Data reported by the popular Shibburn wallet tracker has revealed an increase in the daily $SHIB burn rate. However, it may seem rather disappointing – over the past 24 hours, this metric has gone up only by 38%. This was not enough to make any significant dent on the total $SHIB supply circulating tin he market at the moment.

But the amount of meme coins that were transferred to unspendable blockchain wallets constitutes several million $SHIB.

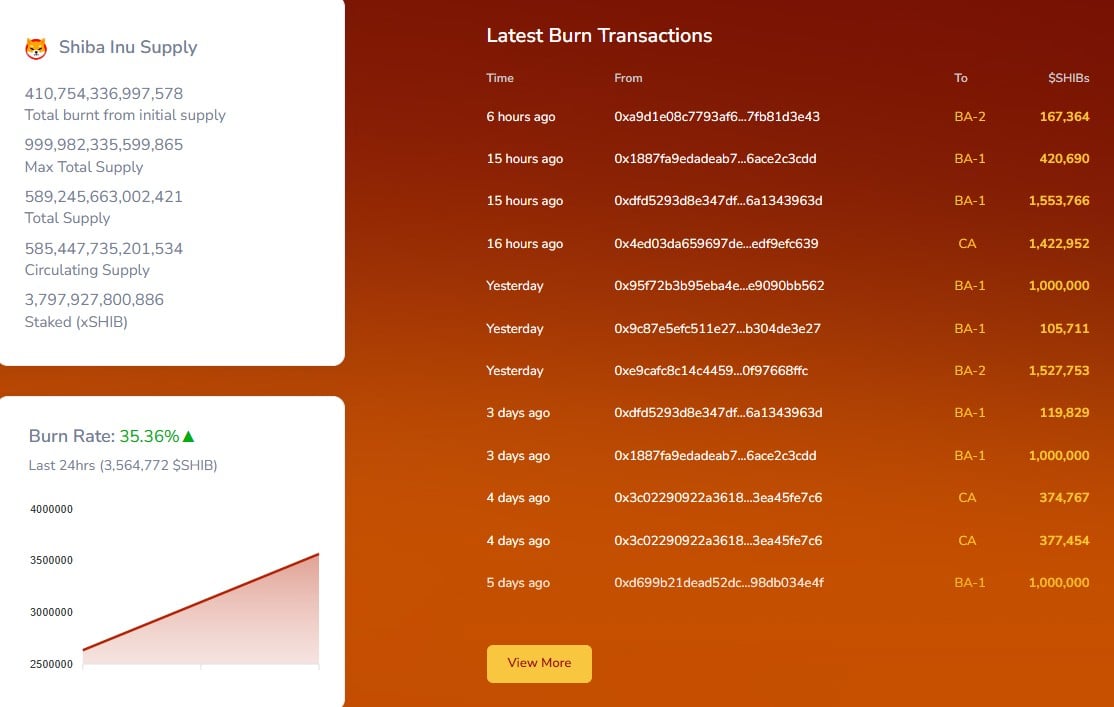

3,564,772 $SHIB gets burned today

The Shibburn website shows that since last morning, there have been four burn transactions. The largest of them carried 1,553,766 $SHIB and 1,422,952 $SHIB meme coins to dead-end wallets. This constitutes nearly 2x surge from yesterday’s burns, when only slightly more than 2 million $SHIB were locked out of the total circulating supply.

By now, a total of 410,754,336,997,578 $SHIB have been removed from circulation, mostly thanks to the mysterious $SHIB founder Ryoshi and Ethereum’s leader Vitalik Buterin. The former sent Buterin half of the initial quadrillion $SHIB supply in May 2021, and Vitalik sent nearly all of it to an unspendable wallet as he did not believe in $SHIB’s potential and therefore did not want to hold that monstrous amount of $SHIB to avoid accusations of price manipulation.

$SHIB market performance

Over the past day, the major meme cryptocurrency, $SHIB, has staged a decline of 4.57%, falling to the $0.00000579 level per coin. Since its 13% recovery on Friday last week, Shiba Inu has been trading sideways, holding in the range of $0.000006 and gradually going down. Since Friday, it has faced a total fall of roughly 9.48%.

$SHIB has been going in line with the current trends in the cryptocurrency market, following the leader, Bitcoin. On January 28, it lost the $90,000 psychological level and has been going down since then. An overall decline since that day and Friday last week comprises 30.37%. Largely, $SHIB has been following Bitcoin’s price curve over the past week – both assets have been mostly going down and trading sideways.

Bitcoin collapsed in light of poor reports demonstrated by tech giants (the Magnificent 7), which turned on a high level of AI fear among investors, the 30% crash of silver and gold in a single day, and also the announcement of Donald Trump’s future Fed Reserve chair hawkish candidate, Kevin Warsh.

u.today

u.today