$XRP ($XRP) price extended its slide on Wednesday, adding to a downtrend that has erased 44% of its value over the past year.

Amid this, a market analyst has highlighted unusual trading activity emerging from South Korea’s largest crypto exchange, raising questions about its potential impact on $XRP’s price dynamics.

Study of 82 Million Trades Flags Structural Selling in $XRP/KRW Market on Upbit

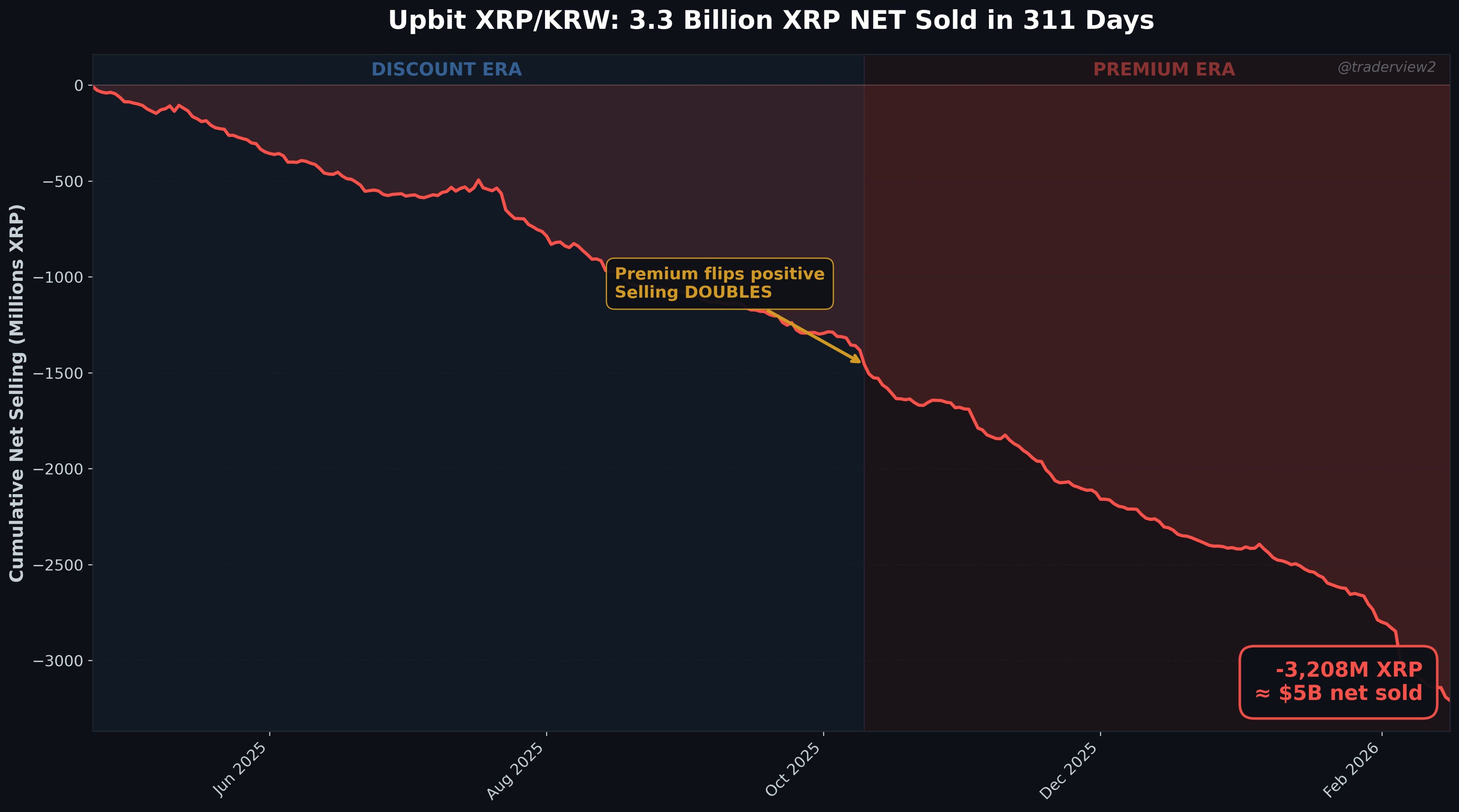

Crypto analyst Dom claims to have uncovered what he describes as a nearly year-long, multi-billion-dollar $XRP selling pipeline. In a thread published on X (formerly Twitter), Dom said his findings are based on 82 million tick-level $XRP/KRW trades on Upbit, alongside 444 million trades from Binance for comparison.

According to his analysis, Upbit’s $XRP pair has recorded a net negative cumulative volume delta every month for the past 10 months.

“It started with yesterday’s price action. -57M $XRP in CVD over 17 hours. It looked insane. So I ran forensic queries – bot fingerprinting, iceberg detection, wash trade checks. The selling was real. Algorithmic. 61% of trades fired within 10ms. Single bot running 17 hours straight with one 33-second pause,” he wrote.

$XRP/KRW Selling on Upbit">

$XRP/KRW Selling on Upbit">

Dom highlighted several months with particularly heavy negative cumulative volume delta (CVD), including April (-165 million $XRP), July (-197 million $XRP), October (-382 million $XRP), and January (-370 million $XRP). In total, he reports that only 1 of 46 weeks in the sample period showed net positive buying pressure.

“And it’s not ‘the market’ – Binance $XRP/USDT carries 2-5x less sell pressure on the same coin (shocker). In June, Binance was net positive while Upbit bled -218M. The hourly correlation between the two venues is only 0.37. Upbit’s flow is largely its own thing,” the post added.

Dom argues the selling appears algorithmic. Between 57% and 60% of trades were executed within 10 milliseconds, a pattern typically associated with automated systems. He also observed that sell orders frequently appeared in round-number sizes such as 10, 100, or 1,000 $XRP.

Meanwhile, buy orders were often fractional amounts like 2.537 $XRP, consistent with KRW-denominated retail purchases.

“Ten million fractional buy orders over 10 months. Compared to the sell side running mechanical round number clips. Two completely different profiles trading against each other on the same venue,” the analyst added.

Furthermore, the analyst noted that from April to September, $XRP on Upbit reportedly traded at a 3% to 6% discount to Binance, a “reverse Kimchi Discount.”

“The sellers were accepting 6% worse fills than available on global markets, for many months. They don’t care about the price. They need KRW, are mandated to use Upbit, and/or are Korean holders taking profit,” he stated. “Then October 10 happened. The premium has only briefly gone negative since and the sellers? They doubled their daily rate. From -6.3M/day to -11.2M/day.”

He estimates that the overall activity accounts for 3.3 billion $XRP, worth $5 billion, in “net selling.” This represents about 5.4% of the token’s circulating supply. While Dom does not identify a specific entity behind the activity, he describes the flow as consistent, 24/7, and infrastructure-like rather than discretionary trading.

“So who has enough $XRP to sell 300-400M per month for a year straight, doesn’t care about 6% discounts, runs identical algo infrastructure 24/7 and needs KRW specifically or is in some walled garden and can only use Upbit? AND who are they selling to? Who’s been on the other side of that trade? It could be 1 entity, 50 entities or 10k people I’ll let you speculate,” Dom remarked.

Why Does This Matter?

This matters because sustained, large-scale selling may influence price dynamics over time. A consistent flow of sell orders may limit upward momentum, intensify declines during periods of market stress, and absorb buying demand before it translates into meaningful price appreciation.

The impact is particularly relevant given that $XRP was the most traded asset on Upbit in 2025. If this pattern is accurate, it would suggest that a significant source of supply has been active within one of the world’s most active $XRP markets, with retail participants frequently on the opposite side of those trades.

Should that selling pressure decrease or stop, overall market behavior could shift as the balance between supply and demand adjusts.

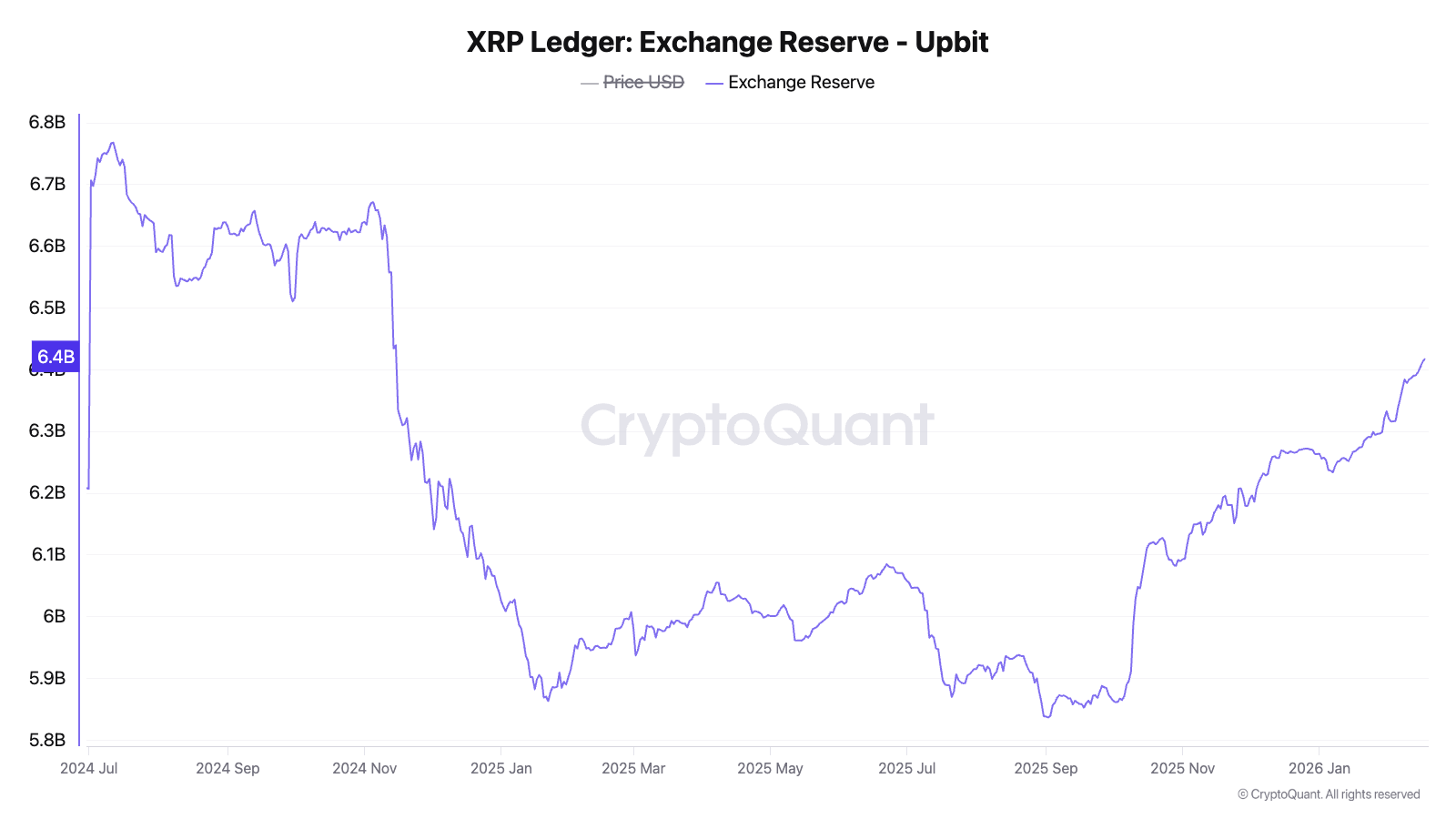

The findings come as $XRP balances on Upbit have reached a one-year high, exceeding 6.4 billion $XRP, accounting for nearly 10% of the circulating supply.

$XRP Reserves on Upbit">

$XRP Reserves on Upbit">

In contrast, exchange reserves continued to decline on Binance, reflecting a divergence between Korean $XRP investors and participants in other markets.

Binance $XRP reserves just hit their lowest level since early 2024.

— Ripple Bull Winkle | Crypto Researcher 🚀🚨 (@RipBullWinkle) February 17, 2026

700 million $XRP left the exchange from the November peak. At current prices, that's hundreds of millions of dollars — gone from exchange wallets.

You sell on exchanges. You move off when you intend to hold. $XRP… pic.twitter.com/7iUee7SqdV

Taken together, the reported structural selling on Upbit and the rise in $XRP balances on the exchange point to a sustained flow of tokens circulating within that venue. At the same time, contrasting reserve trends and accumulation patterns observed on other exchanges highlight a divergence in regional market behavior.

The post Analyst Claims $5 Billion $XRP Selling Flow on Upbit: What It Means for Price appeared first on BeInCrypto.

beincrypto.com

beincrypto.com