- Polkadot ($DOT): A Quick Introduction

- Polkadot: Infrastructure And $DOT Cryptocurrency

- $DOT Cryptocurrency

- Polkadot Price Prediction: Price History

- Polkadot Price Prediction: Technical Analysis

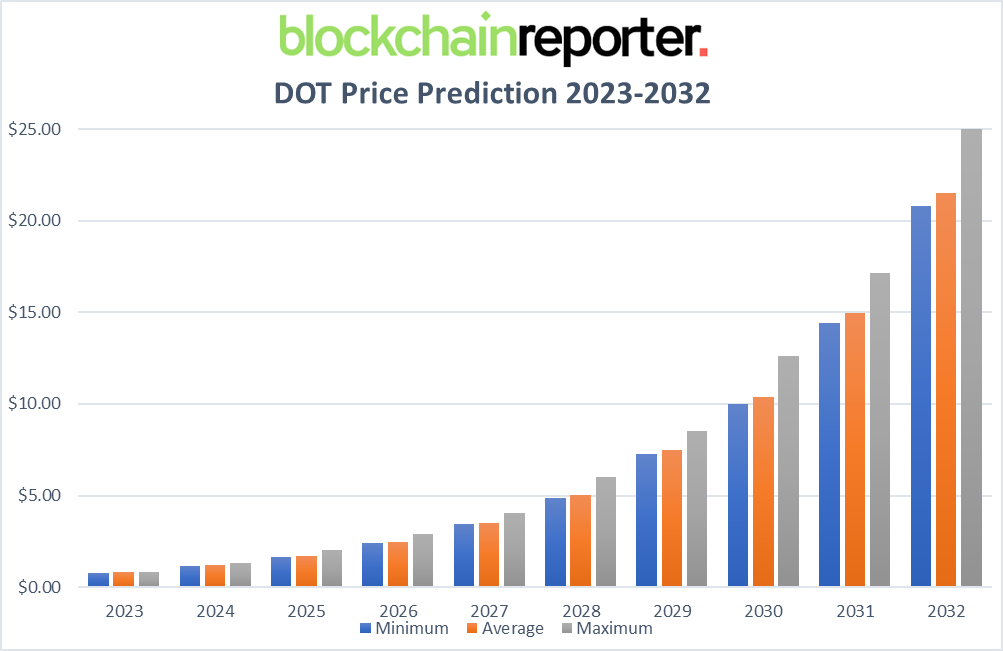

- $DOT Price Prediction By Blockchain Reporter

- Polkadot Price Prediction 2023

- Polkadot Price Prediction 2024

- Polkadot Price Forecast for 2025

- Polkadot ($DOT) Price Prediction 2026

- Polkadot Price Prediction 2027

- Polkadot Price Prediction 2028

- Polkadot ($DOT) Price Prediction 2029

- Polkadot Price Forecast 2030

- Polkadot ($DOT) Price Prediction 2031

- Polkadot Price Prediction 2032

- Polkadot Price Forecast: By Experts

- Polkadot 2.0 Brings Bullish Vibe

- Conclusion

Polkadot is a groundbreaking multi-chain network, often known as a key player in the evolution of the blockchain infrastructure. It distinguishes itself from other blockchain networks by promoting interoperability and scalability, two critical aspects that address some of the most persistent challenges in the crypto space. At its core, Polkadot facilitates the seamless transfer of not just tokens but also data and assets across various blockchains, enabling otherwise isolated networks to communicate and interact with each other. One of Polkadot’s most significant contributions to the crypto market is its innovative architecture, which consists of a main network known as the Relay Chain and various interconnected chains called parachains. This unique design allows for a high degree of customization, as each parachain can be tailored to specific use cases and functionalities while still benefiting from the shared security and interoperability offered by the Relay Chain. This approach effectively solves the scalability issues faced by older blockchains, which often struggle with congestion and high transaction costs during periods of peak demand. Furthermore, Polkadot introduces a novel consensus mechanism that enhances network security and efficiency. This mechanism allows for faster transaction processing and more equitable participation in the network’s governance. By providing a platform where different blockchains can interact and integrate, Polkadot paves the way for new applications and services that were previously unfeasible. In this article, we’ll discuss $DOT price prediction with in-depth technical analysis and provide future Polkadot price prediction to help investors with a profitable investment plan.

Polkadot ($DOT): A Quick Introduction

Launched in 2016, the Polkadot network emerges as a key player among numerous software platforms that incentivize a worldwide network of computers to manage a blockchain infrastructure. This infrastructure enables users to create and manage their own blockchains.

The development of this project is spearheaded by Parity Technologies, affiliated with the Web3 Foundation. Parity Technologies dedicates its efforts to pioneering technologies that dismantle centralized online services and develop institutional innovation.

Setting itself apart from similar platforms like Ethereum, Cosmos, and EOSIO, Polkadot introduces a distinctive protocol. This protocol interlinks a network of specialized blockchains, known as ‘parachains,’ facilitating their seamless interaction and collective operation.

Polkadot stands out for its capability to handle multiple transactions concurrently. Its design is both user-friendly and conducive to further innovations and collaborations due to its compatibility with various blockchain protocols.

Another notable feature of the Polkadot network is its ability to enable blockchain upgrades without necessitating a chain fork, a process that traditionally could take months and sometimes resulted in splitting the community. This aspect of Polkadot marks a significant advancement in blockchain technology, offering a more streamlined and cohesive approach to network evolution.

Polkadot: Infrastructure And $DOT Cryptocurrency

David Lawant, a research director at Bitwise Asset Management, describes Polkadot as a “heterogeneous multichain system,” highlighting its capacity to support various blockchains within its ecosystem.

As previously mentioned, Polkadot operates as a layer 0 blockchain, providing a foundational framework that supports layer one blockchains. This structure offers programmers a pre-established infrastructure for developing their own blockchains, complete with the ability to interoperate across different chains.

Layer 1 blockchains, such as Ethereum, co-founded by Gavin Wood and Vitalik Buterin, enable the creation of decentralized applications (DApps), smart contracts, non-fungible tokens (NFTs), and more. However, developing a layer 1 blockchain is a complex task. As Bill Birmingham, the Chief Investment Officer at Osprey Funds, notes, it involves constructing a base layer and then incentivizing a large number of users to run the layer 1 protocol on their computers.

According to experts, Polkadot offers a significant advantage in this regard by providing an already established base layer. This allows layer 1 developers to concentrate more on refining their specific projects rather than building the foundational infrastructure from scratch.

Thibault Perréard, the head of finance at Bifrost, a cross-chain staking hub, points out that most layer 1 systems are isolated, with minimal interaction between them. Polkadot, however, aims to facilitate communication between any public or private blockchain, aspiring to be the “internet of blockchains” by bridging these disparate networks.

$DOT Cryptocurrency

The unifying element that integrates proof-of-stake validation, cross-chain interactions, and base layer programming within Polkadot is its native token, $DOT.

As the central component of Polkadot’s proof-of-stake mechanism, $DOT is utilized by validators as a form of collateral to authenticate and approve subsequent blocks on the Polkadot blockchain. This process is integral to maintaining the network’s integrity and functionality.

Within the Polkadot ecosystem, each independent blockchain is known as a parallel chain or parachain. These parachains operate concurrently, contributing to the network’s extensive capabilities.

A critical aspect of data transfer across these parachains is maintaining robust security. Polkadot achieves this through its central relay chain, which acts as the backbone of the system. This relay chain, as noted by David Lawant, sets Polkadot apart from its primary competitor, Cosmos (ATOM).

Thibault Perréard emphasizes the significance of the relay chain in ensuring the network’s security. He notes that the parachains benefit from the established architecture and foundational security of Polkadot, relieving them of the burden of independently securing their chains.

In addition to its role in block validation on the relay chain, the $DOT token has multiple functions within the Polkadot ecosystem. It is not only essential for staking but also plays a vital role in governance and bonding. $DOT holders are empowered to participate in key decision-making processes, including voting on network upgrades and fee structures, reflecting the democratic ethos at the heart of the Polkadot network.

Polkadot Price Prediction: Price History

Examining the price history of Polkadot ($DOT) can offer context for understanding and forecasting its future price trends, though past performance is not a reliable indicator of future results. Polkadot made its debut in late August 2020, starting at $2.79. For the initial six months, its price remained relatively stable, but by mid-January 2021, it experienced a significant rise, reaching $8.62, a 208% increase from its launch.

The bullish momentum continued, with the price soaring to $39.70 by 21 February 2021, marking a 360% surge within just over a month. However, this uptrend was short-lived as the price fell below $32 and fluctuated between $33 and $38 throughout March 2021.

By May 14, 2021, $DOT reached a new peak of $47.95, coinciding with Polkadot’s parachain launch. However, on May 23, 2021, a technical issue caused a drastic 60% drop to $18.03. The price trend remained bearish over the summer, hitting a low of $10.42 by mid-July.

In September 2021, the announcement of Polkadot’s cross-consensus messaging format helped the price recover. On November 4, 2021, $DOT hit its all-time high of $55, following the successful community vote on Referendum 42 for parachain registration and crowdloans. This surge was sustained for a few days due to the successful passing of Referendum 41 and the registration of its first parachain.

However, the coin ended 2021 at $26.72 and faced a further decline in 2022 due to various market crashes, including the FTX collapse, eventually reaching a 52-week low of about $5 and closing the year at $4.31, marking an over 80% annual loss.

The year 2023 saw a modest recovery, with the price breaking past $5 on January 9 and stabilizing around $4.90 by January 11, with more than 1.15 billion $DOT in circulation from a total supply of 1,270,814,926. However, $DOT’s price failed to hold its bullish momentum as it slowly declined. In June, $DOT’s price touched the low of $4.5. It further dropped to a low of $3.5 in October; however, the price has now recovered much since then as it broke the $5 mark in recent weeks.

Polkadot Price Prediction: Technical Analysis

Recently, the $DOT coin price experienced intense bullish sentiment, which has triggered buyers near the immediate resistance levels. The price has been on a steady upward trajectory over the last few weeks due to the market’s ‘Uptober’ trend revival and solid bull run. After surging above the $4.5-mark, $DOT’s price sparked an intense buying momentum and surged exponentially. The price has been facing intense buying pressure recently, and it managed to break above multiple resistance levels following Bitcoin’s surge above $36K. A thorough technical analysis of the $DOT token price reveals mixed indicators, which may soon send the price either to new lows or highs.

According to Coinmarketcap, the $DOT price is currently trading at $5.26, reflecting a decrease of 5.2% in the last 24 hours. Our technical evaluation of the $DOT price indicates that the current bullish momentum may soon fade as bears are attempting to reverse the trend from the upcoming resistance at $6; however, bulls are trying to prevent the price from dropping below the support level of $5. Examining the daily price chart, $DOT coin price has found support near the $5 level, from which the price gained recent bullish momentum and was attempting to break above multiple Fib channels. As the $DOT price continues to trade above the EMA20 trend line, buyers are gaining confidence to open further long positions and send the price to test its upcoming resistance. The Balance of Power (BoP) indicator is currently trading in a negative region zone at 0.31 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of a Polkadot ($DOT) coin, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a decline as the Polkadot price failed to hold buyers’ demand near $5.9. The trend line is currently hovering below the midline as it trades at level 43, hinting that further downward correction is on the horizon. It is anticipated that the $DOT price will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $6. If bears fail to plunge below the current 0.038 Fibonacci region, an upward trend might be on the horizon.

As the SMA-14 continues its swing by trading at 52, it trades slightly above the RSI line, potentially holding promises about the coin’s upward movement on the price chart. If $DOT’s price makes a bullish reversal, it can pave the way to resistance at $6.9. A breakout above will drive the coin’s price toward the upper limit of the Bollinger Band at $8.

Conversely, if $DOT fails to hold above the critical support region of $5, a sudden collapse may occur, resulting in further price declines and causing the coin’s price to trade near the Bollinger Band’s lower limit of $4.2. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $3.6.

$DOT Price Prediction By Blockchain Reporter

Polkadot Price Prediction 2023

The forecast and technical analysis for 2023 suggest that Polkadot could reach a minimum price of $5.53. The maximum price is expected to be around $6.08, with an average value of $5.75.

Polkadot Price Prediction 2024

In 2024, Polkadot’s price is anticipated to reach a minimum of $8.31. It could achieve a maximum price of $9.84, with the average trading price throughout the year being around $8.59.

Polkadot Price Forecast for 2025

Based on a detailed technical analysis of past $DOT price data, Polkadot’s price in 2025 is expected to hover around a minimum value of $11.90. The maximum price might reach $14.62, with an average trading value of $12.25.

Polkadot ($DOT) Price Prediction 2026

For 2026, the price of Polkadot is forecasted to reach a minimum level of $16.79. The $DOT price could peak at $20.70, with an average expected price of $17.28.

Polkadot Price Prediction 2027

Polkadot’s price in 2027 is forecasted to reach a minimum of $24.99. It could go as high as $29.41, with an average price of around $25.85.

Polkadot Price Prediction 2028

In 2028, the minimum price of Polkadot is expected to be $35.55. The Polkadot price might reach a maximum of $43.70, averaging around $36.84 throughout the year.

Polkadot ($DOT) Price Prediction 2029

For 2029, Polkadot’s price is predicted to reach a minimum of $51.18. It has the potential to climb to a maximum of $62.18, with an average price of $53.02 throughout the year.

Polkadot Price Forecast 2030

The price of Polkadot in 2030 is predicted to reach a minimum of $76.67. It could go up to a maximum of $90.66, with an average trading price of $79.32.

Polkadot ($DOT) Price Prediction 2031

In 2031, the price of Polkadot is expected to reach a minimum level of $107.96. The Polkadot price might hit a maximum of $130.61, with an average trading price around $111.93.

Polkadot Price Prediction 2032

Based on an in-depth technical analysis of $DOT’s past price data, in 2032, Polkadot is predicted to reach a minimum price of $162.95. The maximum level could be around $188.30, with an average trading price of $167.42.

Polkadot Price Forecast: By Experts

According to Digital Coin Price, the price of $DOT is anticipated to surpass $11.52 in 2024. By the year’s end, it’s projected that Polkadot will achieve a minimum price of $11.32. Moreover, the $DOT price has the potential to attain a maximum of $13.30. In 2032, the price of $DOT is forecasted to exceed $101.55. By the end of the year, it is projected that Polkadot will reach at least $99.97. Furthermore, the $DOT price has the potential to attain a maximum of $101.89.

According to the current price prediction from Coincodex, the price of Polkadot is expected to decrease by -6.21%, reaching $5.09 by November 22, 2023. Coincodex’s technical indicators suggest a Neutral market sentiment, while the Fear & Greed Index indicates 63 (Greed). In the past 30 days, Polkadot has experienced 19/30 (63%) green days and a price volatility of 12.94%. Coincodex’s forecast suggests that it might be a favorable time to invest in Polkadot.

Furthermore, considering the historical price trends of Polkadot and BTC halving cycles, the lowest predicted price for Polkadot in 2024 is around $4.83. Meanwhile, its price is anticipated to reach a high of approximately $11.47 in the following year.

Polkadot 2.0 Brings Bullish Vibe

Polkadot has experienced challenging times in recent months. Despite not being classified as an unregistered security by the United States Securities and Exchange Commission (SEC), it suffered significantly due to the SEC’s lawsuit against the Binance and Coinbase cryptocurrency exchanges.

Throughout the second quarter of 2023, Polkadot witnessed a decline in most of its system metrics, both annually and quarterly. On a positive note, there have been developments since then. The network, renowned for enabling the creation of individual blockchains, announced the completion of Polkadot 1.0 and laid the groundwork for the introduction of Polkadot 2.0.

The announcement about Polkadot 2.0 was somewhat vague, leaving unclear details about its features. Gavin Wood, the co-founder of the blockchain, hinted that it could involve a shift in the payment structure, potentially allowing users to pay based on their usage time rather than the technology used.

In a significant move in October, the Web3 Foundation, led by Wood, committed to investing 20 million Swiss Francs and five million $DOT to bolster Polkadot’s development community.

Conclusion

While the launch of Polkadot 2.0 generates excitement, it’s important to approach it with a measured perspective, as the specifics of its features and functionalities are not entirely clear yet.

Despite this uncertainty, $DOT stands as one of the more robust and significant cryptocurrency platforms in the market. It has a history of stability, having recovered from past challenges, and recently, it has mirrored the market’s upward trend over the past few weeks.

An additional positive aspect for $DOT is its exclusion from the SEC’s list of potential unregistered securities in the crypto space, which bodes well for the coin’s standing.

Furthermore, the Web3 Foundation’s announcement of grants signifies a strong commitment to supporting the Polkadot development community, which could positively impact its future. On the flip side, Polkadot’s performance throughout the year has not been particularly impressive. This track record suggests that investors should carefully weigh their options and consider the potential risks and benefits when deciding to invest in Polkadot.