Litecoin ($LTC) has dropped nearly 60% from last year’s peak and has returned to the lows seen in previous market cycles. Despite remaining one of the more liquid altcoins, $LTC has struggled to overcome the market’s increasingly negative pressure.

However, several signals suggest that demand for $LTC is still present. This may not lead to an immediate price rebound, but it provides support for Litecoin to endure and wait for a recovery opportunity.

Emerging $LTC Demand Despite The Sharp Decline

One notable recent development is that SBI VC Trade, a cryptocurrency exchange under Japan’s SBI Holdings, has expanded its crypto lending services to include $LTC.

Japanese users can now lend $LTC through the Lending Coin program to earn interest. The program currently supports more than 30 cryptocurrencies, including $BTC, ETH, XRP, $LTC, BCH, DOT, LINK, ADA, DOGE, and SHIB.

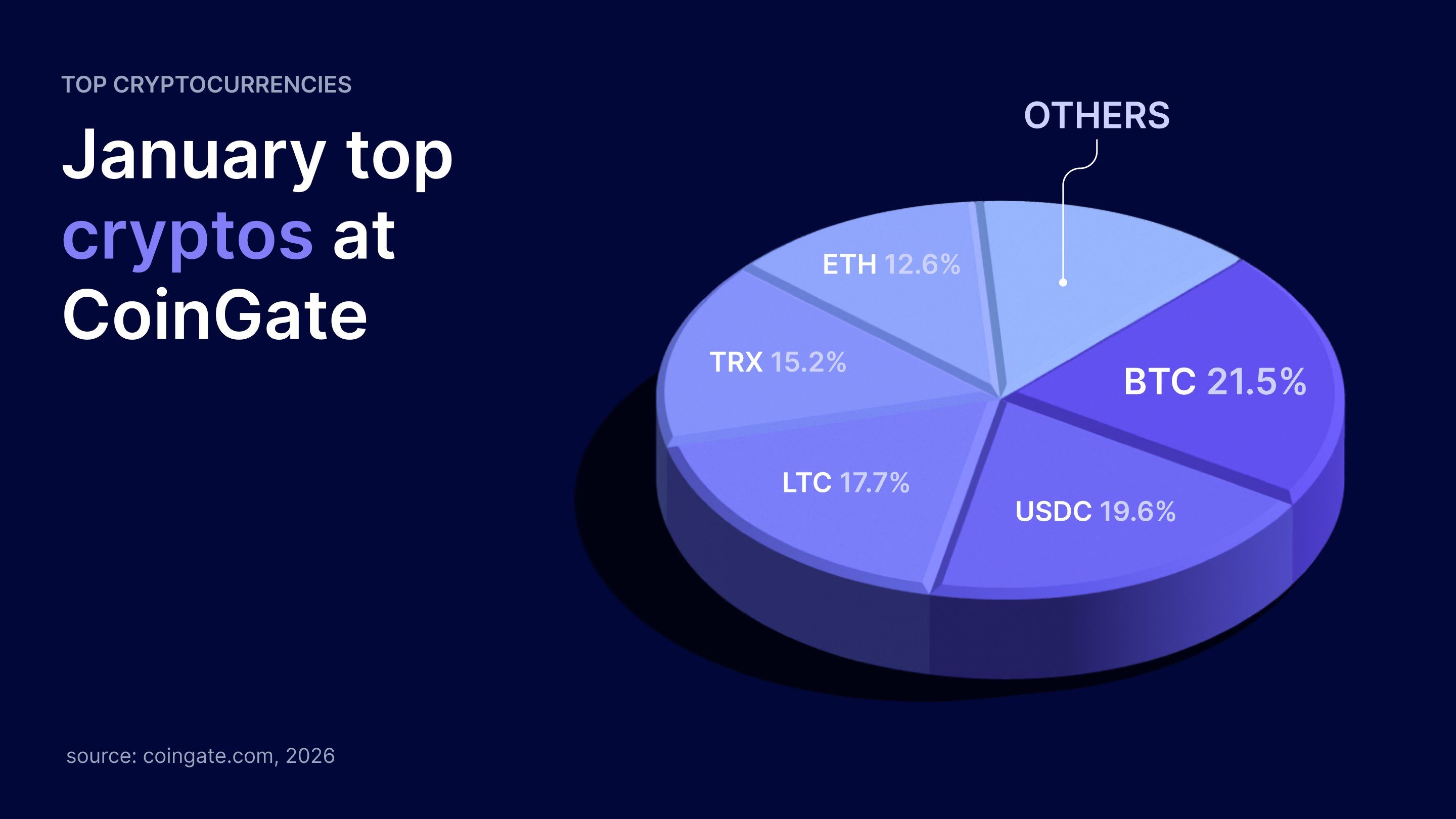

In addition, the latest report from CoinGate — a leading crypto payment gateway that allows businesses to accept cryptocurrency payments — shows that $LTC accounts for 17.7% of all payment transactions on the platform. This places it behind only $BTC and USDC.

The Litecoin Foundation stated that this figure has increased from 16.4% in December last year.

These developments reflect sustained demand for $LTC. Still, the demand remains insufficient to offset the broader selling pressure across the market.

Positive On-chain Signals Help $LTC Absorb Selling Pressure

Other on-chain indicators suggest that Litecoin’s internal momentum remains strong and may even be strengthening in early 2026.

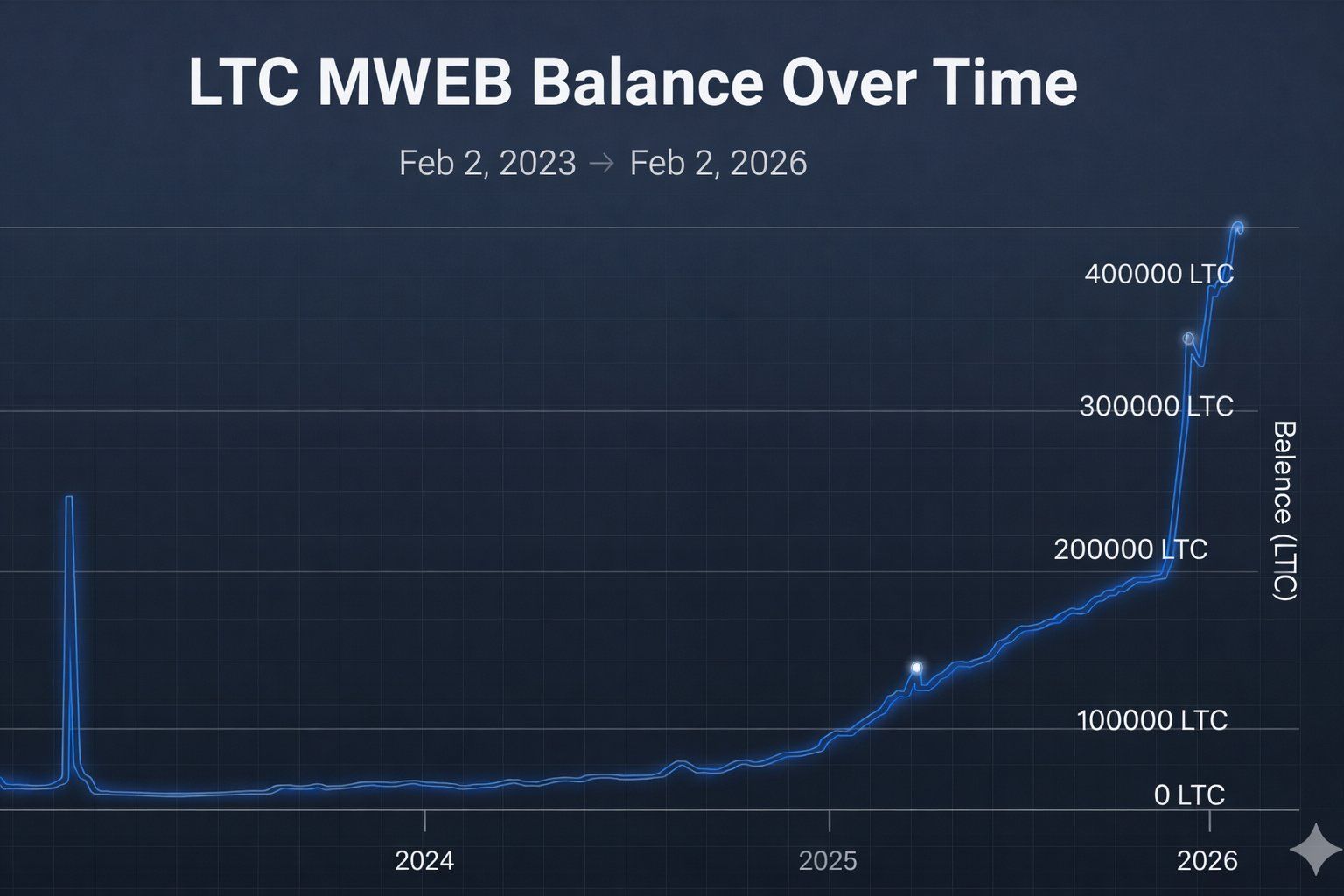

For example, Litecoin’s optional privacy layer, MWEB, has set a new record for peg-ins, surpassing 400,000 $LTC.

$LTC MWEB Balance Over Time. Source: Litecoin">

$LTC MWEB Balance Over Time. Source: Litecoin">

MWEB enhances Litecoin transactions with privacy features, including confidential transactions and stealth addresses. The rising amount of $LTC being pegged in indicates growing demand for private on-chain transactions. This trend could help absorb part of the selling pressure.

“Litecoin’s opt-in privacy layer, MWEB, set a new record for peg-ins last month. Real-world utility has been the mission since day one,” Litecoin noted.

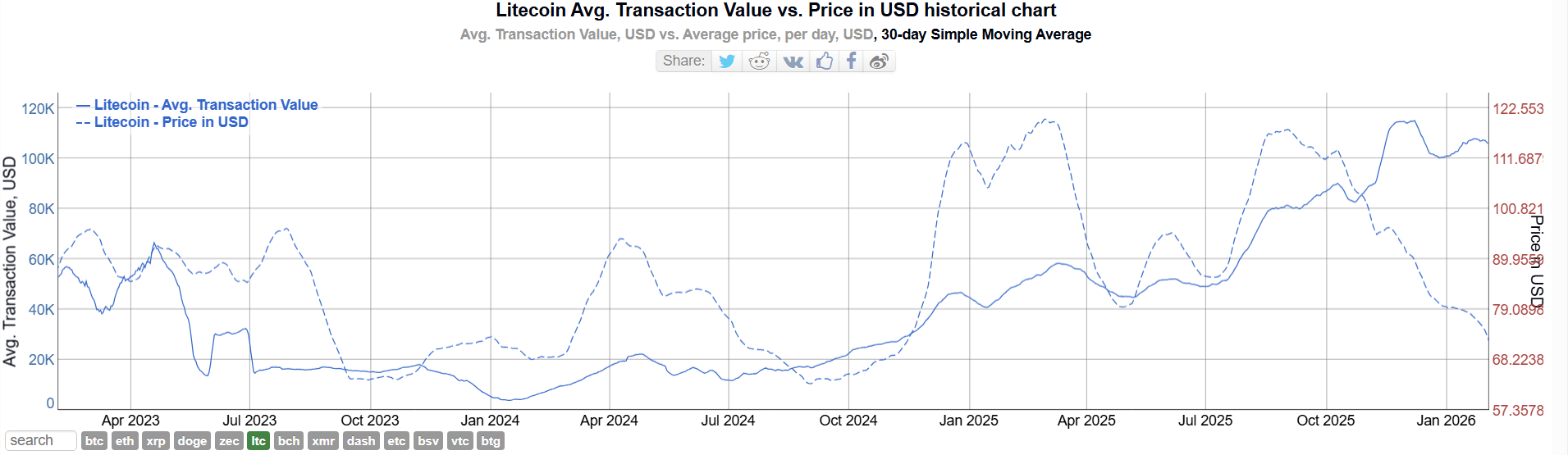

Additionally, data from BitInfoCharts highlights a rare divergence between Litecoin’s average on-chain transaction value and its market price.

Typically, the average transaction value moves in the same direction as the price. In recent months, however, while $LTC has fallen roughly 55% since October last year, the average on-chain transaction value has continued to rise.

This divergence may suggest accumulation activity from investors who view broader market selling as an opportunity.

Still, with $LTC trading around $60 — down 85% from its all-time high and 60% from last year’s top — any recovery is likely to remain a difficult journey.

The post Litecoin ($LTC) Returns to Multi-Cycle Lows as New Demand Emerges appeared first on BeInCrypto.

beincrypto.com

beincrypto.com