Dogwifhat ($WIF) price is bearing the brunt of the bearish cues stemming from Bitcoin’s recent decline below $60,000.

The traders changed their tone just as quickly as the price did, which is evident in the massive withdrawal over the last 24 hours.

Dogwifhat is Missing Support

Volatility is an old friend of the crypto market, and so is panic selling, even during the slightest declines. The $WIF price’s correction had a similar impact. As the meme coin witnessed a 10% drop in a day, the investors’ investment noted a similar outcome.

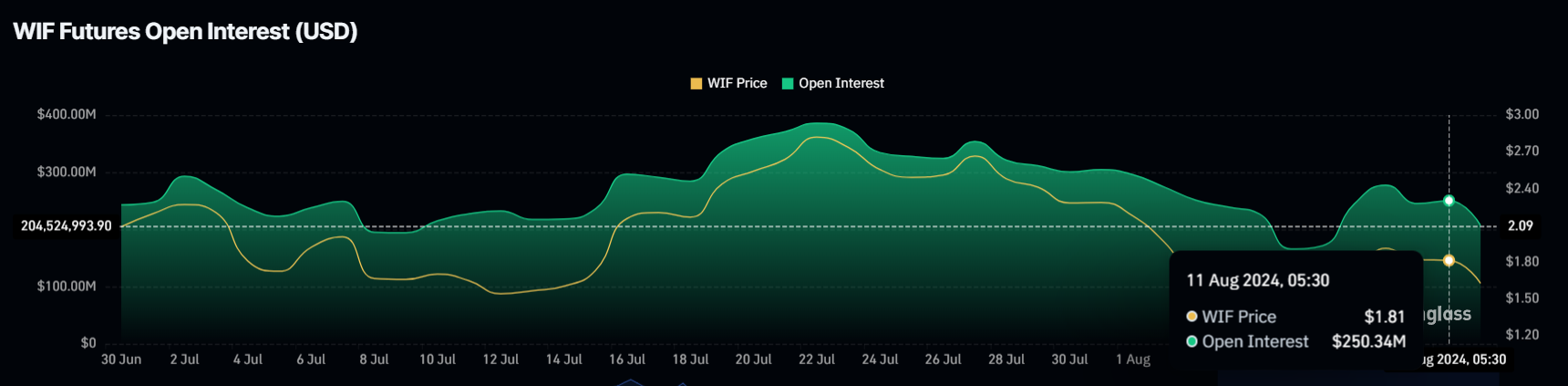

The Open Interest for the meme coin has experienced a notable decline of $43 million within a single day. This drop highlights a growing sense of pessimism among investors and traders regarding the coin’s future performance.

Read more: How To Buy Dogwifhat ($WIF) and Everything Else To Know

Adding to the bearish sentiment, the Relative Strength Index (RSI) appears to be struggling within the negative territory. Despite the recent recovery in $WIF price, the RSI has not managed to cross the neutral line, suggesting continued weakness in the market.

This technical indicator often gauges momentum and market sentiment, and its current position reinforces the prevailing bearish outlook. If buying momentum remains just as weak as it currently is, recovery will become significantly more difficult.

$WIF Price Prediction: It’s a Long Way Up

The $WIF price at $1.64 noted a 51% increase in merely 72 hours last week, half of which was wiped out over the weekend. The meme coin is now looking to bounce back from the next crucial support of $1.52.

Reclaiming $1.83 is key for the $WIF price to climb back above the resistance of $2.01. In the past, this price level has emerged as a crucial support level for the meme coin. A similar outcome could help $WIF jump towards $2.36.

Read more: Dogwifhat ($WIF) Price Prediction 2024/2025/2030

However, if $WIF fails to secure $1.83 as support, a decline to $1.52 is likely again. This time, the meme coin could note significantly larger outflows, which might make recovery challenging.

beincrypto.com

beincrypto.com