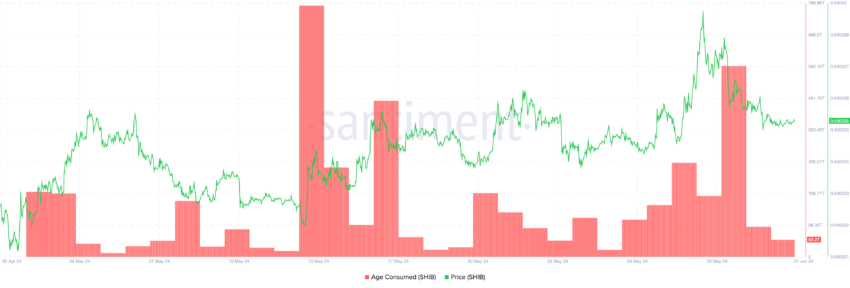

During the intraday trading session on June 2, Sushi’s ($SUSHI) Age Consumed metric rose to a seven-day high, suggesting that previously dormant tokens have begun to change hands.

This surge was followed by a rally in the altcoin’s price, signaling that a price bottom might be in.

Sushi Dormant Addresses On the Move

On-chain data showed that on June 2, 196,000 dormant $SUSHI tokens were moved, as indicated by the spike in the altcoin’s Age Consumed metric.

This metric tracks the movement of its long-held coins. It is important because it offers insight into the behavioral shifts of an asset’s long-term holders. This group of investors rarely moves their dormant coins around. However, it is noteworthy when they do because it often precedes a shift in market trends.

When the metric rises, it means that many tokens are changing hands after being left untouched for an extended period. Conversely, when it falls, it means that idle coins are left unmoved.

The metric is seen as a good marker of an asset’s local price bottom, especially when a spike in its value is followed by a surge in its price.

This has played out in $SUSHI’s case, as the altcoin’s value has surged by 5% since it bottomed at $1.11 during the trading session on June 2. As of this writing, $SUSHI exchanged hands at $1.16.

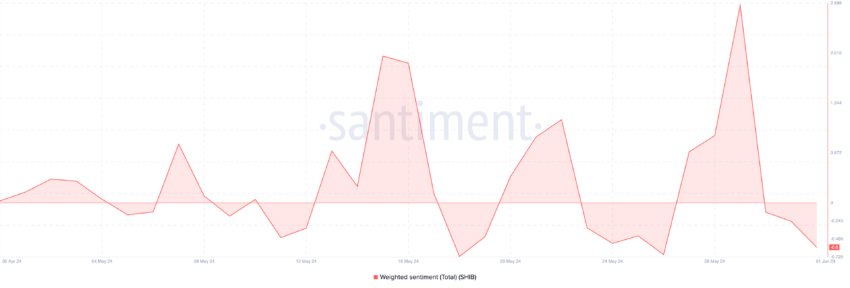

While this may have presented a buying opportunity, bearish sentiments continue to trail $SUSHI. As of this writing, the token’s weighted sentiment was -0.516.

Read more: How To Use SushiSwap: A Step-by-Step Guide

This means that most social media discussions around $SUSHI are tainted by a negative bias toward the altcoin.

$SUSHI Price Prediction: Now May Not Be The Time

In addition to $SUSHI’s negative weighted sentiment, readings from its key technical indicators confirmed the bearish outlook.

For example, its price currently trades under its 20-day Exponential Moving Average, signaling a consistent decline in buying pressure.

When an asset’s price falls under this key moving average, it trades at a level lower than its average price in the past 20 days.

Confirming the decline in $SUSHI buying pressure, its Relative Strength Index (RSI) was 49.65, below its 50-neutral spot. At this value, this momentum indicator suggested that $SUSHI traders favored selling their current holdings rather than buying new tokens.

If this selling trend continues, $SUSHI may lose its most recent gains and fall under $1 to exchange hands at $0.88.

However, if this is invalidated and buying pressure picks up momentum, the token’s price may climb toward $1.22.

beincrypto.com

beincrypto.com