The cryptocurrency market is showing massive strength in an expressive bull rally during the first day of this week. Bitcoin ($BTC) leads the movement in a remarkable performance year-to-date (YTD), which leaves concerns regarding a profit-realization sell-off.

Notably, the crypto total market cap has increased by over $1 trillion YTD—from a $1.59 trillion capitalization to $2.63 by press time. Bitcoin alone surged by 70% since January 1, 2024, and traders could be willing to realize some of this profit.

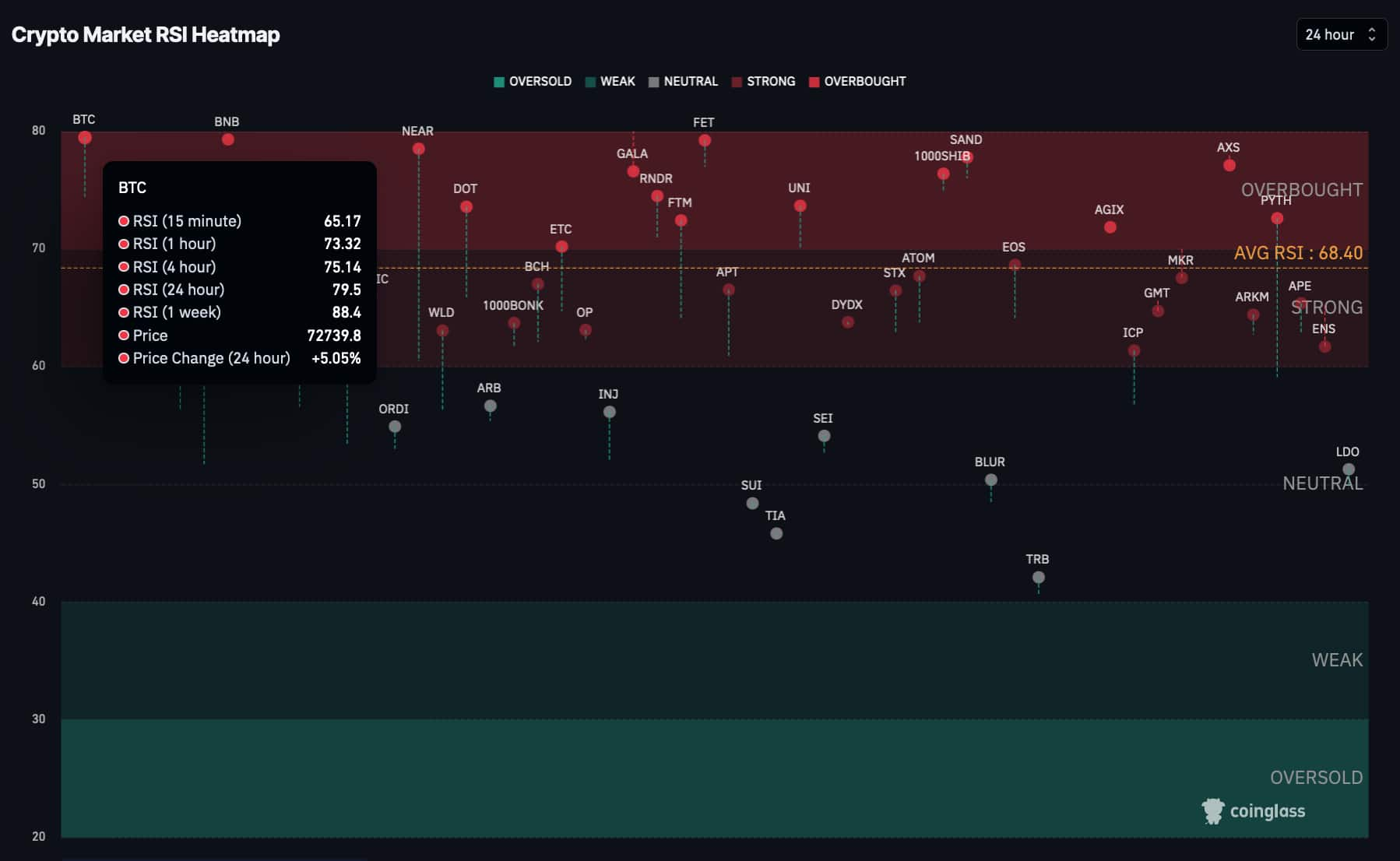

In this context, on March 11, Finbold turned to a Relative Strength Index (RSI) heatmap on CoinGlass. This technical indicator evidences strong momentum, with an average daily RSI superior to 68 and above 65 in the weekly.

Therefore, investors must observe the potential sell signal for cryptocurrencies floating in the overbought zone. In particular, for those with a combination of multiple time frames signaling the same extreme status.

Bitcoin ($BTC) RSI is overbought in 4 time frames

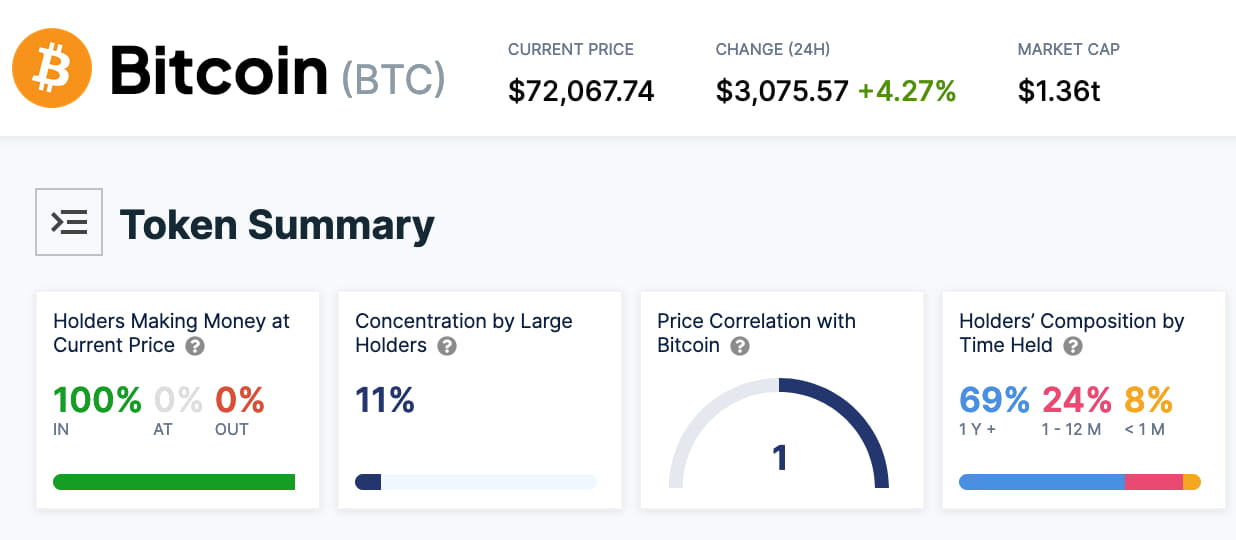

First, Bitcoin is overbought in four out of five RSI time frames, with higher values for higher intervals. It has 88.4, 79.5, 75.14, and 73.32 in the weekly, daily, 4-hour, and hourly Relative Strength Indexes, respectively.

Currently, $BTC trades at $72,739, up 5% in the last seven days and above the last cycle’s all-time high. This combination of recent price action and records breaking suggests a relevant sell signal for the maiden cryptocurrency.

Interestingly, IntoTheBlock’s data indicates that 100% of Bitcoin holders are now in profit. Increasing the chances of profit-seeking sell-offs in the short term.

Fetch.ai ($FET)

Meanwhile, according to CoinGlass‘s heatmap, Fetch.ai ($FET) is the second-most overbought cryptocurrency in different time frames.

$FET trades at $2.79, up 2.25% in a week. Its weekly RSI is 89.32 overbought. Additionally, the token’s daily Relative Strength Index is 79.26, threatening a correction at any time.

Essentially, this token has benefited from the artificial intelligence (AI) narrative that has affected different markets. For example, AI figures as one of the leading crypto narratives for this cycle, sided with memes and payments.

Nevertheless, having an overbought RSI does not guarantee a price crash or trend reversals. The cryptocurrency market is highly volatile, and projects can continue growing with the proper conditions and demand increase.

On that note, the recently launched Claude 3 Opus advanced AI model forecasted Bitcoin could reach $200,000 in 2024.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com