Discussions from 2018 confirm that former Ripple CTO, David Schwartz, intended for Codius to bring assets like Bitcoin and Ethereum to the $XRP Ledger.

Notably, Schwartz pointed out that the XRPL already featured a built-in decentralized exchange (DEX) that could allow users trade non-native assets like Bitcoin and Ethereum. However, he suggested that holding such assets on the XRPL posed counterparty risks, and Codius could solve that.

Key Points

- Eight years ago, Schwartz explained in a community discussion that XRPL’s built-in DEX allows users to hold, pay, and trade arbitrary issued assets directly on the ledger.

- However, he warned that gateways holding real Bitcoin or Ethereum pose counterparty risk and can split liquidity when multiple issuers offer separate versions of the same asset.

- Schwartz proposed Codius as a decentralized smart contract platform that could act as a generic, trustless counterparty instead of a human-managed gateway.

- Ripple paused Codius in June 2015 after Stefan Thomas described the market as too small and cited the lack of a universal web payment standard.

- In mid-2025, Ripple launched an EVM-compatible sidechain and expanded interoperability through Axelar and Wormhole.

XRPL’s Unique DEX

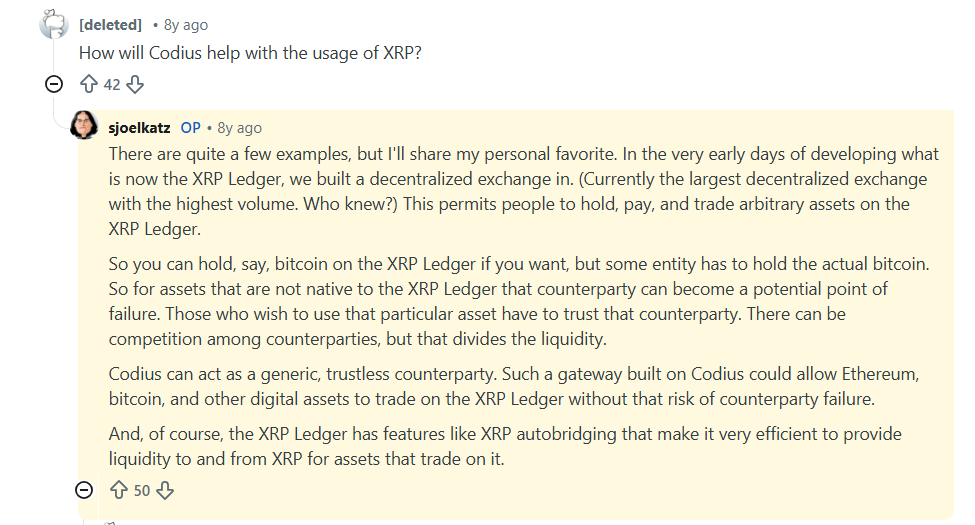

The Ripple CTO Emeritus made his comments during a discussion in 2018. Notably, six years after the $XRP Ledger went live, Schwartz, who served as CTO at the time, joined Reddit in February 2018 for an AMA session.

During the discussion, a user asked how Codius would increase $XRP usage. In response, Schwartz emphasized that there were multiple ways, but called attention to its potential to eliminate counterparty risk as his favorite.

He explained that from the very beginning, the team embedded a decentralized exchange into the $XRP Ledger itself. This allows users to hold, send, and trade different types of assets directly on the network.

While other blockchains relied on separate decentralized apps for trading, XRPL built this feature into the base layer. Schwartz noted that users could trade more than just $XRP. Notably, they could trade issued assets such as gold, fiat currencies, or other tokens created on the ledger.

The Gateway Problem and Liquidity Split

However, the former Ripple CTO highlighted a major issue around this. Specifically, when users bring assets like Bitcoin onto the $XRP Ledger, someone must hold the real Bitcoin on its native chain. A gateway issues a representation of that asset on XRPL.

This creates a counterparty risk because users must trust the gateway to safeguard the underlying asset. If the gateway fails or gets hacked, users lose confidence in the issued token.

He then pointed out another challenge. Notably, when several gateways issue their own versions of the same asset, liquidity spreads across multiple pools. For example, if five companies each issue their own version of Bitcoin on XRPL, traders deal with five separate markets instead of one deep pool.

Codius as a Code-Based Counterparty

Schwartz noted that Codius was a solution to this problem. He called Codius a decentralized hosting platform for smart contracts. Users could rely on transparent code instead of trusting a company to manage assets. With this, smart contracts would act as a neutral counterparty and handle the movement of assets without human control.

He said a gateway built on Codius could allow assets like Bitcoin and Ethereum to trade on the $XRP Ledger without exposing users to the same counterparty risks. This way, the system could reduce the chance that someone mismanages or misuses funds.

He also mentioned $XRP autobridging as a major strength of the ledger. For the uninitiated, autobridging uses $XRP as an intermediary asset to complete trades between two assets that lack a direct market.

If traders want to exchange one issued asset for another, the system can automatically route the trade through $XRP. As long as $XRP maintains strong liquidity, the network can support efficient trading across many assets.

Codius Abandoned

At the time Schwartz made these comments, Ripple had already paused Codius in June 2015. Notably, Stefan Thomas, Ripple’s former CTO and co-creator of Codius, said the decentralization market at the time was too small and early to support the project. He called the effort premature.

The team also faced the absence of a universal web payment standard, which later led to the creation of the Interledger Protocol. Ripple then shifted its focus toward strengthening institutional partnerships instead of running a general-purpose hosting platform.

EVM Sidechain and Hooks

By 2026, several new technologies had addressed the concerns Schwartz raised in 2018. For instance, Ripple launched an EVM-compatible sidechain on mainnet in mid-2025. This sidechain allows Ethereum-style smart contracts to operate alongside the $XRP Ledger.

Meanwhile, Hooks introduced another step forward. Hooks allow developers to build Layer-1 smart contract logic, including smart escrows that release funds automatically when predefined conditions are met. While developers have not activated Hooks on the XRPL mainnet due to security concerns, they have implemented them on the Xahau sidechain.

thecryptobasic.com

thecryptobasic.com