Ripple’s newly outlined roadmap for the $XRP Ledger (XRPL) is arriving at a pivotal moment. On the one hand, the company is positioning XRPL as a foundation for institutional DeFi.

On the other hand, one of the most prominent $XRP treasury firms—Evernorth—is already experiencing the risks and potential rewards of that vision in real time.

Institutional DeFi on XRPL Could Turn Idle $XRP Into Yield-Generating Capital

Evernorth holds roughly 473 million $XRP and has signaled plans for a Nasdaq debut under the ticker XRPN. However, recent market conditions have exposed the downside of such a concentrated treasury strategy.

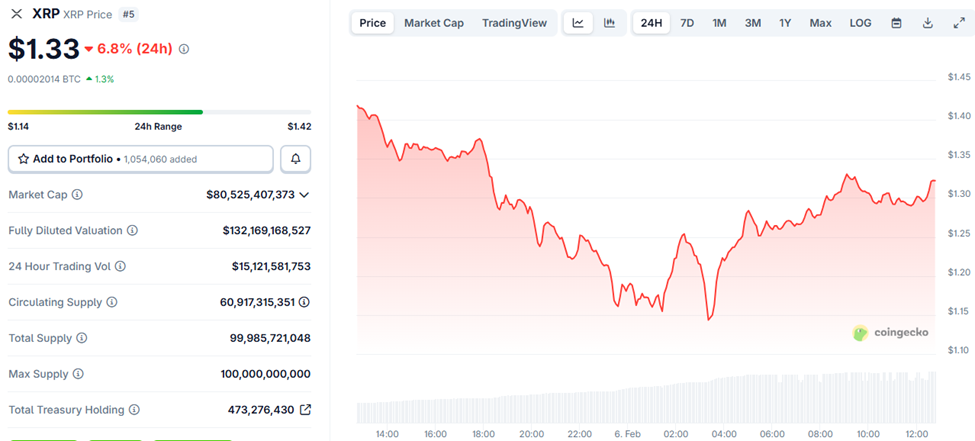

With $XRP trading around $1.33, CoinGecko data shows the asset has fallen nearly 7% in the past 24 hours, leaving Evernorth with an estimated $380 million in unrealized losses.

$XRP Price Performance">

$XRP Price Performance">

The situation highlights a paradox facing crypto treasury companies: large holdings can amplify upside in bull markets but also magnify losses in downturns.

This is especially true when the underlying infrastructure intended to unlock additional value is still being built.

Ripple’s Institutional DeFi Push

Ripple’s latest update on the XRPL roadmap frames the network’s next phase as a transition from a payments-focused blockchain to a broader financial infrastructure layer.

The Institutional DeFi roadmap details how the $XRP Ledger is advancing toward everyday institutional use, with $XRP at the center of settlement, FX, collateral, and onchain credit.

— RippleX (@RippleXDev) February 5, 2026

The blog covers what is live, what is coming, and how developers can build toward compliant…

According to Ripple, new features are designed to enable regulated institutions to move lending, settlement, and liquidity operations on-chain.

Notably, $XRP would function as a bridge asset and settlement layer, with the new features comprising:

- Permissioned markets

- Confidential transfers

- Tokenized collateral tools, and

- A native lending protocol

“[The ledger is growing into] an end-to-end operating system for real-world finance, with $XRP playing a central role in payments, liquidity, and credit markets,” read an excerpt in the blog.

Among the upcoming upgrades, the XRPL Lending Protocol (XLS-66) is attracting particular attention for its potential to open on-ledger credit markets.

The system is expected to introduce pooled liquidity through Single-Asset Vaults, fixed-term lending structures, and automated repayment mechanisms.

Notably, these features are intended to mirror traditional credit markets while preserving blockchain transparency and efficiency.

Evernorth’s High-Stakes Bet on Yield

For Evernorth, these developments are more than theoretical. The firm has already indicated plans to deploy its $XRP holdings into the lending ecosystem once the protocol goes live.

Sagar Shah, Chief Business Officer at Evernorth, recently described the initiative as a major shift in how on-chain institutional liquidity could operate. He noted that participation in XRPL’s lending infrastructure could help unlock significant yield opportunities for $XRP holders and the broader ecosystem.

If successful, the strategy could transform large $XRP treasuries from passive reserves into active, income-generating assets. This could reduce sell pressure while increasing network activity.

Execution Risk Remains

Despite the long-term narrative, key uncertainties remain. The lending protocol still requires full deployment and validator support.

Also, the broader success of Ripple’s roadmap depends on whether institutions actually allocate capital to XRPL-based markets at scale. Infrastructure alone does not guarantee adoption.

Liquidity, regulatory clarity, and real-world use cases will ultimately determine whether institutional DeFi on XRPL becomes a meaningful sector or remains a niche experiment.

A Test Case for $XRP’s Future

Evernorth’s current losses, combined with its long-term commitment to deploying capital within the XRPL, are making it an early test case for Ripple’s broader thesis.

If lending, privacy features, and permissioned markets attract meaningful institutional participation, today’s treasury losses could be reframed as early positioning in a new financial infrastructure layer.

If adoption fails to materialize, however, the risks of concentrated treasury strategies may overshadow the promise of institutional DeFi.

As it stands, therefore, the market remains caught between those two possibilities:

- Short-term volatility on one side

- A still-unproven vision of $XRP-powered financial rails on the other.

The post $XRP Price Drops 7% as Evernorth’s $380 Million Paper Loss Becomes First Test of Ripple’s 2026 Roadmap appeared first on BeInCrypto.

beincrypto.com

beincrypto.com