- 1 Despite strong market presence, $UNI faces low liquidity and instability, with high short liquidations and significant outflows to wallets.

- 2 Uniswap’s ($UNI) market cap surged 11% to $4.67 Billion, but trading volume dropped sharply, with a 48% decline in spot volume and 62.82% in derivatives.

Uniswap ($UNI) ranked 22nd in terms of market capitalization, while its market cap dominance stood at 0.22% around the time of writing.

Despite the strong market presence, a decrease in its trading volume was observed over the past 24-hours. It resulted in a 48% decline in spot volume, followed by a 62.82% decrease in the volume of derivatives.

$UNI Derivative Data Weak

A few unsettling scenarios including high short liquidations of around $146.2K against long liquidations of about $24.98K, showed that $UNI price pivoted to bearish. Its market cap had advanced by nearly 11% in the past 24 hours, amounting to $4.67 Billion.

Its volume-to-market cap ratio stands at 3.25%, signifying low liquidity in the $UNI market, which makes the markets less stable. The circulating supply highlights that nearly 60% of tokens are in people’s hands out of 1.0 Billion $UNI token.

What Does On-Chain Highlights In Uniswap ($UNI)?

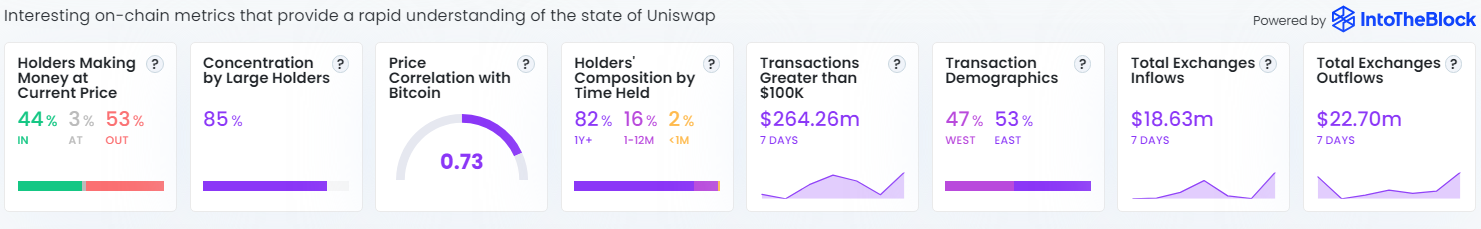

According to Intotheblock, in the past 7 days, an increase in the outflows was recorded from the exchanges to wallets, which resulted in a $22.70 Million. Meanwhile, the inflows saw a surge, from wallet to exchanges, that stands at $18.63 Million.

Token Summary | Source: Intotheblock.com

As per the demographics transactions, the east timings (10 pm-10 am) were utilized more for trading and investing in $UNI, which stands at 53%. The greater transactions also happened that were above $100K, and in the past 7 days, it has recorded $264.26 Million.

Moreover, it has also come into sight that the large holder’s concentration stands heavy at 85%, which owns more than 1% of the circulating supply. Similarly, 82% of holders hold the $UNI for more than 1 year, and its price correlation with Bitcoin ($BTC) stands at 0.73 (gets affected when the market leader increases and decreases).

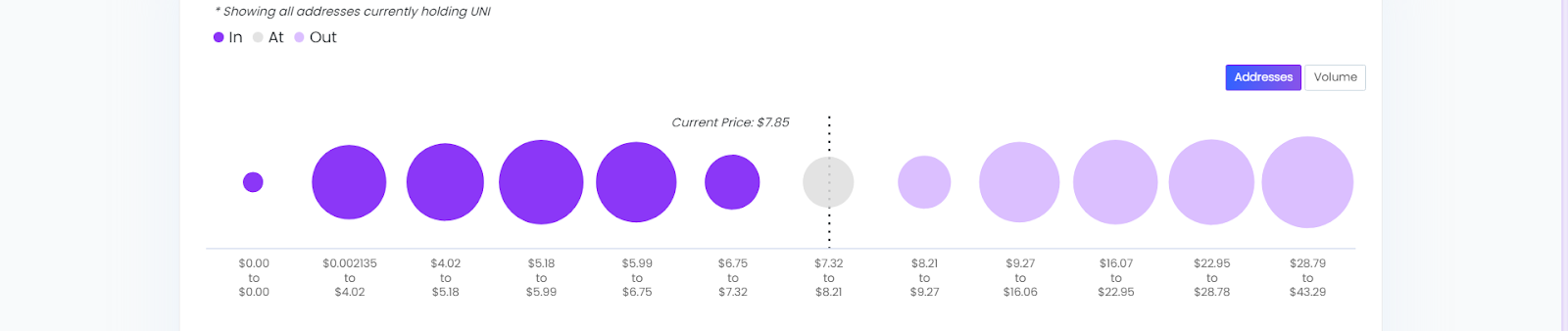

In/Out Of Money | Source: Ixfi.com

According to the In/Out of the money data, shows that the Uniswap addresses that are in the money hold 44.14% percentage with 159.81K Addresses, Out of the Money holds 53.12% with 192.32K addresses, and At the money percentage is 2.75% with 9.94K addresses.

Decoding Uniswap ($UNI) Price

The Uniswap had a great start in January 2024 and flew more than 200%, from $5.50 to $17.00 by March 6th, 2024. $UNI price gains were unstable and price fell to form a support at a high volume level around $11.08.

After sustaining the level for a while above $10.25, $UNI price gave a breakdown of a bearish flag pattern in correlation with the $BTC dip on April 9th, 2024.

The $UNI price fell and formed support at $6.86 by April 13th, consolidated for some days, and then gave a breakout from a descending triangle pattern up to $11.85, where the resistance posed a threat.

Thereon, the price did best to sustain, but by June 21st, the price gave a breakdown of ascending channel and reached $6.85 by July 5th.

At press time, as $BTC tries to sustain its price, $UNI continues to struggle. The current price traded at $7.911 with an intraday gain of 1.61%.

If the price rises, surpassing $9.0 it could reach $11.0. On the contrary, if the price slips $6.86, it could deteriorate further.

Summary

Uniswap ($UNI) ranks 22nd by market cap at $4.67 billion, with a 0.22% market cap dominance. Despite an 11% market cap rise, trading volume dropped, signaling low liquidity. Notable was $146.2K in short liquidations versus $24.98K in long liquidations. $UNI’s price is currently $7.911, with a volatile trend and strong large-holder concentration.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com