Dogecoin’s first spot ETF products have been live since Nov. 24, 2025 in the U.S., but judging by the numbers by SoSoValue, it is fair to say that $DOGE has yet to live up to the hype surrounding the ETF.

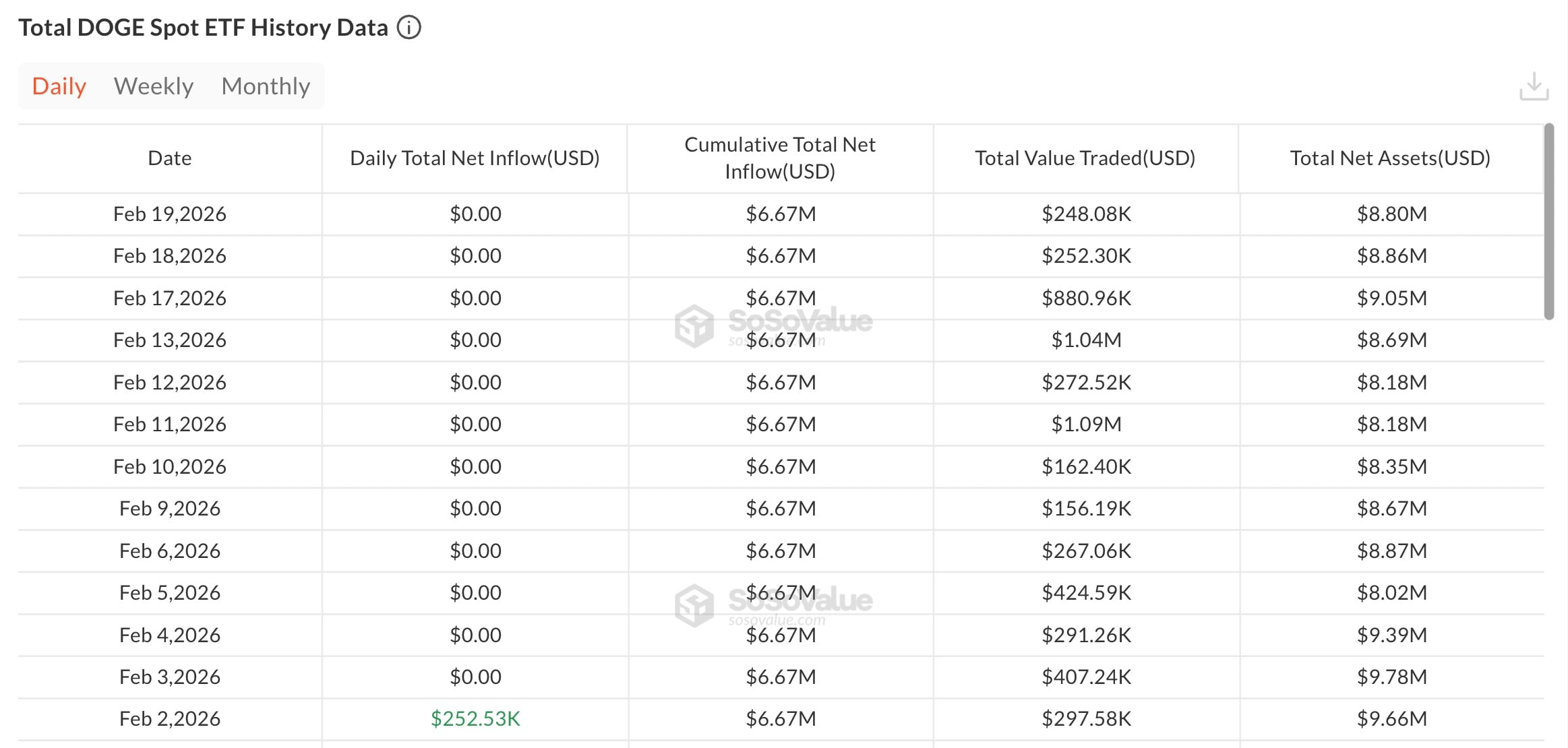

As of Feb. 19, the cumulative net inflows across the U.S. $DOGE spot ETFs were $6.67 million, with a 18-day streak of $0 in net inflows and total net assets of approximately $8.8 million.

Under 1% of market cap: Is institutional demand for $DOGE just lagging?

The total value traded in the most recent session was nearly $247,000. For context, leading Bitcoin and Ethereum ETFs moved billions in their opening weeks, setting a benchmark that any new crypto fund inevitably faces. This raises the question of whether the demand for this asset born from a meme was overestimated.

Three issuers currently dominate the $DOGE ETF table: Grayscale’s GDOG, which has approximately $6.38 million in net assets; 21Shares's TDOG, which has nearly $1.77 million; and Bitwise's BWOW, which has around $641,000. The whole segment itself is so small, it represents less than 1% of Dogecoin’s overall market capitalization worth $16.25 billion, as per CoinMarketCap.

$DOGE is quoted at around $0.096 at the time of writing, down by over 1.5% for the day and well below the $0.15 resistance level seen earlier this year. The long-term chart shows a consistent downward trend since September 2025, with recent attempts to reach higher levels failing miserably.

Calling the ETF a failure at this stage may be premature. However, expectations for the institutionalization of meme assets were clearly higher than current flow data for Dogecoin reflects.

A more relevant question is whether $DOGE can generate sustained inflows beyond early adopters. If assets under management remain below $10 million and trading activity stays low, issuers could face commercial pressure.

u.today

u.today