-

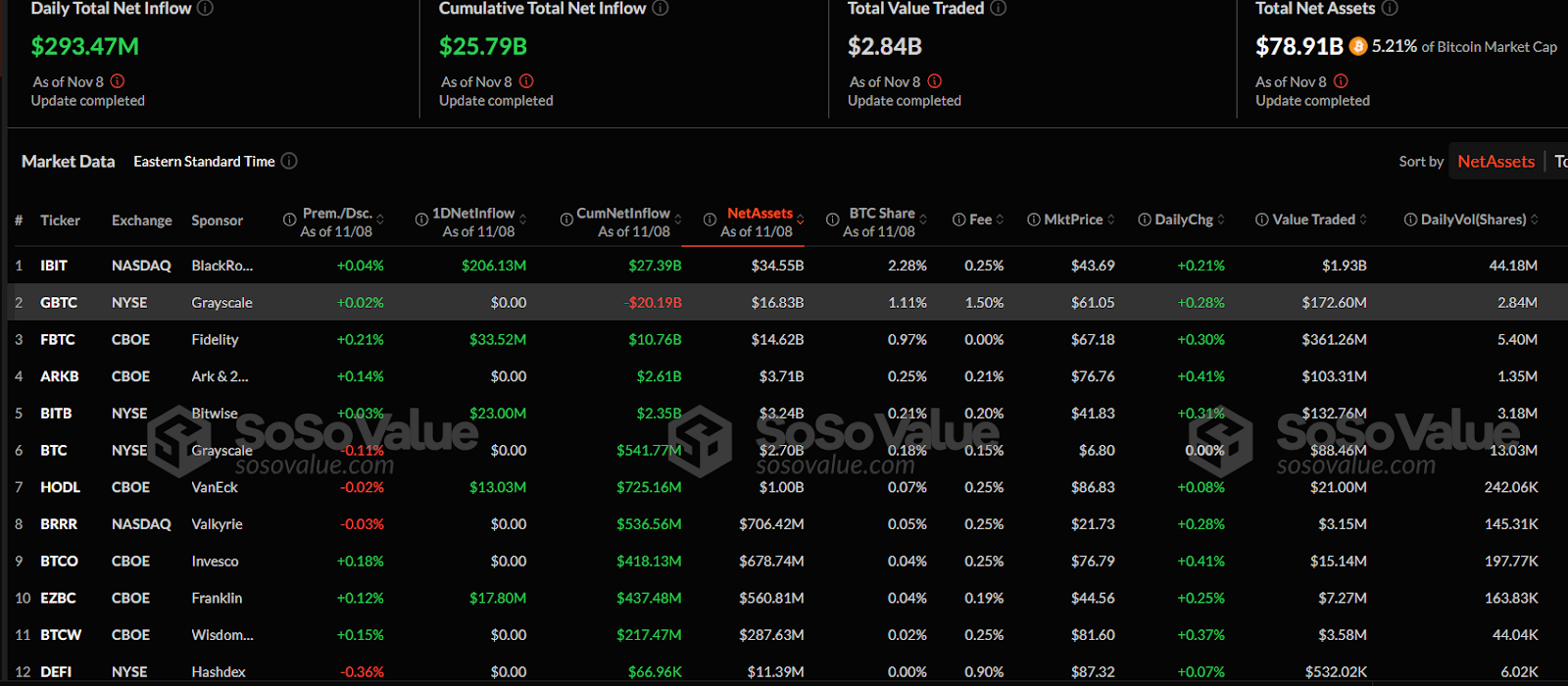

Bitcoin ETFs record $293.47 million in daily inflows, with $78.91 billion in total net assets, reflecting high investor interest.

-

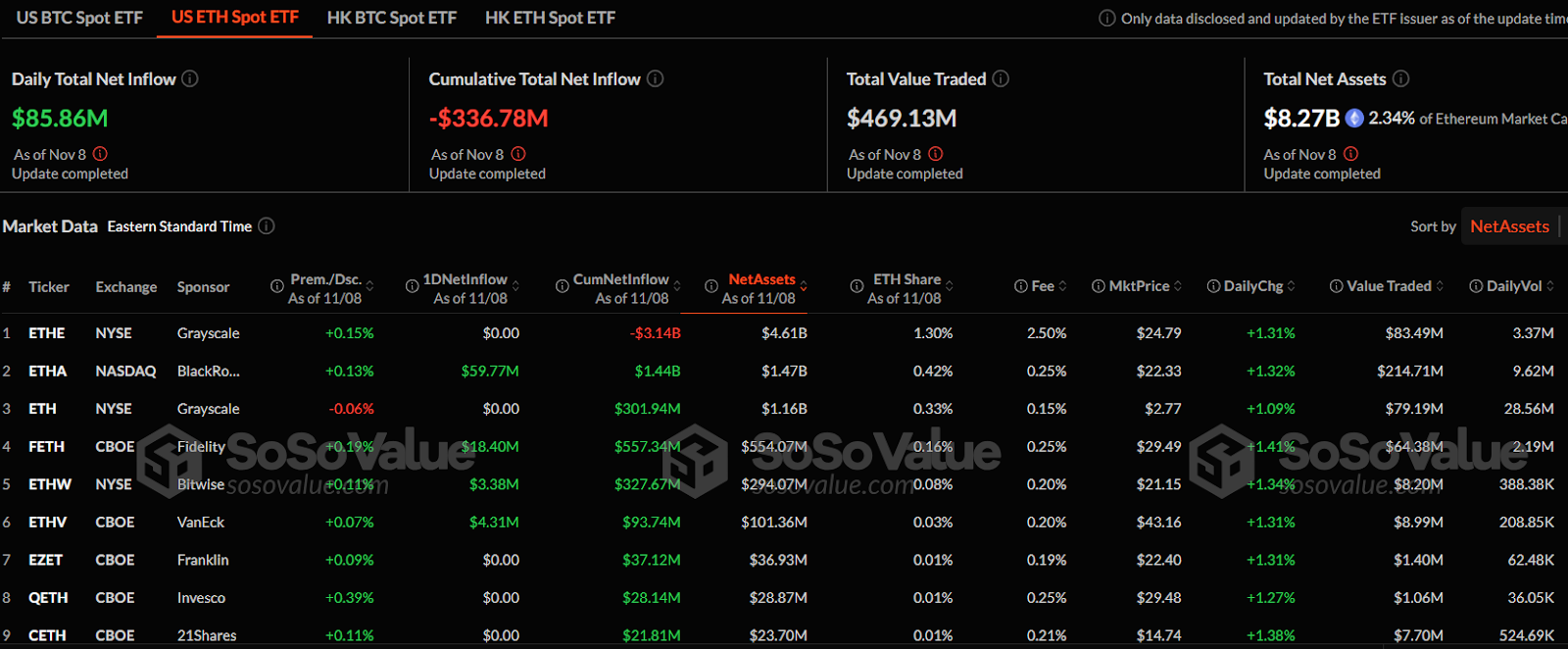

Ethereum ETFs see $85.86 million in daily inflows, though cumulative inflows remain negative, showing varied demand across ETH funds.

-

BlackRock’s IBIT and Fidelity’s FBTC lead in Bitcoin ETF inflows, while Grayscale’s ETHE holds the most assets among Ethereum ETFs.

With a new ATH of Bitcoin and a trading price value of above $81,000 level over the last 24 hours, the Bitcoin-related exchange-traded funds (ETFs) have seen great market movements across various exchanges. The Daily Total Net Inflow of BTC ETFs stands at $293.47 million as of November 8, indicating active market movement with increased asset inflows.

According to SoSoValue, the cumulative total net Inflow now reads at $25.79 billion, showing the overall cumulative demand and capital inflow into these products over time. The total value traded for the day at the time of writing amounted to $2.84 billion and the total net assets at $78.91 billion represents 5.21% of Bitcoin’s market cap.

Source: SoSoValue

BlackRock’s IBIT Leads BTC ETFs; GBTC Declines, FBTC Gains $33.52M

In a detailed insight of the listed products, IBIT from NASDAQ, sponsored by BlackRock, leads with net assets of $34.55 billion. IBIT recorded a daily net Inflow of $206.13 million, a cumulative net inflow of $27.39 billion, and a market price of $43.69, with a slight daily increase of 0.21%. IBIT currently holds a BTC share of 2.28%, and its fee is set at 0.25%.

GBTC, traded on NYSE and sponsored by Grayscale, has net assets worth $16.83 billion. Although it shows no daily net inflow, its cumulative net inflow reflects a negative figure of -$20.19 billion, suggesting a historical decline in asset inflows over time. The BTC share stands at 1.11%, with a higher fee of 1.50%. The market price for GBTC is $61.05, marking a daily change of +0.28% as daily trading volume records 2.84 million shares.

FBTC, on the CBOE exchange, sponsored by Fidelity, reported a net asset value of $14.62 billion. With a one-day net inflow of $33.52 million and a cumulative net inflow of $10.76 billion, FBTC indicates a growth and strong demand with a BTC share of 0.97% and charges no fee, making it cost-effective as trading volume reaches 5.40 million shares showing active market participation.

ARKB, BITB, BTC ETFs Show Steady Gains; BlackRock’s IBIT Dominates Assets & Volume

ARKB, sponsored by Ark & 21Shares and listed on CBOE, has net assets of $3.71 billion. Although it shows no recent net inflow, its cumulative net inflow totals $2.61 billion. The BTC share is 0.25%, with a fee of 0.21%, and the market price is $76.76, marking a daily gain of 0.41% making it among the top gainer in the market. It trades with a daily volume of 1.35 million shares, indicating steady interest from investors.

BITB, listed on NYSE and sponsored by Bitwise, reports net assets worth $3.24 billion. With a one-day net inflow of $23 million and a cumulative net inflow of $2.35 billion, it demonstrates positive market traction. BITB has a BTC share of 0.21%, a fee of 0.20%, and a market price of $41.83. The daily change is +0.31%, with a trading volume of 3.18 million shares, reflecting consistent investor engagement.

BTC, sponsored by Grayscale on NYSE, shows net assets of $2.70 billion and no inflows recorded for the day. Its cumulative net inflow stands at $541.77 million, with a BTC share of 0.18% and a fee of 0.15%. The market price is $6.80, without any significant daily price change, and records a substantial trading volume of 13.03 million shares.

BlackRock’s IBIT has shown it dominance as it leads with net assets, daily inflow, and trading volume. Despite a negative cumulative inflow,Grayscale’s GBTC,holds substantial assets and volume. Fidelity’s FBTC shows a strong daily inflow and no fees, attracting a higher trading volume.

Ethereum ETFs Trade $469.13 Million Daily as Total Net Assets Reach $8.27 Billion

On the other hand, the daily total net inflow of Ethereum Exchange Traded Funds(ETFs) stands at $85.86 million, indicating substantial market activity with positive daily inflows. In contrast, the Cumulative Total Net Inflow shows a negative value of -$336.78 million, reflecting historical outflows exceeding inflows over time.

According to SoSoValue, the total value traded reached $469.13 million demonstrating high trading volumes, while the total net assets amount to $8.27 billion, representing 2.34% of Ethereum’s market capitalization.

Source: SoSoValue

ETHE Leads Assets; ETHA Gains $59.77M; ETH Tops Volume

Among the listed products, ETHE from NYSE, sponsored by Grayscale, holds the highest net assets at $4.61 billion. This product has shown no new inflow for the day, with a cumulative net inflow of -$3.14 billion, indicating a notable decline in demand over time. ETHE represents 1.30% of the ETH market share and a charging fee of 2.50%. Its market price stands at $24.79, reflecting a daily increase of 1.31% as the daily trading volume for ETHE records 3.37 million shares.

ETHA, listed on NASDAQ and sponsored by BlackRock, reported a strong one-day net inflow of $59.77 million, the highest among the products listed. Its cumulative net inflow now read at $1.44 billion, showcasing positive demand. ETHA has net assets valued at $1.47 billion, with an ETH share of 0.42% and a fee of 0.25%. The market price for ETHA is $22.33, with a daily gain of 1.32%, and it records the highest trading volume among all ETFs, with 9.62 million shares traded.

ETH, sponsored by Grayscale on NYSE, holds net assets of $1.16 billion. According to SoSoValue, It shows a cumulative net inflow of $301.94 million but reports no daily inflow as of Nov 8. ETH has an ETH share of 0.33%, a fee of 0.15%, and trades at a market price of $2.77, marking a daily gain of 1.09%. This product has the highest daily trading volume, with 28.56 million shares, indicating strong trading interest.

Fidelity’s FETH Gains $18.4M, Bitwise’s ETHW $3.38M

FETH, on CBOE and sponsored by Fidelity, holds net assets of $554.07 million. It records a daily net inflow of $18.40 million and a cumulative inflow of $557.34 million, reflecting continued positive inflow trends. FETH has an ETH share of 0.16% and charges a fee of 0.25%. The market price is $29.49, with a daily change of +1.41%. Its daily volume stands at 2.19 million shares, suggesting steady interest from investors.

ETHW, sponsored by Bitwise and traded on NYSE, holds $294.07 million in net assets. It reports a daily inflow of $3.38 million and a cumulative net inflow of $327.67 million. ETHW has an ETH share of 0.08% and a fee of 0.20%, with a market price of $21.15, which increased by 1.34% for the day. The product traded 388.38 thousand shares, showing moderate investor interest.

Despite no records in recent inflows, Grayscale’s ETHE leads in net assets, while BlackRock’s ETHA shows the highest daily net inflow. Fidelity’s FETH has a positive cumulative net inflow, indicating strong investor demand.

cryptonews.net

cryptonews.net