The cryptocurrency market is concluding 2023 on a high note, marked by Bitcoin (BTC) taking the lead. The pioneer cryptocurrency has surged, breaking the $40,000 resistance zone, and there is anticipation that the gains will likely extend into the new year, especially with catalysts such as potential spot exchange-traded fund (ETF) approval and halving.

With Bitcoin predominantly in the green zone, attention has shifted to altcoins and their potential to rally. It’s worth noting that Bitcoin gains often influence the overall market, and several altcoins are presenting investment opportunities moving into 2024. In this regard, Finbold has identified the following altcoins worth watching in 2024.

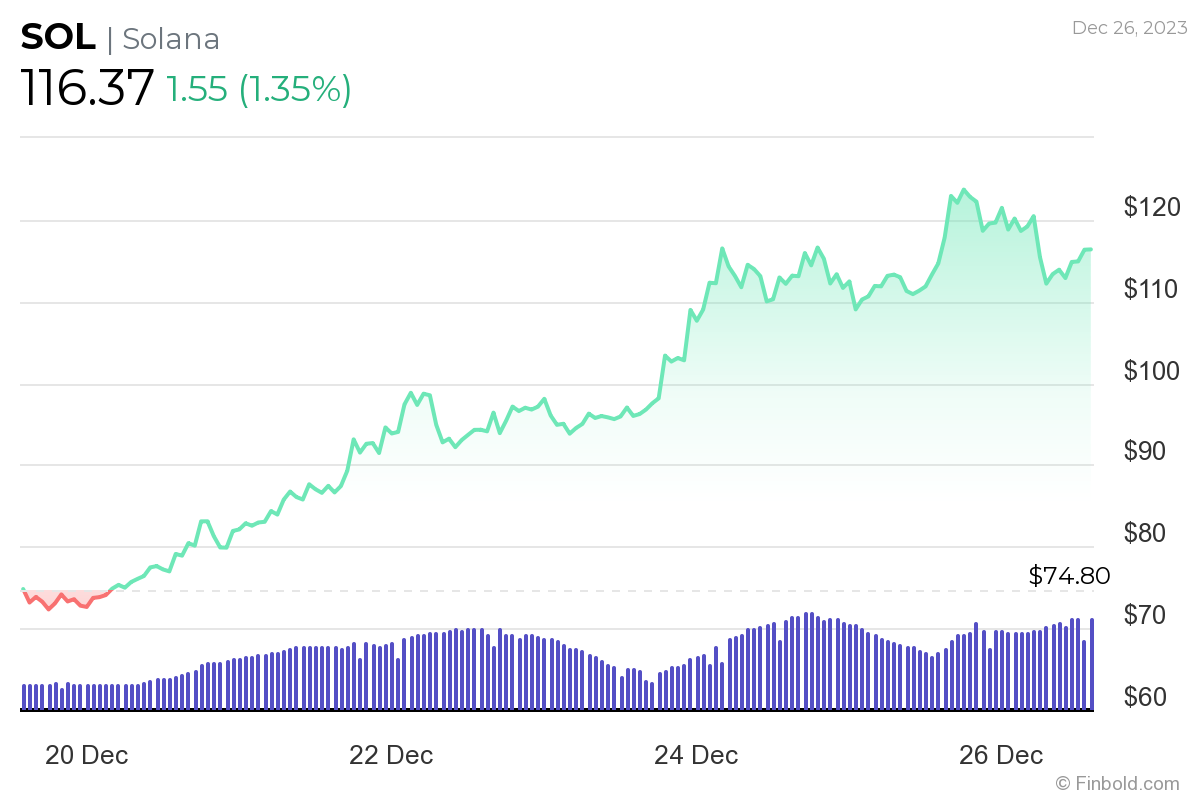

Solana ($SOL)

Solana ($SOL) is currently on a bullish run following its surge past the $100 mark. These gains underscore Solana’s resilience in navigating the 2022 bear market, during which the crypto faced the threat of significant devaluation due to its association with the collapsed FTX crypto exchange.

While Solana’s upward trajectory aligns with overall market sentiment, the rally is also linked to selling Saga phones loaded with BONK airdrops. The resulting frenzied selling has positively impacted onchain metrics.

For instance, as of December 24, the number of active Solana network addresses surged by almost 50% compared to November, reaching over 15.6 million. At the same time, the total locked value on the Solana network has soared, reaching the $1.5 billion mark on December 26.

These factors have contributed to a year-to-date surge in $SOL gains, surpassing 750%, with most of this growth occurring in the last two months alone. Notably, buying pressure has remained robust despite substantial selling pressure from the bankruptcy estate of the FTX crypto exchange, which held billions of dollars worth of $SOL.

Looking ahead to 2024, Solana retains key fundamental elements poised to fuel a sustained price rally. Its appeal lies in high-speed transactions and low fees, positioning the platform as a competitor to Ethereum. However, it’s important to note that $SOL’s progress will depend on other factors, such as the general market trajectory.

By press time, $SOL was valued at $116, with weekly gains of almost 50%.

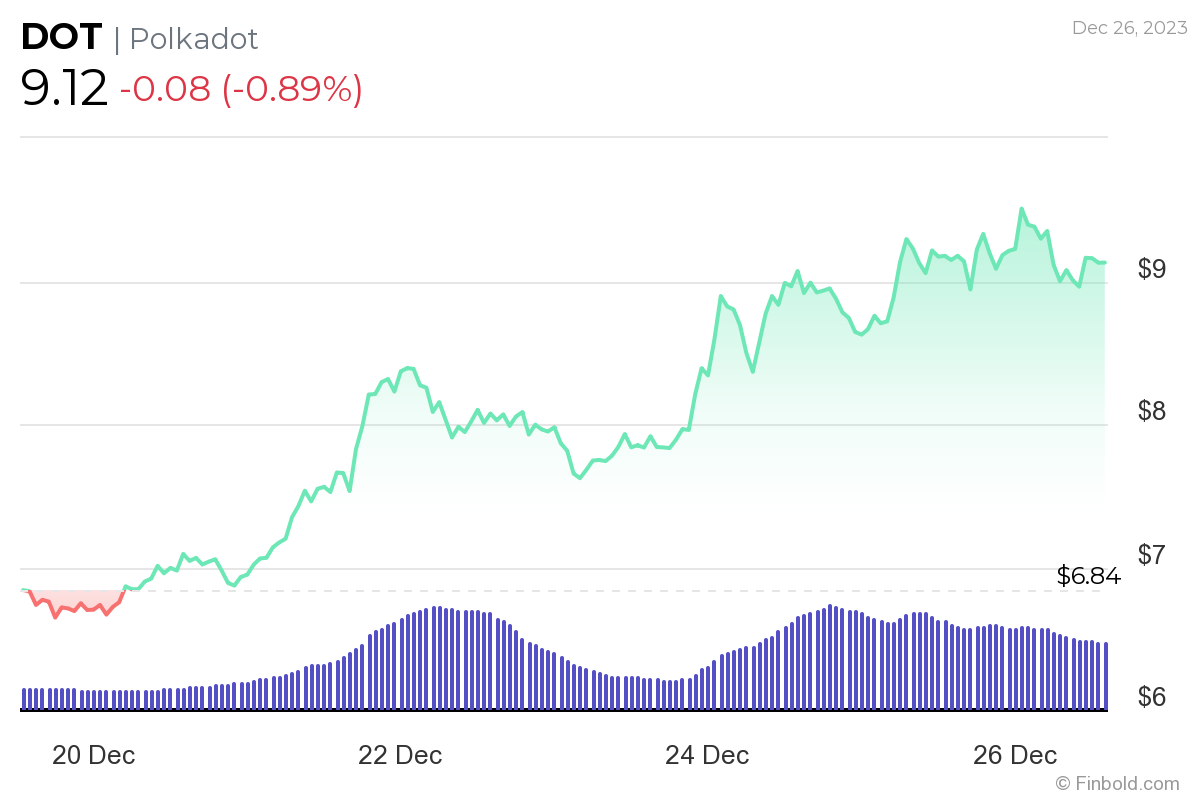

Polkadot ($DOT)

In recent months, Polkadot ($DOT), an open-source protocol, has emerged as a standout altcoin aiming to break the crucial $10 resistance zone. Notably, the token’s gains are accompanied by impressive on-chain metrics, including a surge in network activity that has boosted blockchain revenues.

As of December 21, Polkadot’s relay chain achieved a significant milestone with one million transactions in a single day. This surge in activity is attributed to inscriptions, which, similar to Bitcoin’s Ordinals, serve as data embeds. Since their launch this year, inscriptions have proven to be a driving force behind on-chain transactions and revenue.

In addition to its on-chain success, Polkadot is positioned for potential further growth with recent partnerships. The network inked a deal with a division of Deloitte. Under this collaboration, the firm will leverage the Polkadot-based Kilt blockchain to provide logistics and supply-chain services focused on the shipping industry.

While the surge in transactions aligns with the current surge in $DOT prices for 2023, concerns have arisen about inscriptions potentially causing network congestion, akin to the challenges faced by Bitcoin in scaling. Critics argue that inscriptions may act as network spam, dissuading users due to associated increases in transaction fees.

The sustainability of inscriptions and their potential to attract more users remains uncertain. Nevertheless, Polkadot has thus far demonstrated its ability to manage the increased transaction volume.

Enthusiasm is building within the community for the imminent technological advancements set to enhance the Polkadot ecosystem. Notably, the highly anticipated milestone is the debut of Polkadot 2.0, ushering in parachains, cross-chain compatibility, and on-chain governance to the ecosystem. Of utmost significance, Polkadot 2.0 will elevate the network’s consensus mechanism to Nominated Proof of Stake (NPoS), promising heightened security and governance capabilities.

By press time, $DOT had recorded weekly gains of almost 35%, trading at $9.12.

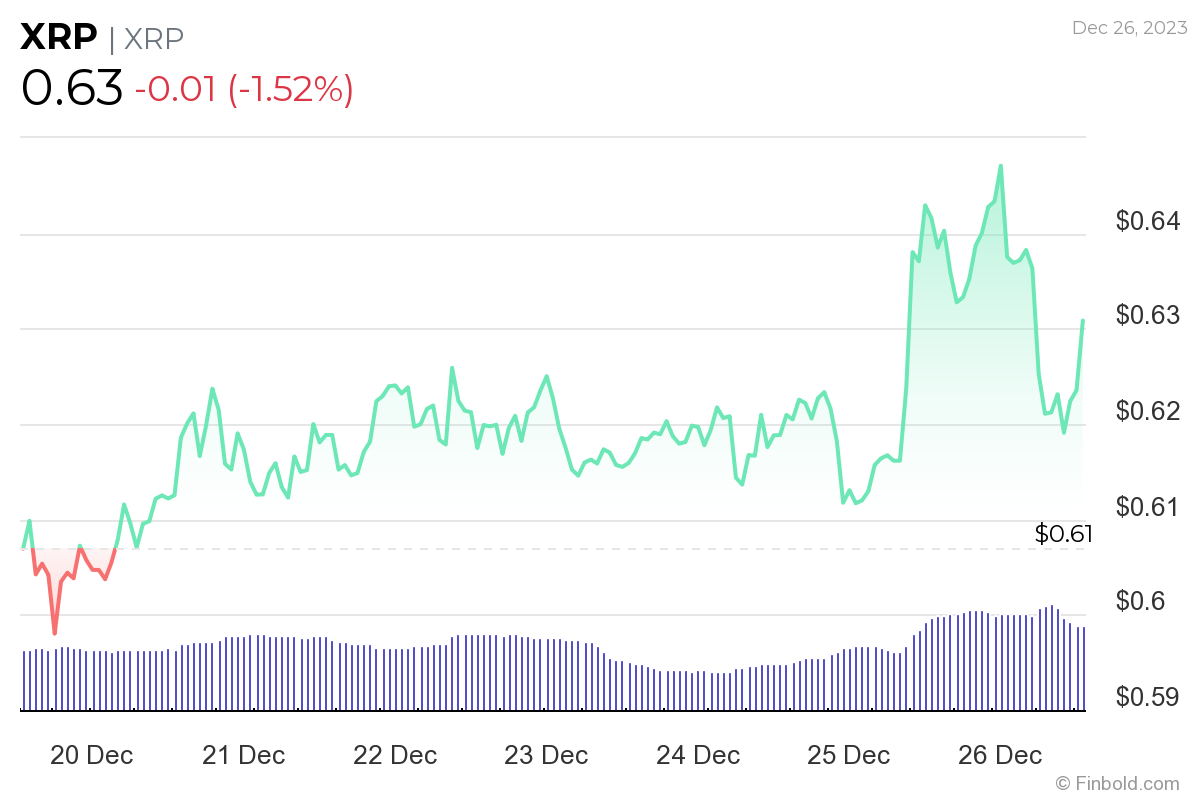

$XRP

The value of $XRP has largely remained consolidated despite the legal clarity declaring the token not a security in the Securities and Exchange Commission (SEC) case against Ripple. Indeed, insiders in the $XRP community have questioned the price trajectory, terming it as ‘very strange.’

Despite the apparent stall in price, $XRP has several bullish elements likely to spur a price rally in 2024. As reported by Finbold, $XRP has the potential to rally past the crucial $1 mark in 2024, driven by factors such as an overall bullish pattern on the $XRP chart and the potential for an initial public offering (IPO) for Ripple.

In the meantime, the progress in the SEC case will likely play a crucial role in determining how $XRP moves, with possible appeals currently in consideration.

Nevertheless, from a technical standpoint, despite facing two significant rejections at $0.7, the $XRP chart displays a pattern of sideways consolidations linked to increased holder behavior.

Notably, if $XRP manages to breach the current minor resistance at $0.65, there is potential for a surge beyond $0.8, with a subsequent target surpassing $1.

As of press time, $XRP was valued at $0.63 with daily losses of about 1.5%, while on the weekly chart, the token has slight gains of about 1.6%.

While the highlighted cryptocurrencies exhibit potential underlying bullish scenarios, it is crucial to note that they remain susceptible to overall market sentiment, as well as external factors such as regulatory changes.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com