The cryptocurrency market kicked off the week with strong bullish momentum, led by Ethereum’s ($ETH) recent surge to $3800, causing notable gains across major altcoins.

Amid this surge, two cryptocurrencies are showing notable strong momentum. In this context Finbold turned to the Relative Strength Index (RSI) heatmap from CoinGlass on May 21 to identify potential buy signals.

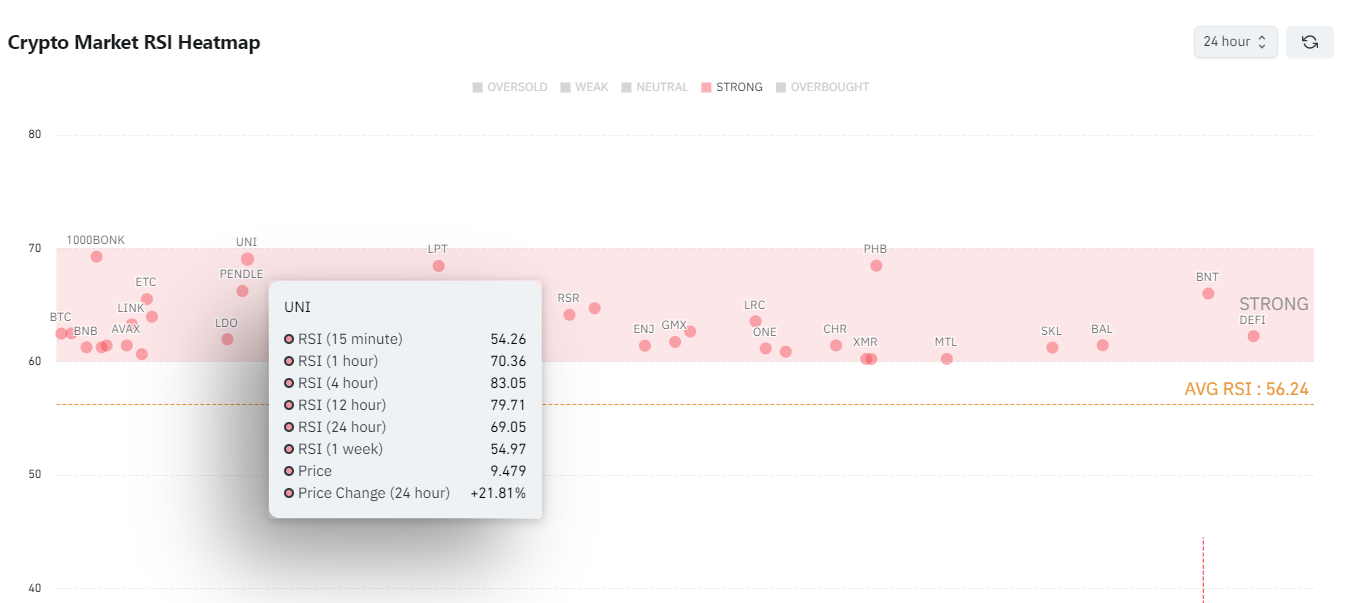

Uniswap ($UNI) showing strong buy signal

Uniswap ($UNI), the first automated market maker (AMM) decentralized exchange, remains the most popular and leads with the highest exchange volume and liquidity for trading Ethereum tokens.

Currently trading at $9.52, $UNI experienced a 22% gain driven by excitement over a potential Spot Ethereum exchange-traded funds (ETF) approval.

In the past 24 hours, $UNI’s price rose by 22% to $9.34, breaking out of a six-week correction and signaling a major market shift. RSI values (1 hour at 70.36, 4 hours at 83.05, and 12 hours at 79.71) indicate overbought conditions, usually a sell signal, but strong buying pressure suggests a buy signal.

Uniswap Labs, in collaboration with Across Protocol, introduced ERC-7683, a new standard for cross-chain intents enhancing $UNI’s utility and market value.

Technical indicators, like the 50- and 200-day exponential moving average (EMA) at $8.35, provide strong support if the price reverts.

The bullish divergence in daily RSI above 60% indicates continued buying pressure, making $UNI a compelling buy

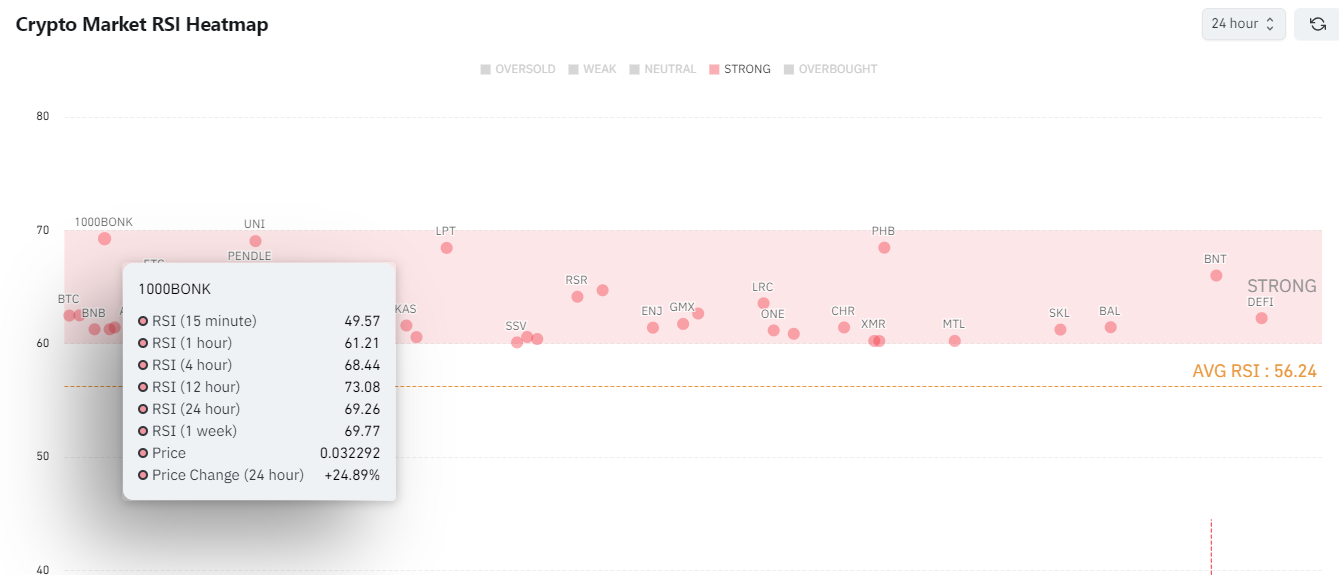

Strong momentum for Bonk (BONK)

Bonk is currently trading at $0.00003181, showing a 23.46% gain in the past day. Fueled by market excitement around the potential approval of $ETH ETFs, Bonk recorded a 7.8% jump today, breaching the neckline resistance of $0.00003.

The RSI values (1 hour at 61, 4 hours at 88, and 12 hours at 73) indicate strong buying pressure, with the sharp upswing in daily EMAs (20, 50, 100, and 200) highlighting aggressive buying activity.

These factors and technical indicators collectively present a strong buy signal for Bonk, making it an attractive investment opportunity.

While these cryptocurrencies show strong buy signals, it is important to exercise caution. The sustainability of this rally is uncertain, and many believe that a bearish correction is inevitable.

Therefore, cryptocurrency investors should conduct thorough research and prioritize robust projects to ensure sound capital allocation.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com