Following the launch of the mainnet and the transferability of tokens, a series of projects are about to be launched on Polkadot, relating in particular to the DeFi ecosystem.

Phase 1, launched in May 2020, marked the initial step of a multi-stage implementation process described in the mainnet launch roadmap of the project.

This first version of Polkadot functioned as a Proof-of-Authority (PoA) network managed by six validators belonging to the Web3 Foundation. On June 18th, 2020 (phase 2) the network switched to the proposed Proof-of-Stake (PoS) system, which allowed DOT owners to request validation slots and unlocked staking rewards.

Phases 3 and 4 at the end of July 2020 introduced Polkadot’s governance functionality and the delivery of protocol control to the community, respectively. On August 21st, the transferability of DOT to the network was enabled.

This allowed all users to trade DOT on exchanges and stake them.

Polkadot’s auctions for the assignment of Parachains

The next step on the Polkadot roadmap is the assignment of parachains through an auction in which the highest bidder will win the slot. The type of auction chosen by the team, however, is that of the “Candle Auction” in which the duration of the auction will be random, whereby participants do not know the time limit for bidding.

There will then be a specific phase called “open phase” and the winner will be determined retroactively, as the auction will have ended at some point in the past. Bids will continue to be accepted throughout the opening phase of the auction, but as time passes bids have a lower chance of winning. This is because it may happen that bids are submitted after the closing time determined retroactively.

There are no exact estimates of how many DOT are needed to win a slot, but it could be as high as 40,000 DOT (at the current exchange rate around 180,000 USD). Funds locked for a slot are not eligible for staking, so projects that will use their DOT for a slot will not earn staking rewards.

Some projects finance their DOT reserve through users, who expect to receive a higher reward from the potential parachain.

It has not yet been declared when the auction for the first 3 parachains will take place, but the projects are organizing themselves to continue even if they do not win the slot. Projects can become parathreads and rent capacity from a parachain until they are able to secure a slot.

Parathreads work in a similar way to parachains but with a pay-as-you-go model, and are designed to offer a cheaper system for blockchains that do not require continuous connectivity to the network. Polkadot’s ultimate goal is to achieve 100 active parachains.

However, this participation model can be critiqued for not being open to all but only to those who have large funds to participate. In contrast to Ethereum, which allows everyone to deploy a smart contract and immediately attract users thanks to the actual product.

What would have happened to last summer’s DeFi development if all projects had to face an auction to reserve a place on the Ethereum blockchain?

Incoming DeFi projects on Polkadot

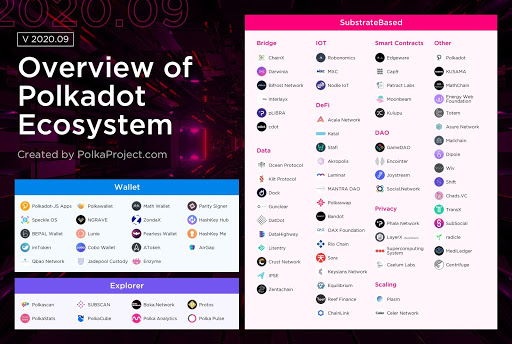

Although the date of the first Parachain auction is unknown, many projects are developing products based on Polkadot. Some of them are compiled using substrates, the framework designed to allow the construction of fully interoperable blockchains with Polkadot.

Several of these projects have been developed thanks to web3 foundation grants.

According to PolkaProject there are now over 280 projects being launched on Polkadot, including 20 focused on DeFi. Let’s take a brief look at the most interesting projects.

StaFi aims to unlock the staked cash in the platforms of Polkadot, Kusama, Cosmos and Tezos (and in the future Ethereum), in order to use it in DeFi. StaFi was deployed on the mainnet at the beginning of September, after conducting an airdrop to all the stakers of the above protocols in August.

Then there is ChainX, which integrates assets from other blockchains such as Bitcoin, EOS and Ethereum and many others in a similar way to pTokens, WBTC and REN but with a parachain-based approach. ChainX is also already working on its own DEX and bridge with Filecoin, allowing the Polkadot ecosystem to use P2P storage.

Acala Network intends to offer the possibility to create Collateralized Debt Position (CDP) using the assets of Polkadot’s various parachains to issue its stablecoin, like Maker on Ethereum. Currently being tested on Kusama Network, the launch on mainnet is scheduled for the end of this year.

Preparations are also underway for Polkaswap, an AMM DEX aimed at trading the various assets available on Polkadot in a decentralized, non-custodial manner.

Polkadot’s ecosystem is growing at a rapid pace, attracting many developers, and thanks to interoperability it promises interesting developments also in the area of DeFi, the most important trend in 2020 that has restored a positive sentiment in the cryptocurrency market.

It will be interesting to see which of these projects will be able to grab a slot for a parachain or will be able to rely on one with a parathread.

en.cryptonomist.ch

en.cryptonomist.ch