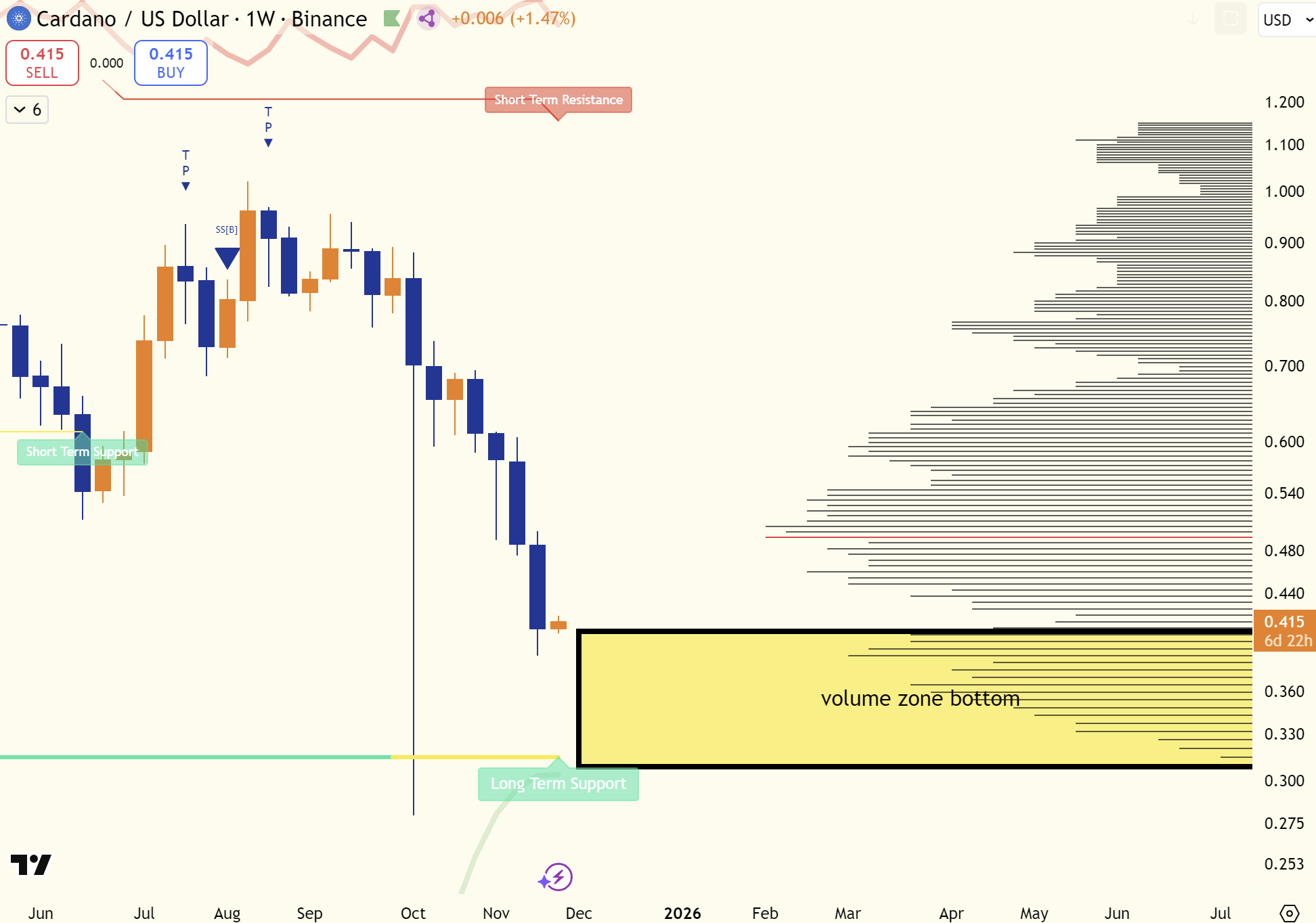

ADA Approach Key Volume Zone Cluster

On his end, market commentator Trend Rider frames Cardano’s recent pullback as a return toward a major demand zone. He notes that after the large downside wick that took Cardano to $0.28 a few weeks earlier, the price has been drifting lower.

It is now approaching a highlighted “yellow zone,” which he describes as the lower boundary of a key volume cluster. In that area, between $0.29 and $0.41, a high amount of trading previously occurred, and buyers stepped in aggressively.

According to his view, this zone still represents one of the more reasonable regions for a “buy-and-hold-for-weeks” strategy. He also points out that Cardano’s long-term trend-support line sits just below, arguing that the closer price moves toward this support, the more attractive the long-term entry becomes.

thecryptobasic.com

thecryptobasic.com