After launching on Ethereum (ETH) sidechain Polygon last week, usage of decentralized finance (DeFi) liquidity protocol Aave (AAVE) has been surging.

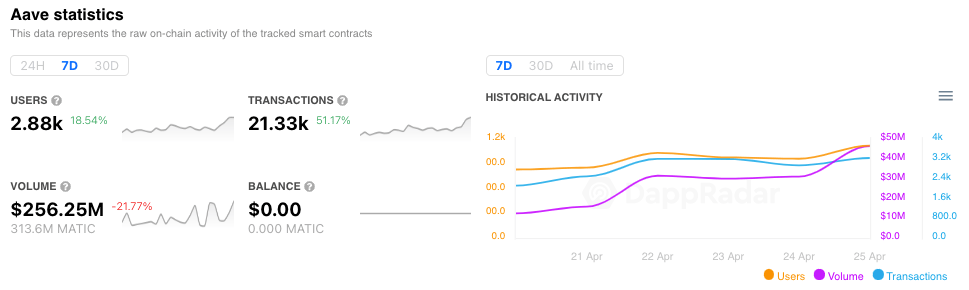

In the past seven days, Aave transactions on Polygon have jumped 50%, past 21,000. Additionally, the number of unique active wallets has increased almost 20%, to 2,800.

Although down from launch week, transaction volume reached $256 million, at the time of writing. The switch to the Ethereum sidechain enables Aave to offer their services without the need for gas fees.

What is Aave?

Aave is a DeFi liquidity protocol. This means it allows for the creation of lending pools, which allow users to lend or borrow different cryptocurrencies. Users deposit funds they wish to lend into these liquidity pools. Borrowers can then withdraw from those pools to take out a loan. Several different tokens can be used in these transactions. For instance, a borrower can provide collateral in DAI, then borrow in ETH.

Aave facilitates this by issuing two types of tokens. First, lenders use aTokens so they can collect interest on their deposits. Second, there are Aave tokens, which are the protocol’s native token. The Aave token provides its holders with benefits such as discounts or no fees at all when taking out a loan.

DeFi apps are flourishing on Polygon

Polygon is a platform designed for infrastructure development and scaling on Ethereum. It is a protocol built for connecting Ethereum-compatible blockchain networks, but is not the new Ethereum. Instead, it is one of many solutions posed to provide higher throughput and deal with high gas fees.

Currently, decentralized finance apps are flourishing on Polygon. In addition to Aave, QuickSwap is another top DeFi protocol seeing increased adoption. Just earlier today, DeFi stablecoin infrastructure protocol mStable announced their launch on Polygon.

beincrypto.com

beincrypto.com