In brief:

- XRP has posted a 3-year high value of $0.944 – Binance rate

- The bullish push by XRP towards $1 has caused $182.25 million in liquidations in a 24 hour period

- The XRP liquidations in the last day have eclipsed Bitcoin’s

- The majority of the XRP liquidations were short positions

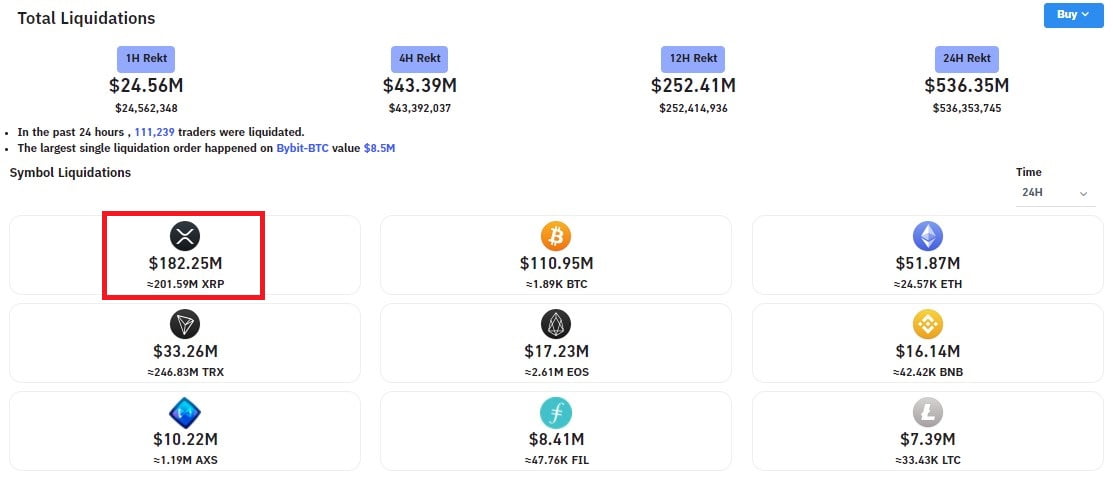

The value of XRP trading positions liquidation in the last 24 hours has hit $182.25 million. This is according to data from Bybt.com that also indicates that the XRP liquidations in the last day have eclipsed those of Bitcoin at $110.95 million. The screenshot below, courtesy of the tracking website further demonstrating this fact.

The majority of the Liquidations were Short Positions as XRP Inched Closer to $1

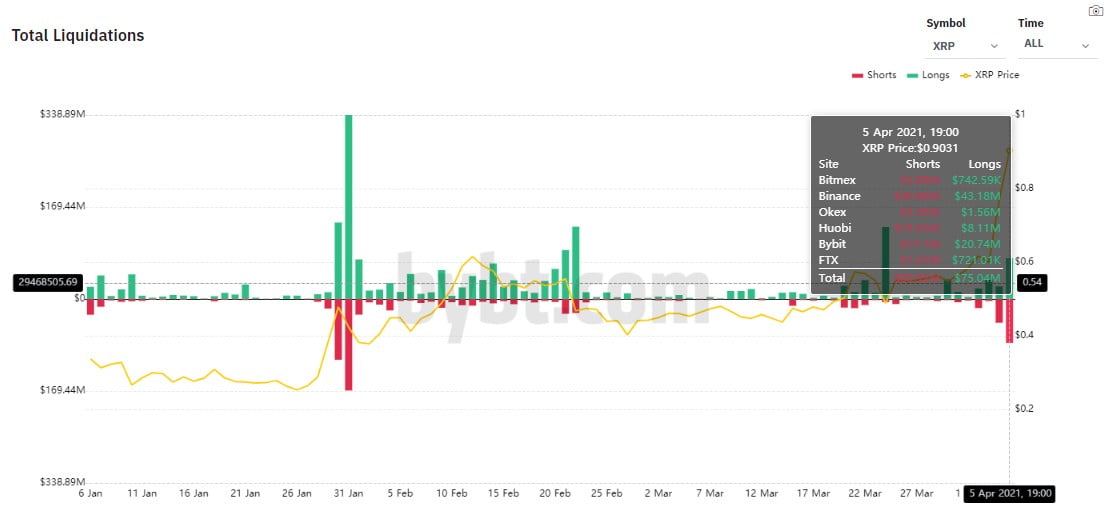

The liquidations were a result of XRP pumping from the $0.65 price area during yesterday’s open, to a three-year high of $0.94483. Data also from Bybt.com concludes that $80.92 million of the $182.25 million in liquidations were XRP short positions. Traders who were overleveraged on their longs were also liquidated to the tune of $75.04 million as illustrated by the chart below courtesy of Bybt.com.

What Next for XRP in the Crypto Markets?

What Next for XRP in the Crypto Markets?

The push by XRP towards the psychological price of $1 caused the remittance coin to move up to the 6th position on Coinmarketcap. XRP has edged out Uniswap (UNI) and Cardano (ADA) with only $59.45 million in Market capitalization separating the remittance coin from Polkadot in the number five position.

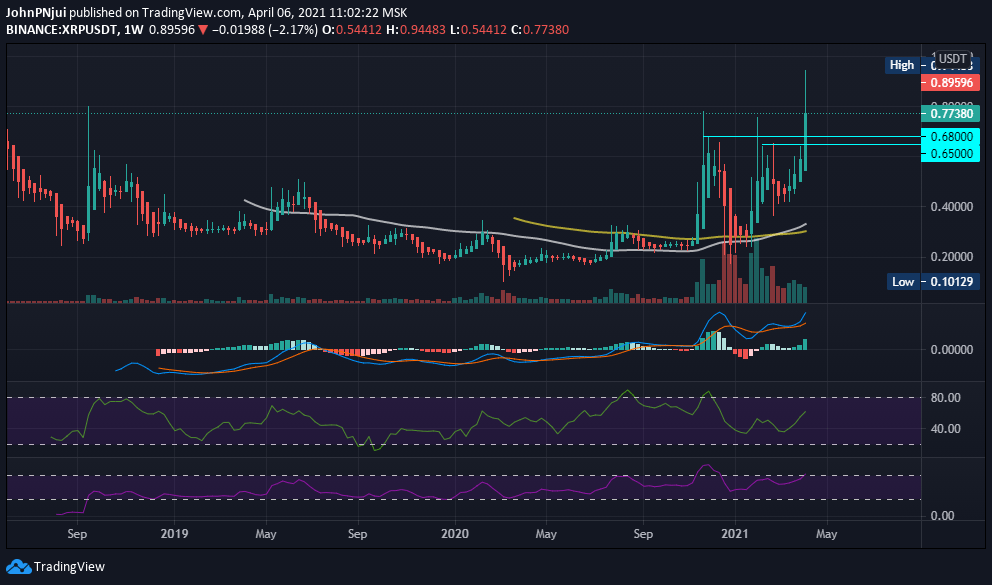

The XRP daily chart is already hinting at an overbought scenario. However, the weekly chart below points to a bullish few weeks for XRP at least till the beginning of May this year as shall be explained.

To begin with, XRP has confidently broken the earlier identified resistances at $0.65 and $0.68. These price areas are now acting as support zones moving forward.

Secondly, the weekly trade volume is in the green with the MACD yet to show signs of exhaustion on a macro level. Thirdly, the weekly MFI and RSI are yet to also show signs of an overbought scenario at values of 64 and 75 respectively.

Fourthly, and by simply eyeballing the indicators, an overbought scenario will most likely occur on a macro level, around late this month or early May.