TL;DR:

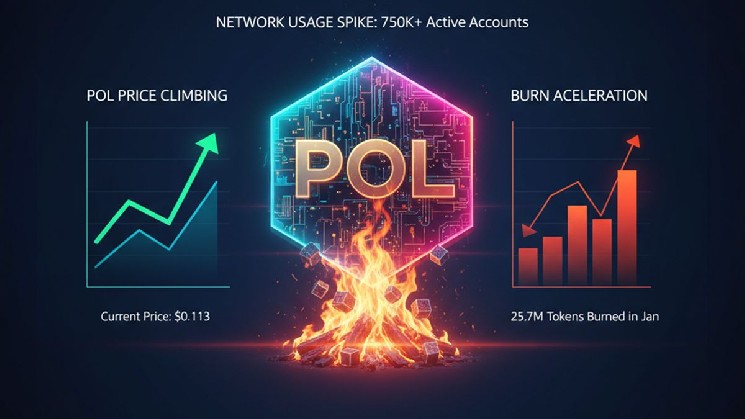

- During the month of January, 25.7 million $POL tokens were removed from circulation, representing 0.24% of the total supply.

- Increased activity on the PoS network, with peaks of up to 800,000 active accounts, is the primary driver of this process.

- Despite the deflationary mechanism, $POL price shows caution and remains within a technical consolidation range.

The Layer 2 ecosystem is experiencing a moment of high operational intensity, causing the Polygon token burn to reach record figures since its transition to $POL. This phenomenon is driven by the increased usage of the Proof-of-Stake (PoS) chain, where transaction volume directly translates into a constant reduction of supply.

Consequently, the current pace suggests that if adoption levels persist, at least 3% of the total supply could be destroyed by the end of 2026. This programmed scarcity mechanism aims to strengthen the asset’s long-term value model, linking its economic health directly to the real utility of the network.

On the other hand, user activity stabilized between 400,000 and 500,000 daily accounts after the peaks recorded at the beginning of the year. This steady flow of operations ensures that the protocol continues to withdraw assets from circulation, even during periods of open market volatility.

$POL Price Analysis and Supply Impact

Despite the positive news regarding token deflation, the $POL price saw a moderate recovery, reaching the $0.11 range. Although the asset recorded an increase of nearly 10% in a single day, technical indicators such as the RSI have yet to confirm a definitive trend reversal.

Market capitalization stands at approximately $1.19 billion, supported by a 20% increase in trading volume. However, the impact of the $3 million burn in January is still small compared to the daily transaction flow, which limits its immediate effect on the charts.

In summary, experts agree that deflationary pressure will become more evident as general market sentiment improves. In the meantime, the Polygon network continues to strengthen its fundamentals through a system that rewards intensive use with greater scarcity of the native token.

crypto-economy.com

crypto-economy.com