- 1 $AAVE TVL has surged to $12.6 Billion and its revenue has been consolidating.

- 2 $AAVE net deposits has seen a surge of 17% while active users has been consolidating for a while.

- 3 $AAVE is currently trading near $82 with a slight gain in the intraday session.

$AAVE is at the forefront of the DeFi movement. It seeks to transform traditional financial systems by eliminating intermediaries and providing more inclusive access to financial services. The protocol allows users to lend and borrow a variety of assets without relying on any financial institutions. Meanwhile, users can earn interest by lending their crypto to the liquidity pool and borrowers can seek loan by collaterlazing their assets.

One of $AAVE‘s most notable innovations is the introduction of flash loans. Flash loans are uncollateralized loans which can be borrowed and repaid within a single transaction block on Ethereum. These loans enable users to execute arbitrage opportunities without any upfront capital.

Recently Stani Kulechov, founder and CEO of $AAVE has reached out to US VC firms for another round of funding for Lens protocol as per Dlnews. Meawnhile, as per Dune analytics more than 70% iof the users of Lens protocol has less than 50 followers.Lets have a look towards the onchain analysis of the asset.

$AAVE Sees a Surge In Deposit While Active Users Decline

$AAVE has a total supply of 16 Million in which over 14.5 Million tokens is circulating in the market.It has a total of 168258 users which are holding the token. As per Coincarp the top 10 holders of $AAVE on Ethereum controls 55.2% of the total supply. The top holders of the asset has seen net negative outflow in the past few weeks.

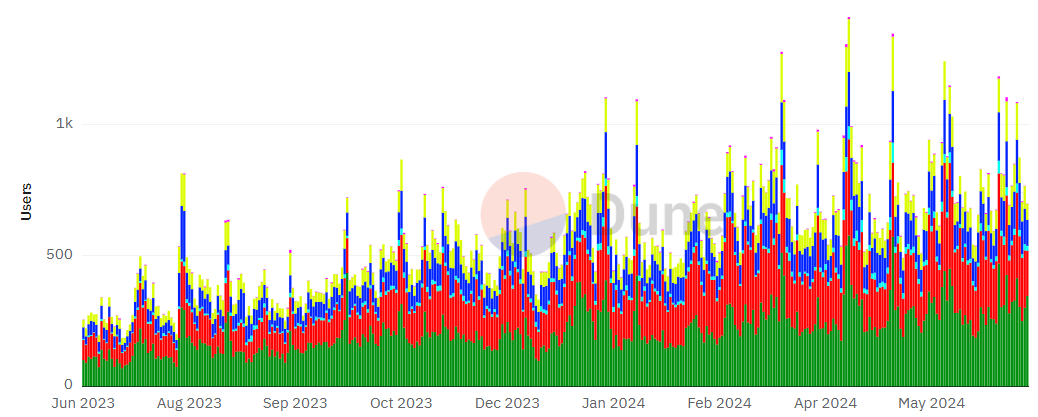

Source: $AAVE User activity on Dune

$AAVE has a total of 37059 unique users which has been growing constantly for the past few months. $AAVE V3 42.6% users are currently involved in the deposits while 23% of the users are net borrowers. The amount of users using flash loans has also increased in the last few months.

$AAVE protocol has observed a surge of 15.7% in the net deposits while the active loans saw a surge of 25% in June. The overall earnings of the protocol has also seen an increase of 11% in the past one month.

Source: $AAVE TVL by Defillama

$AAVE has a TVL of $12.6 Billion and is currently consolidating near this range. The treasury holdings of the protocol has seen an increase to $120 Million while the active borrowers has surged to $7.7 Billion. Lets see the price action scenario of the $AAVE token price.

Will $AAVE Bulls Push its Price to $100?

Ritika_TCR on TradingView.com

$AAVE has a market cap of $1.2 Billion and is currently ranked 64th in the cryptoverse. The volume of the asset has seen a drop of 42% in the past 24 hours. The asset price is currently trading near the value of $81 with a gain of 2% in the intraday session.

$AAVE is currently forming strong consolidated candles in the daily chart. It is trading below the 50 and 100 EMA on the daily chart. The upside trend of $AAVE can see a halt near the value of $100. Meanwhile, the support of the asset price can be observed near $75.

The RSI of $AAVE is currently near 37 suggesting its presence in the oversold zone. The overall sentiment of the RSI is bearish in nature.

Summary

$AAVE has been observing a consolidation in the overall TVL and active users. $AAVE token price is currently in a bearish mode and can see a new high in the near future.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com