The $XRP Ledger now hosts over $1 billion worth of tokenized commodities, making these financial products the largest tokenized asset class on the network.

While the $XRP price has struggled, reflecting the broader crypto market turbulence, the $XRP ecosystem has continued to reach new milestones in the areas of tokenization and on-ledger technical improvements. Specifically, the $XRP Ledger (XRPL) now boasts $1.14 billion in tokenized commodities.

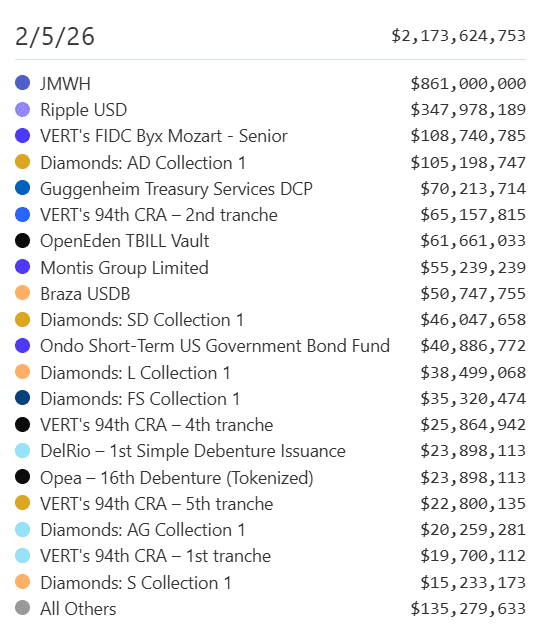

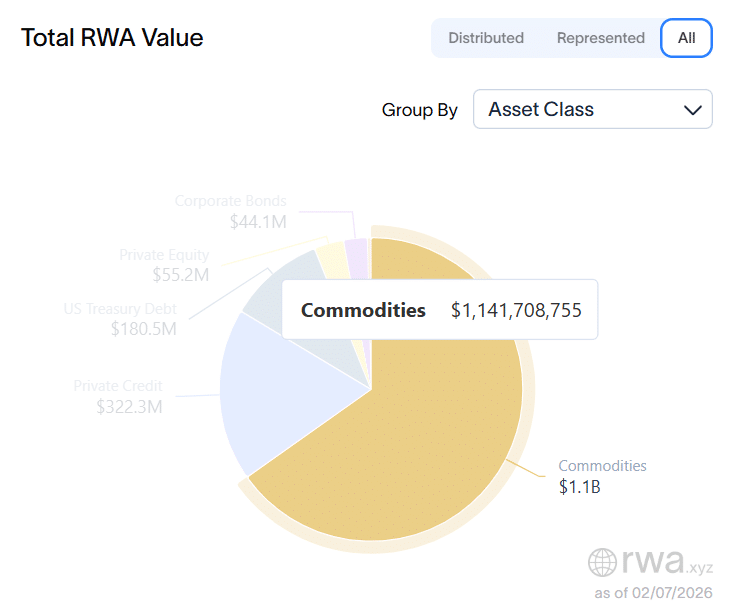

Interestingly, these commodities represent the single-largest tokenized asset class on the XRPL, making up 52.6% of the total tokenized real-world assets (RWA) on the network worth $2.173 billion. The largest of these tokenized commodity products is Justoken’s JMWH.

Key Points

- While the $XRP price has struggled in recent times, down 15.56% over the past week, the $XRP ecosystem has continued to hit new milestones.

- One such milestone involves tokenized commodities on the $XRP Ledger, which recently crossed the $1 billion mark.

- At $1.14 billion, tokenized commodities make up 52% of the total tokenized RWA on the XRPL, worth $2.173 billion.

- Stablecoins ($422.8 million) and private credit ($322.3 million) contribute the next biggest shares to the XRPL’s total tokenized RWA.

- Justoken’s JMWH product accounts for most of the tokenized commodities worth, valued at a whopping $861 million, with 12 holders.

Tokenized Commodities on the XRPL Cross $1B

This is according to on-chain data provided by RWA.xyz, a leading data analytics resource for real-world assets tokenization. Notably, the $XRP Ledger hosts $2.173 billion worth of tokenized real-world assets, per RWA.xyz, including stablecoins. This comes two weeks after The Crypto Basic confirmed that the ledger had crossed the $1 billion milestone.

Further data indicates that tokenized commodities contribute the largest share to this $2.173 billion figure. For the uninitiated, tokenized commodities refer to digital tokens that represent real-world commodities, securities tied to commodities, or investment funds that track raw materials and natural resources. Examples include tokenized gold, silver, platinum, copper, oil, corn, and wheat.

The XRPL currently hosts $1.141 billion worth of these products, representing 52.6% of all hosted real-world assets on the network. Interestingly, this also places the XRPL second on the list of chains with the largest worth of tokenized commodities, only behind Ethereum with $5 billion. The XRPL outpaces Polygon, Arbitrum, and BNB Chain.

Which Tokenized Commodities Exist on the XRPL?

While Tether’s gold token represents the largest tokenized commodity on Ethereum, the XRPL hosts the JMWH asset from Justoken. Notably, JWMH is a digital token where each unit equals one real megawatt-hour (MWh) of energy from energy companies. It helps handle payments and allows users to track green energy directly through real-world energy production.

Justoken, a B2B platform for RWA tokenization, has deployed $861 million worth of the JMWH asset on the XRPL, making it the biggest contributor to the $1.14 billion in commodities. This represents all of the JMWH value, as Justoken only hosts the asset on the XRPL.

Interestingly, the rest of the commodities on the XRPL come from Ctrl Alt’s diamond collections. Specifically, the Diamonds: AD Collection from Ctrl Alt accounts for $105 million. Meanwhile, the Diamonds: SD Collection makes up for $46 million, with the L Collection boasting $38.5 million. Also, the FS Collection has a value of $35 million.

Other Tokenized Assets Classes on the XRPL

Besides commodities, the XRPL also hosts other tokenized asset classes worth millions as adoption continues to rise. Specifically, the network boasts $422 million worth of stablecoins, with the Ripple stablecoin, RLUSD, contributing the most, about $347 million.

Moreover, the XRPL is also home to $298 million worth of private credit. Meanwhile, as part of the distributed assets, multiple platforms have tokenized $180 million worth of U.S. Treasury Debt on the $XRP Ledger. The Crypto Basic confirmed this growing value of tokenized Treasury Debt in a report last month.

thecryptobasic.com

thecryptobasic.com