CCData stands at the forefront of the digital asset data space, serving as a crucial resource for anyone navigating the cryptocurrency market. Their core focus lies in gathering comprehensive market data from a vast network of global crypto exchanges. This includes real-time pricing, trading volumes, order book information, and other essential metrics for numerous digital assets. Beyond simply collecting data, CCData transforms it into actionable insights. They meticulously design and calculate a wide range of highly granular crypto indices, providing benchmarks that illuminate different segments of the market. These indices follow transparent, rules-based methodologies to ensure accuracy and reliability.

CCData’s expertise extends to supporting the development of innovative investment products. They collaborate with financial institutions to license their indices for use in ETFs, derivatives, and more. This opens doors for investors seeking structured ways to gain exposure to specific areas of the crypto market. Additionally, CCData provides robust APIs and customized data solutions. Traders, researchers, and institutions can seamlessly integrate real-time and historical market data into their platforms and tools using these powerful interfaces. Through its commitment to reliable data, transparent indices, and accessible data solutions, CCData fuels informed decision-making, fosters market understanding, and plays a vital role in the evolving cryptocurrency ecosystem.

Stablecoins have rapidly gained prominence in the past year. These cryptocurrencies, designed to maintain a stable value through their peg to a traditional asset, play a fundamental role in digital asset trading and bringing fiat currencies into blockchain systems. However, recent controversies surrounding Tether’s collateral and the TerraUSD collapse raise questions for investors and regulatory bodies.

CCData’s Stablecoins & CBDCs Report aims to illuminate key trends within this sector. Their analysis breaks down stablecoins based on their collateral type, the pegged asset, market capitalization, and trading volumes. This monthly report serves a wide audience – from crypto enthusiasts seeking a market overview to investors, analysts, and regulators requiring more detailed data.

Earlier this week, CCData released the February 2024 edition of its “Stablecoins & CBDCs” research report.

Stablecoin volume on CEXs rose 4.54% to $1.05tn in January, its highest level since December 2021.

— CCData (@CCData_io) February 22, 2024

Notably, $FDUSD's market share continued to rise in January, reaching 15.6%, aided by the popularity of the $BTC-$FDUSD pair on Binance.

Full Report: https://t.co/uR1uf3BuaZ pic.twitter.com/zs2LxbkFGz

Below are highlights from this report:

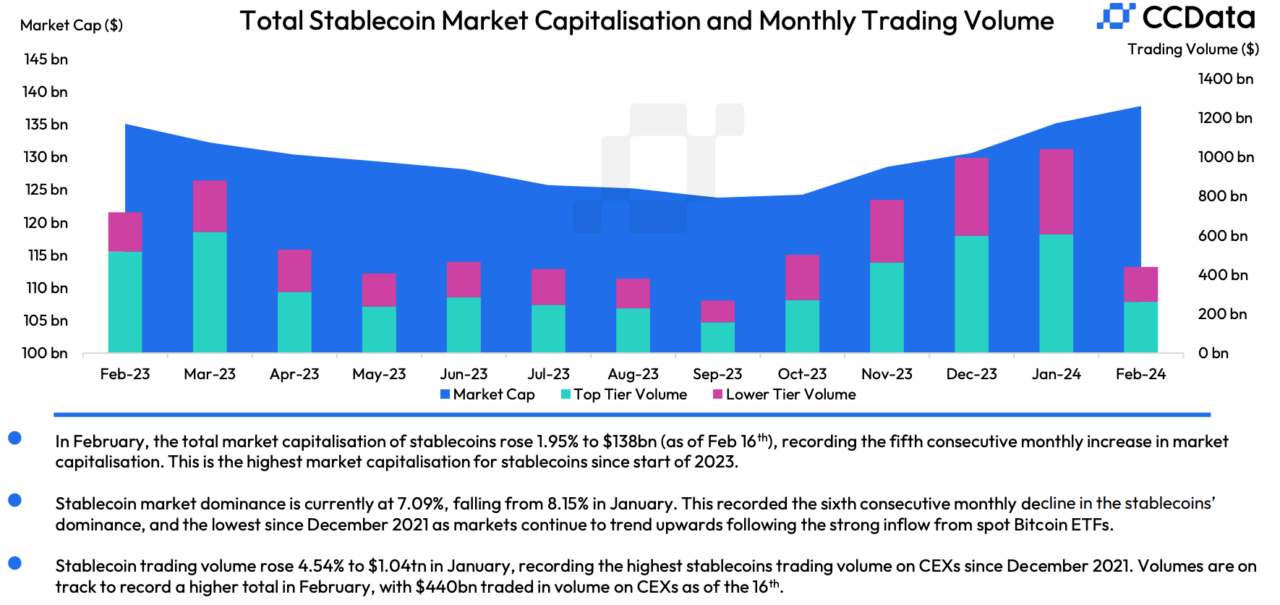

Continued Growth in Market Capitalization

CCData’s February report notes a 1.95% increase in the total market capitalization of stablecoins, reaching $138 billion. This marks the fifth consecutive month of growth, achieving the highest end-of-month market capitalization since December 2022. Despite this growth, the market cap dominance of stablecoins dipped to 7.09%, the lowest since December 2021, indicating a shifting landscape within the broader cryptocurrency market.

The MIM Stablecoin Depeg Incident

A significant event reported was the de-pegging of the Magic Internet Money (MIM) stablecoin, which fell to as low as $0.86 following a smart contract exploit of its issuer, Abracadabra Money, resulting in a loss of nearly $6.50 million. Despite this setback, MIM’s market capitalization has remained stable at around $60.2 million, with the stablecoin undergoing a v3 upgrade and expanding its integration with new chains like Blast and Berachain.

Surge in $FDUSD Trading Volume

Following the approval of a spot Bitcoin ETF, the trading volume of $FDUSD pairs on centralized exchanges saw a remarkable 51.1% increase to $122 billion, positioning it as the second most popular trading pair after USDT. The $BTC-$FDUSD pair on Binance emerged as the most traded, with a monthly volume of $80.8 billion. Concurrently, $FDUSD’s market capitalization rose by 12.5% to $2.44 billion, setting a new all-time high.

Ethena $USDe’s Market Cap Growth

Ethena Labs’ announcement of its public mainnet launch, enabling access to its yield-bearing stablecoin $USDe, led to a significant market cap increase. By depositing liquid staking tokens (LSTs), ETH, or USDC, users can now engage with $USDe, which saw its market capitalization jump by $47 million, reaching a new all-time high of $227 million in February.

cryptoglobe.com

cryptoglobe.com