USDAI, a stablecoin protocol that issues loans against GPUs, today announced the upcoming launch of its native CHIP token, slated for Q1 2026.

CHIP will be the USDAI DAO’s governance token, with an initial coin offering (ICO) and token launch set to occur by April.

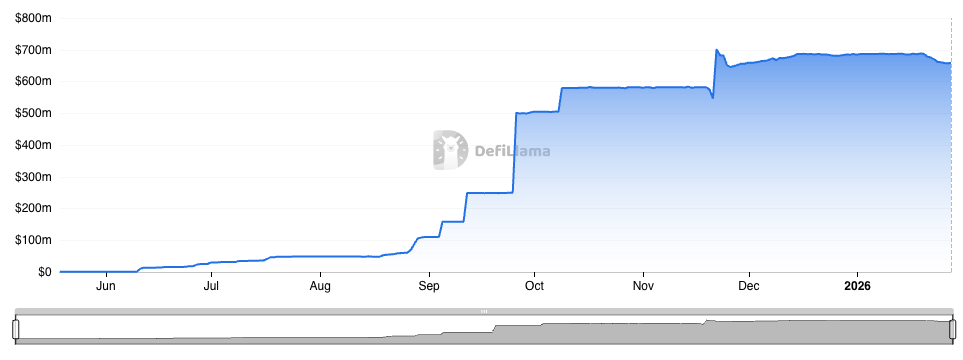

The protocol was bootstrapped by its “Allo Game” in 2025, which incentivized users to mint USDai and sUSDai and earn points towards the ICO and airdrop. USDAI currently boasts $658 million in total value locked (TVL), after briefly peaking at $701 million in November.

The protocol cites its model as a liquid credit instrument for GPUs, claiming that traditional underwriting is unfeasible for GPUs due to their rapid depreciation, despite the growing need for computing power in the artificial intelligence (AI) sector.

USDAI calls its move “The Fannie Mae Moment” for AI. Fannie Mae is credited with launching tradable mortgages and creating a liquid mortgage-rate market for housing, and USDAI aims to do the same with GPU hardware via tokenization.