Psueodonymous crypto trader ProfessorAstrones posted that tokens including Sei Network ($SEI), Fantom (FTM), Fetch.ai ($FET), and Injective ($INJ) have a high chance of pumping over the next few weeks.

According to his post on X, the trader shared charts showing that $SEI might have reached its bottom at $0.63. He also showed a similar trend for $FET. But in FTM and $INJ’s case, Professor Astrones shared a daily chart showing how they could break out of their descending channel.

Don’t forget those prices $SEI $FTM $FET $INJ

— ProfessorAstrones (@Astrones2) January 27, 2024

All gonna pump higher in the next weeks! pic.twitter.com/gBAFLCkoi5

Sei Network ($SEI)

$SEI erased all the losses it had in the last seven days while gaining 4.54% in the last 24 hours. However, signals from the 4-hour chart showed it was hard to break the $0.68 resistance.

But like the chart the trader shared, strong support has been formed at $0.63. Should bulls boost buying pressure, $SEI might breach the resistance and its next target could be as high as $0.80.

However, the volatility needs to be high if $SEI is to reach $0.80. At press time, the Bollinger Bands (BB) showed that volatility has become tight. If this stays the same, significant price fluctuation could be challenging.

Furthermore, the RSI showed that buying momentum has increased. If market participants can maintain the momentum, then $SEI could be programmed for a pump.

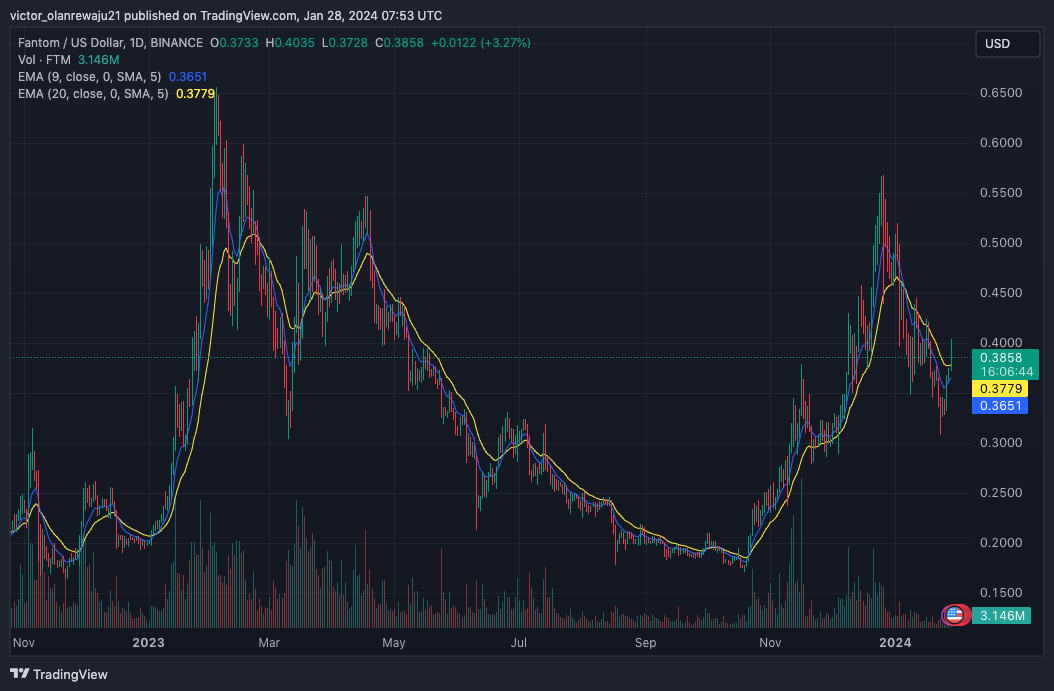

Fantom (FTM)

The FTM/USD daily chart displayed a strong bullish movement for the token. FTM’s trajectory hit $0.38, representing a 6.76% 24-hour hike.

Coin Edition then looked at the Exponential Moving Average. At press time, the 9 EMA (blue) had crossed below the 20 EMA (yellow).

Although this was supposed to indicate a short-term bearish trend, FTM’s price rose above both, suggesting the bearish bias could soon be neutralized.

If bears fail at invalidating the momentum, then FTM might eye a move to $0.55 within the next few weeks.

Fetch.ai ($FET)

On the daily $FET/USD timeframe, bulls seemed to be taking advantage of sellers’ exhaustion. This had pushed up the price to $0.62. However, $FET initially hit $0.63 but was quickly rejected.

According to the chart below, the MACD was down to -0.0018, suggesting a bearish momentum for $FET. If the momentum continues to be in favor of bears, then $FET could drop to $0.57.

But if it does, it could be an opportunity for traders to buy at a discount before a potential rally. Also, the Money Flow Index (MFI) showed that some capitali were beginning to enter into Fetch. If the MFI trend increases, $FET could rise to $0.75 in a highly bullish scenario.

Injective ($INJ)

$INJ hinted at a move towards $40. However, the potential increase to that level was rejected at $37.50, indicating that there could be some hurdles to cross before the token eventually breaks out.

An assessment of the RSI showed that the reading had increased to 63.03. This was a testament to the increasing presence of buyers in the market. If buyers continue to outweigh sellers, $INJ could rise past $37.50, and another 10% increase could be on the cards.

In addition, the Awesome Oscillator (AO) had risen to positive territory, suggesting increasing upward momentum for the token.

In a highly bearish case, $INJ’s price could drop to $33. But technical indicators revealed that it looked unlikely and the value could be higher going forward.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com