dogwifhat ($WIF) price is following the broader market’s trend as the altcoins have noted consistent declines over the past week.

This resulted in many investors selling their holdings to secure whatever gains they have noted, with one investor making millions of $WIF.

dogwifhat Traders Make Huge Profit

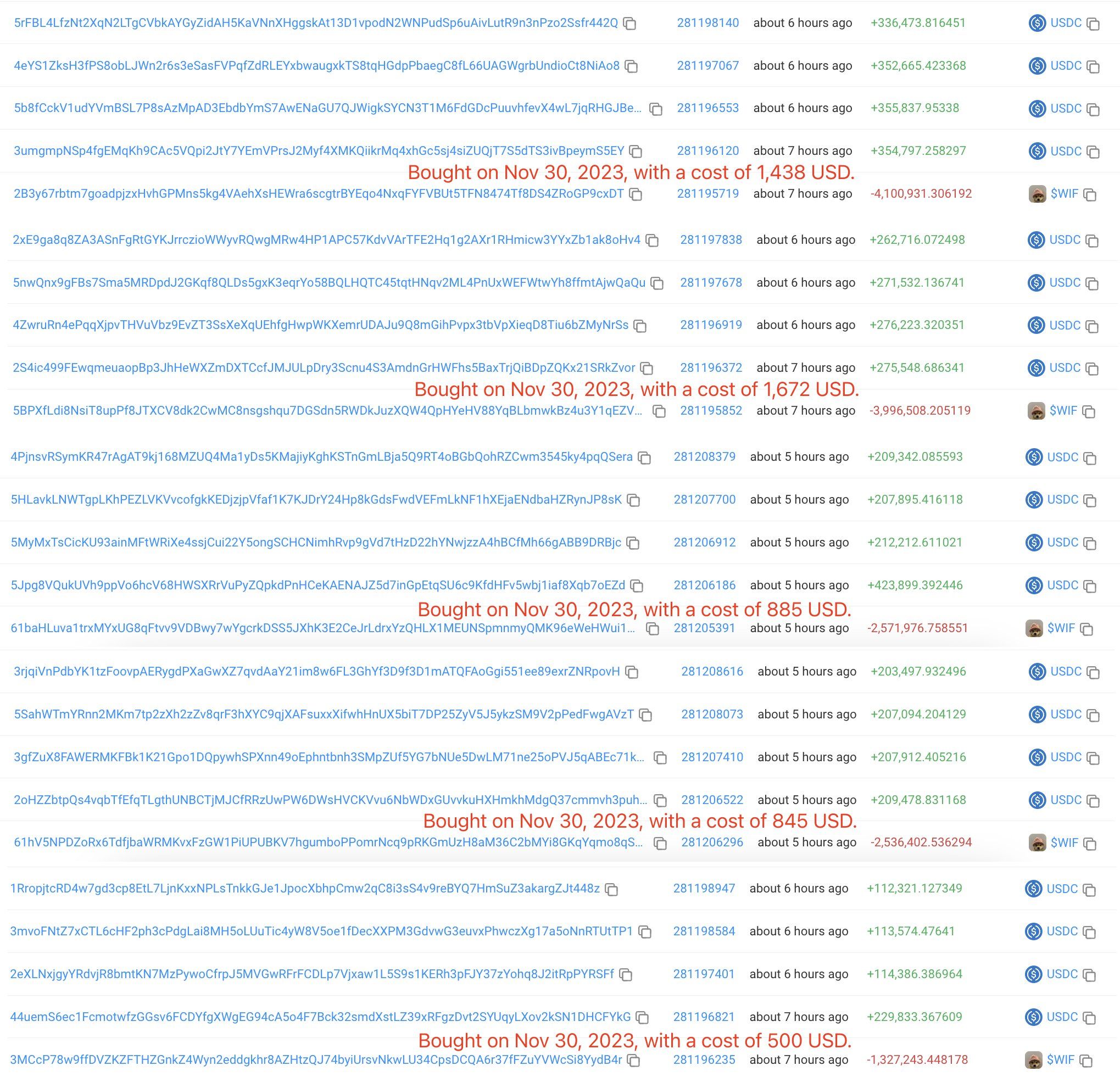

While most meme coin traders opt for rapid asset buying and selling to book profits, one $WIF holder chose to play the long game. According to the on-chain analysis account Lookonchain, a trader sold off a large chunk of his $WIF holdings bought back on November 30, 2023.

At the time, the trader purchased 14.53 million $WIF for a meager $5,340 and sold them after eight months. Today, these WIFs have earned the trader over $24 million in profit.

Most of the selling took place over the past day, as the meme coin fell by nearly 16% in a single day. This drop added to the drawdown from the past week, bringing the $WIF price down by almost 40%.

In doing so, the altcoin failed its potential 35% rally arising from the bullish double-bottom pattern. This rise would have pushed $WIF price beyond $3.18. However, the pattern failed and brought the meme coin down, with $WIF now trading at $1.69 at the time of writing.

Read more: How To Buy Dogwifhat ($WIF) and Everything Else To Know

This shows that the trader’s decision did not influence the price but the other way around. Thus, the bearish market fetched a 4,497x return, but a bullish market would have resulted in much larger profits.

Solana Meme Coins Losing Spark

Solana meme coins have impressed the market as a fad, but their gains dropped rapidly as the broader market fell. In the last 24 hours alone, Solana meme coins’ market cap has declined by 13.9%, bringing it to $7.14 billion.

Other top coins, such as Popcat ($POPCAT) and Book Of Meme (BOME), also noted substantial declines. $POPCAT fell by more than 21%, while BOME registered a 12% drawdown in the last 24 hours.

Read more: Dogwifhat ($WIF) Price Prediction 2024/2025/2030

There is a good chance that going forward, Solana meme coins’ drawdown could result in higher selling, potentially putting an unfixable dent in the hype and value of these tokens.

beincrypto.com

beincrypto.com