The $XRP Ledger (XRPL) has reached a major milestone following the creation of the first permissioned offer on the $XRP DEX.

Popular XRPL dUNL validator Vet highlighted the development on Wednesday shortly after the network activated XLS-81, popularly known as the “Permissioned DEX” amendment.

Key Points

- The XRPL has reached a major milestone with the creation of its first permissioned offer on the $XRP DEX.

- Labeled “Offer Create Permissioned,” the transaction embeds compliance conditions directly into the trade.

- The transaction comes a few seconds after developers activated XLS-81, or the Permissioned DEX amendment.

- The offer involved 5.89 $XRP in exchange for 589 $RLUSD, referencing the symbolic “589” figure.

First Permissioned Offer Created on XRPL

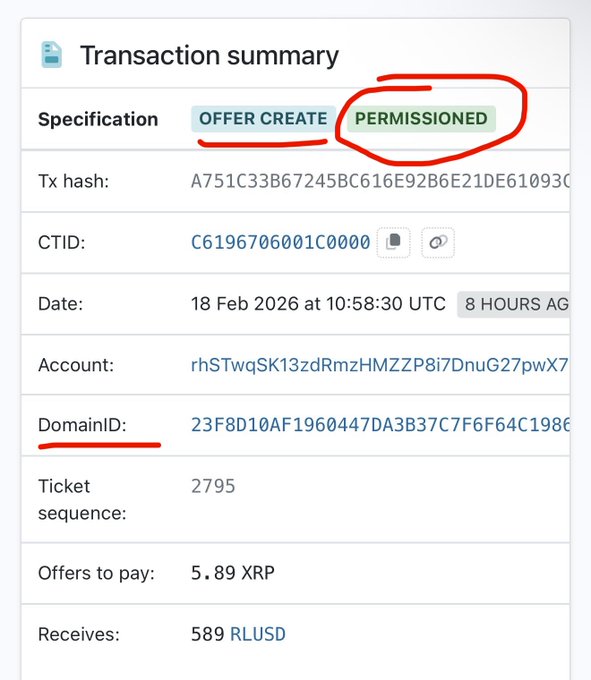

In a tweet, Vet confirmed that the first permissioned offer has gone live on the $XRP DEX, marking a major step toward compliant on-chain trading. The transaction, labeled “Permissioned – Offer Create,” embeds conditions that restrict who can execute the trade.

Vet explained that this feature allows participants to limit access to their orders, including restricting requirements, to only KYC-verified accounts or regulated entities. Unlike traditional open DEX listings, permissioned offers integrate compliance logic directly into the transaction, enabling automated enforcement without third-party intermediaries.

The accompanying screenshot shows that the offer was created on February 18 at 10:58 (UTC). The user listed 5.89 $XRP for 589 $RLUSD, signaling a nod to the symbolic “589” figure widely recognized in the $XRP community.

XRPL Enables Permissioned DEX

Notably, developers activated the Permissioned DEX amendment (XLS-81) just seconds before the first offer went live. This upgrade allows regulated institutions to trade on the $XRP Ledger through gated, compliance-driven marketplaces.

Unlike the open public DEX, permissioned domains restrict who can place and accept offers, limiting participation to AML- and KYC-compliant entities. Developers designed the Permissioned DEX specifically for financial institutions, such as brokers and banks, to facilitate on-chain trading and settlement without exposing markets to unrestricted access.

Enhancing Institutional DeFi on XRPL

Meanwhile, this development strengthens XRPL’s institutional DeFi strategy. It complements the recently implemented Token Escrow amendment (XLS-85), which expanded escrow functionality to all issued assets, including tokenized real-world assets and stablecoins.

In addition, developers are pushing to implement XLS-66, widely known as the XRPL Lending Protocol, which aims to introduce a native lending framework tailored for institutional DeFi.

Collectively, these upgrades equip regulated financial players with a robust on-chain toolkit, enabling use cases such as stablecoin FX rails, tokenized funds, and compliant secondary markets.

thecryptobasic.com

thecryptobasic.com