A lot has happened in the past week, specifically one of the biggest scandals in the past decade regarding financial brokers. Trust is one key component that the broker-investor relationship depends on, and it seems that this trust is starting to break. Regulators and big tech giants are interfering to try to break the ice and level down the impact of the disaster, but so far in vain. In this article, we’re going to specifically tackle what happened with GameStop stock, and how it affected cryptos, more specifically DOGECOIN.

What the Hell happened with GameStop Stock?

Before we tackle the events that happened, we need to understand what are hedge funds and how they operate.

Hedge Funds are financial institutions that pool investors’ funds and trade the markets using complex strategies. One of their activities is analyzing companies’ balance sheets in order to buy strong companies or short weak companies that have bleak futures.

One of those weak companies happened to be GameStop, a company barely making any profit, and has been replaced by the online gaming industry. So most hedge funds had this company on their radar, with short positions in their portfolios.

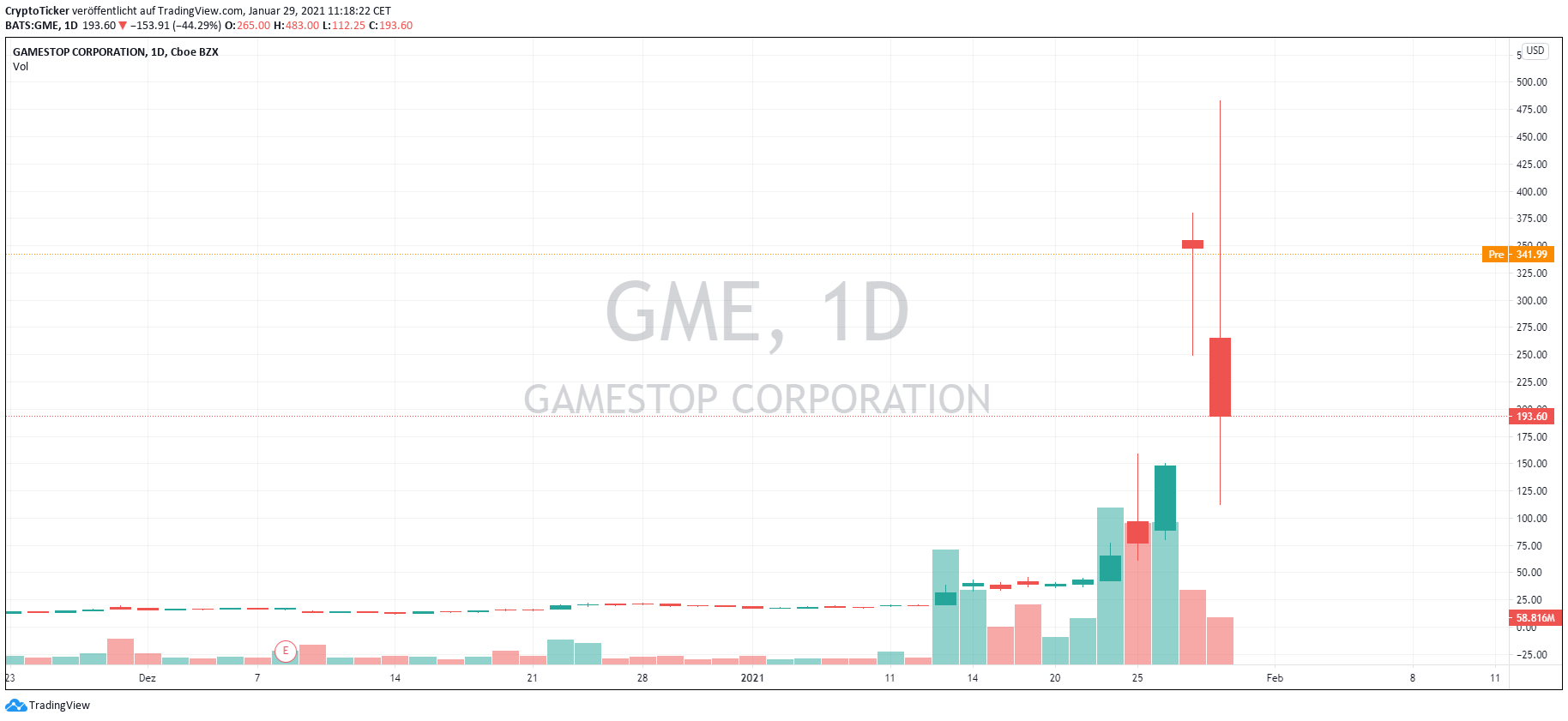

A Reddit page called WallstreetBets, which represents a meme group where retail traders discuss topics, happen to all agree on a strategy to “pump” a certain stock that is being shorted, for the sole purpose of making hedge funds (the big players) lose their money. That’s what happened, everyone decided to buy the stock, leading to a price surge of about 1,000%.

Was GameStop’s price surge ALL due to Retail Traders?

It is very unlikely that the price increase was solely done by retail traders. In the financial markets, many players participate in buying and selling activities. One of those players is Algorithmic Trading:

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders.

Wikipidia explanation

Retail traders usually barely represent 20% of the market activity. So they might have been able to maybe start the buying momentum, which in turn got pushed by algorithmic trading, making a snowball effect.

How did this affect the Crypto Market?

Robinhood, one of the leading brokerage firms in the US decided to side with Hedge Funds and halt buying of a few stocks that for them, are being manipulated. But the truth is far from that, and Robinhood is blamed for manipulating the market by siding with their bigger clientele, and going against a free market principle.

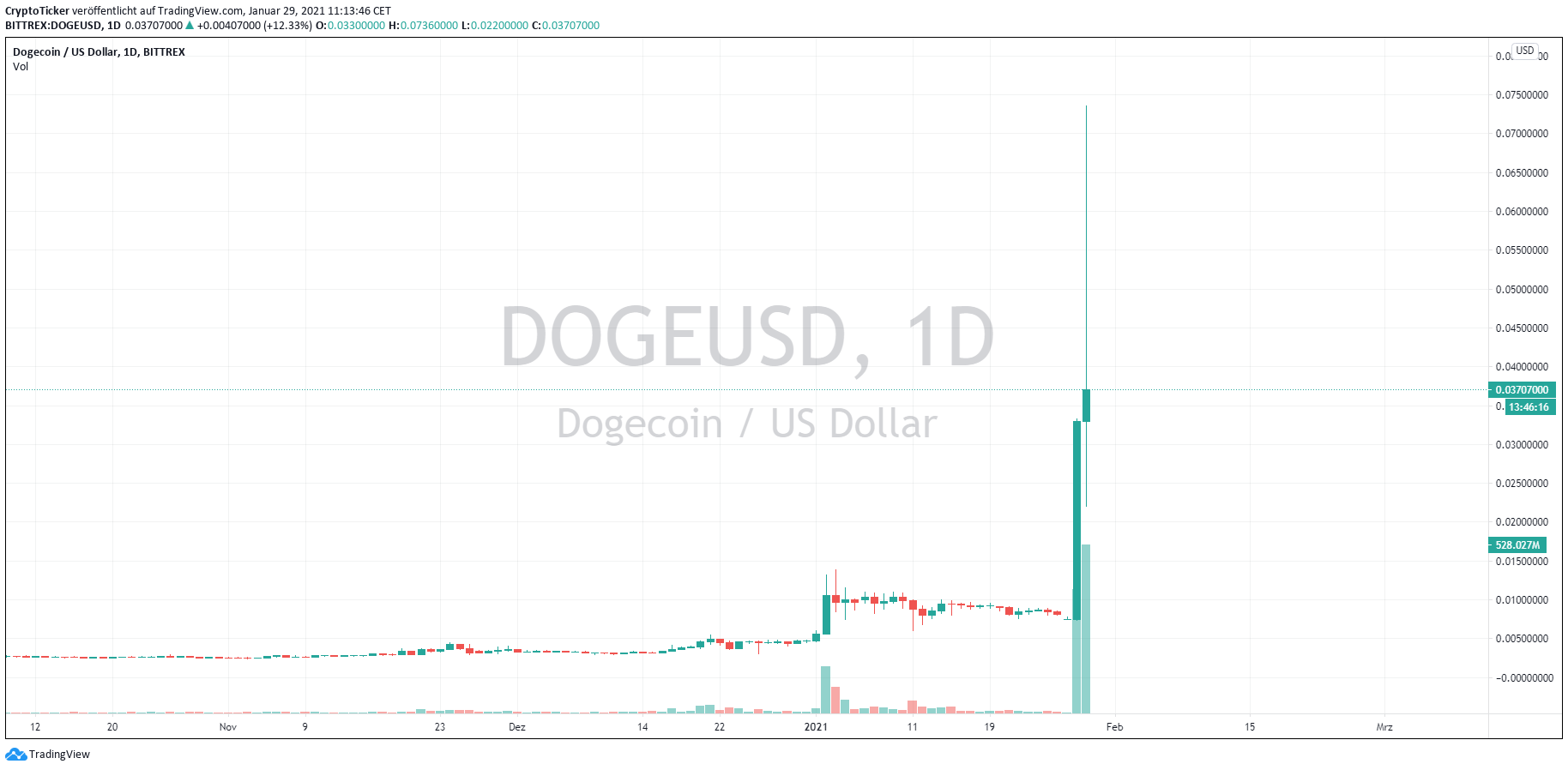

Enter Cryptocurrencies, which are totally made to run away from traditional businesses that are quite manipulative, and represent a totally free market. When chaos started to unveil with this big scandal, investors started to know the importance of a decentralized marketplace and turned to cryptocurrencies, which in turn explains why the cryptocurrency market was up by USD 100 Billion in the past 24 hours, reaching a USD 1 Trillion market capitalization again.

Why did DogeCoin price surge 470%?

We previously spoke about Dogecoin, this cryptocurrency that started based on memes. It all started with Elon Musk tweeting about the coin, making it rise more than 150%.

Stay Ahead, Stay Updated

Rudy Fares

How to Become a Successful Trader – 5 Steps to Follow

You might also like

Elon Musk – The CEO of Tesla OWNS Bitcoin! How much? Read on

How to Pay with Cryptocurrencies?

EXCUSES? TOP 3 reasons used by people who DON’T BUY Cryptocurrencies

More from Altcoin

Pi Network raises Red Flags while claiming to be the New Bitcoin – Full Review

Rudy Fares

0

Rudy Fares

0

Every so often, we witness the launch of a new cryptocurrency that comes with its hype soldiers. In 2019, a …

Cryptocurrency Nostalgia: These Five Ancient Coins From ‘17 Are Showing Signs Of Life

Taha Zafar

0

Taha Zafar

0

For the cryptocurrency investors, the end of ‘17 and beginning of ’18 has been the best so far. As …

As Ether Reaches New All-Time High, Bitcoin Surges Ahead!

Santiago Burelli

0

Santiago Burelli

0

On January 25th, 2021 Ethereum officially hit a new all-time high of $1,467.78, Ethereum propped Bitcoin up as well following an …

cryptoticker.io

cryptoticker.io