The Decentraland (MANA) price could complete the final leg of its correction before resuming its previous increase.

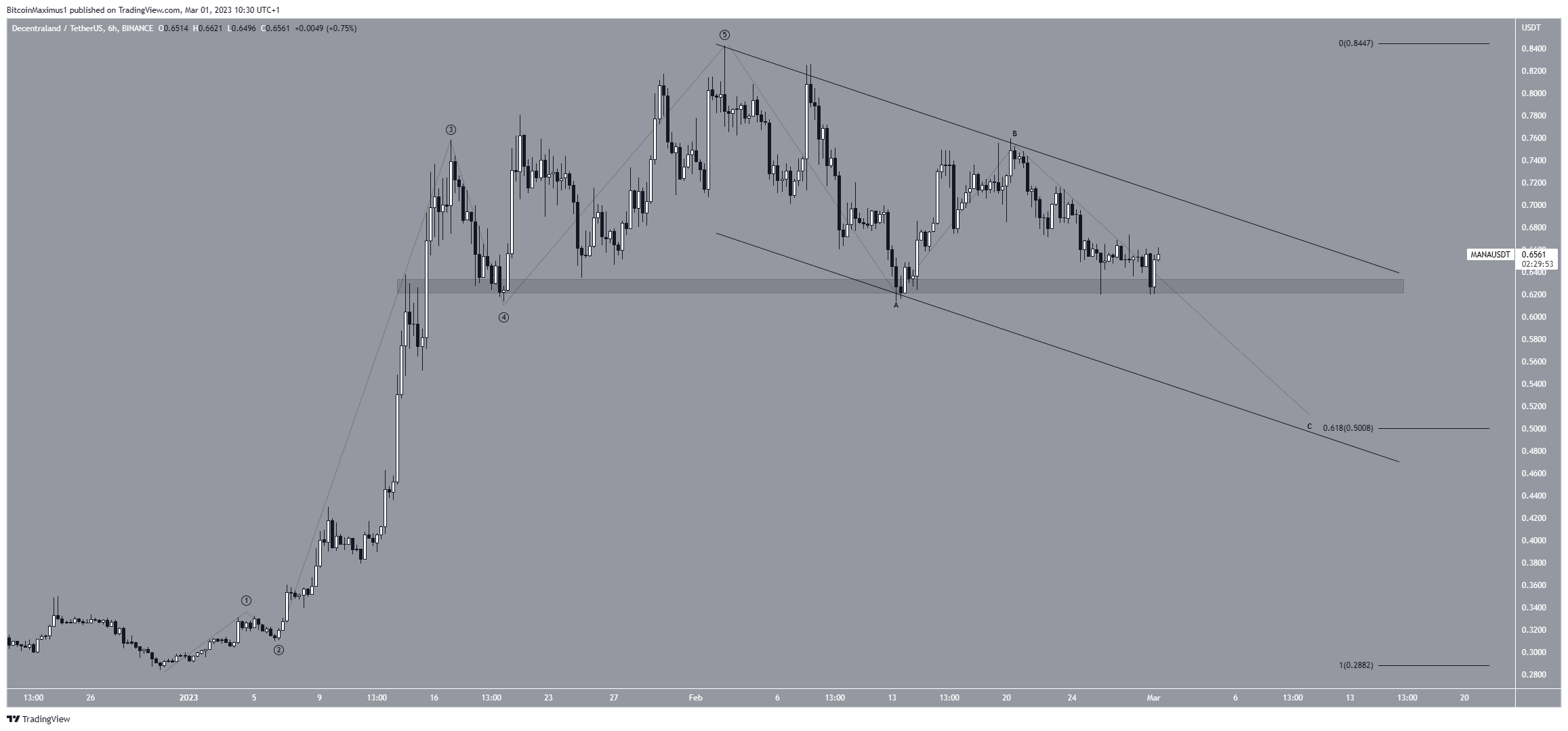

The Decentraland price has fallen below a descending resistance line since reaching a yearly high of $0.842 on Feb. 2. During the descent, the price has traded above the long-term $0.625 horizontal support area. These two structures combine to create a descending triangle, which is considered a bearish pattern. Therefore, the price is expected to break down from it.

If the price breaks down, the closest support level would be at $0.500. This is the upward movement’s 0.618 Fib retracement support level (white).

On the other hand, a breakout from the descending resistance line could lead to an increase toward $0.80.

Due to the presence of a bearish pattern and the fact that the daily RSI is below 50 (red icon), a breakdown is the most likely scenario.

Decentraland (MANA) Price Prediction for March: More Pain Before Reversal

The technical analysis from the short-term six-hour chart shows that the MANA token price completed a five-wave upward movement and could now be in the C wave of an A-B-C corrective structure (black).

If so, the digital asset’s price will soon break down from the $0.625 horizontal support area and complete its correction. If so, the support line of a descending parallel channel would coincide with the $0.500 support area. Since channels usually contain corrections, this outline would perfectly fit with the possibility of a correction.

However, as outlined previously, a breakout from the descending resistance line would invalidate this short-term bearish Decentraland price prediction for March and could lead to a drop toward $0.80.

To conclude, the most likely Decentraland price prediction for March is a drop to the $0.500 support area before the upward movement eventually continues.

For BeInCrypto’s latest crypto market analysis, click here.

beincrypto.com

beincrypto.com