$AAVE is a defi platform built on Ethereum and allows users to lend and borrow cryptocurrency without the need of financial intermediaries. The platform is known for its innovative features including flash loans which allows users to borrow without collateral as long as it is paid in the same transactions. The protocol has gained a strong popularity among the defi users due to its secure and efficient lending.

$AAVE protocol is also secured with a safe backstop for protocol insolvency. The protocol is currently seeing a strong growth in user base and onchain activity. It has over $15,933,584,312 across 8 networks and 15 markets. Here’s a comprehensive briefer on $AAVE’s onchain activity.

The Growing Interest Rates On $AAVE

$AAVE is a fully decentralized community governed protocol with 167,965 holders. It has been growing steadily ever since. The $AAVE treasury is composed of $AAVE tokens and treasury collectors which earn fees from Reserve Factor, Instant liquidity, liquidation fees and portal fees. The community treasury of $AAVE has $111,064,855 in which 66.6% is in $AAVE, while 11.4% is in USDC.

Looking at the variable interest rate on $AAVE V2, one can observe that the interest rate has surged from 14% to 20% within a month.

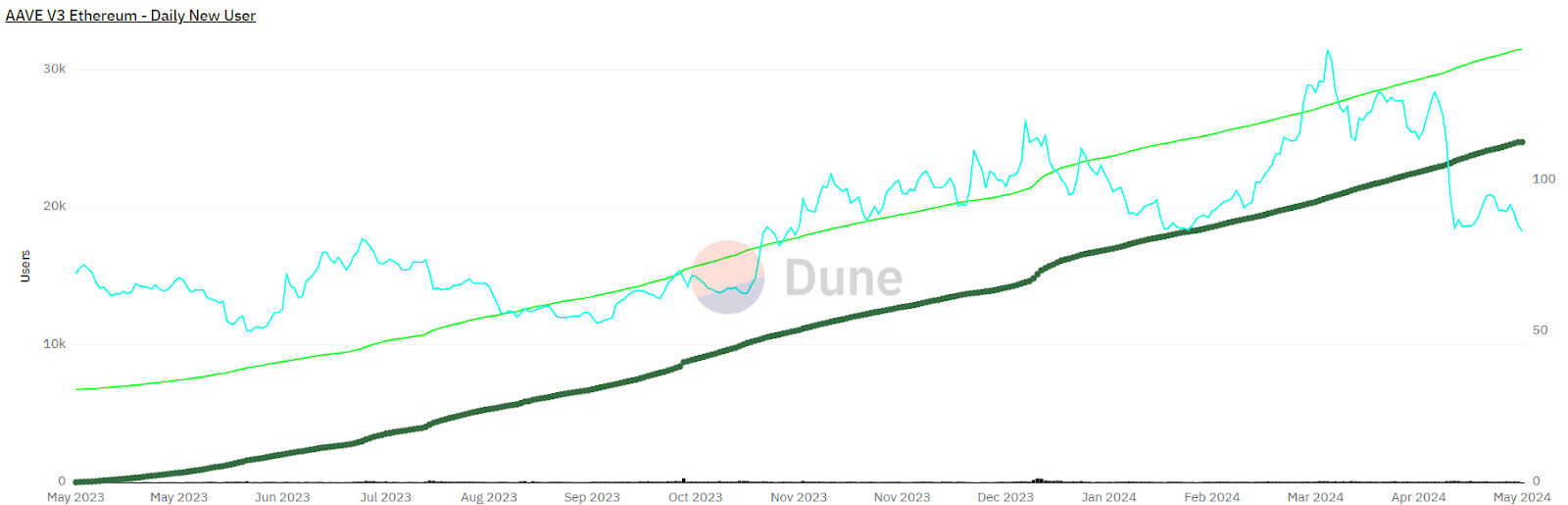

$AAVE V3 ethereum has been seeing a surge in the active users and has around 31496 daily unique users as per data provided by Dune. The majority of $AAVE V3 users use the platform for the deposit function. The number of new users of the protocol has surged on Arbitrum and BASE.

$AAVE TVL has observed a gain of $4 Billion in 2024 and reached $10.2 Billion. The average weekly developers of the protocol is 2X more than other Defi protocols. Meanwhile, the annual operational expense has also declined and reached to $6.3 Million.

Is Technical Data Not In Favor Of $AAVE?

Ritika_TCR on TradingView.com

$AAVE has a market cap of $1.2 Billion and is ranked 66th as per their market cap. It has a total supply of 16,000,000 in which 92.5% is circulating in the market. The volume of token dipped 21% intraday. $AAVE coin price is currently near the value of $86.7 with a slight gain in the last 24 hours. The digital asset price is currently trading below the 50 and 200 EMA. If it sees a crossover in the near future than a strong bearish momentum can be seen in the future. The upside trend of $AAVE can see a halt near the value of $100. Meanwhile, the support for the digital asset price can be seen near $65.

RSI of $AAVE is near 41 suggesting its presence in the neutral zone. The overall sentiment of the RSI and MACD is neutral in nature.

Conclusion

$AAVE protocol is one of the biggest defi protocols for lending and borrowing currently present. The onchain data shows that the daily users along with TVL is growing at a steady pace. $AAVE token price is currently in a consolidated zone but can observe a new high in the future.

Disclaimer

The views and opinions stated by the author or any other person named in this article are for informational purposes only and do not constitute financial, investment, or other advice.

thecoinrepublic.com

thecoinrepublic.com