-

Just 2,200 $XRP now puts holders in the top 10% as wallet growth surges 30%, retail expands, and large investors quietly consolidate positions.

-

$XRP distribution shifts as smaller wallets rise and top-tier thresholds drop, fueling speculation about future Bitcoin decoupling and long-term growth.

The latest $XRP rich list update shows a noticeable shift in token distribution. Investors now need just over 2,200 $XRP to enter the top 10% of all $XRP wallets worldwide.

This change comes as analysts closely watch whether the $XRP price could decouple from Bitcoin in the next major crypto market cycle.

2,200 $XRP Now Secures Top 10% Position

Recent wallet data reveals that around 760,000 addresses currently hold between 2,200 and 7,700 $XRP. Holding approximately 2,232 $XRP now places an investor inside the top 10% of $XRP holders globally.

Here’s how the current distribution looks:

- Top 10%: ~2,232 $XRP

- Top 5%: ~7,700 $XRP (down from ~8,100 two months ago)

- Top 1%: ~46,400 $XRP

- Top 0.1%: ~290,000 $XRP (down from ~360,000 previously)

- Top 0.01%: ~3.8 million $XRP

The lower thresholds suggest that $XRP distribution is slowly changing. While fewer tokens are now required to enter higher wallet tiers, the U.S. dollar value of those holdings remains significantly higher compared to previous years due to $XRP’s long-term price growth.

Retail Participation Rises as Larger Holders Consolidate

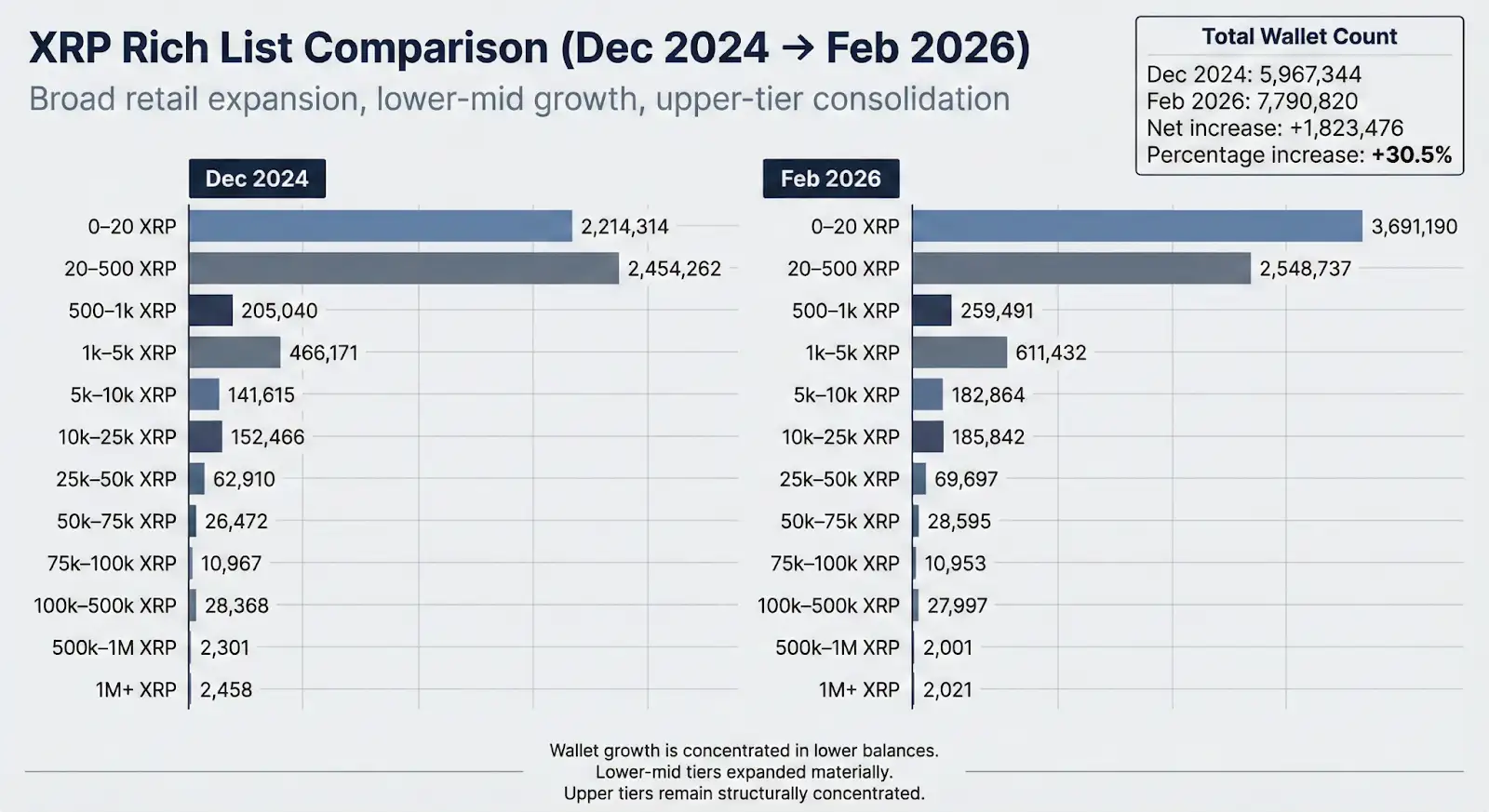

Between December 2024 and February 2026, total $XRP wallets increased from 5.97 million to 7.79 million, marking a rise of nearly 30%.

A closer look at the wallet structure shows:

- Wallets holding under 500 $XRP grew sharply

- Balances between 500 and 10,000 $XRP expanded steadily

- The 10,000–50,000 $XRP tier also increased

- Wallets holding 50,000 to 1 million $XRP remained mostly stable

- Addresses with over 1 million $XRP declined slightly

This suggests that retail participation is expanding. More small investors are entering the $XRP ecosystem. However, large holders continue to control a significant portion of the supply, meaning distribution remains concentrated at the top.

Wallet growth alone does not confirm a major institutional shift. It mainly shows broader participation.

Institutional Positioning vs Retail Uncertainty

Current market conditions show mixed sentiment. Retail investors remain cautious amid price volatility. At the same time, broader crypto ETF inflows and institutional adoption trends indicate that larger players are increasing exposure during market pullbacks.

This pattern has appeared in previous market cycles. Retail fear often peaks near cycle lows, while long-term investors quietly accumulate assets.

If $XRP were to decouple from Bitcoin’s price movements in the future, analysts believe accumulation during uncertainty could play a key role.

Ripple’s Long-Term Infrastructure Strategy

According to recent comments from Brad Garlinghouse, $XRP’s growth will not happen overnight. Instead, it will depend on steady infrastructure development.

Ripple has spent years building partnerships, expanding regulatory engagement, and improving the $XRP Ledger. Ongoing upgrades focus on liquidity improvements, cross-border payments, tokenization, and real-world use cases.

Supporters argue that this long-term strategy could strengthen $XRP fundamentals beyond short-term price speculation.

coinpedia.org

coinpedia.org