Investment giant VanEck launched a new exchange-traded fund (ETF) tied to Avalanche’s native token $AVAX on Monday, Jan. 26 – marking the first U.S.-listed spot $AVAX ETF and expanding its lineup of cryptocurrency-focused products.

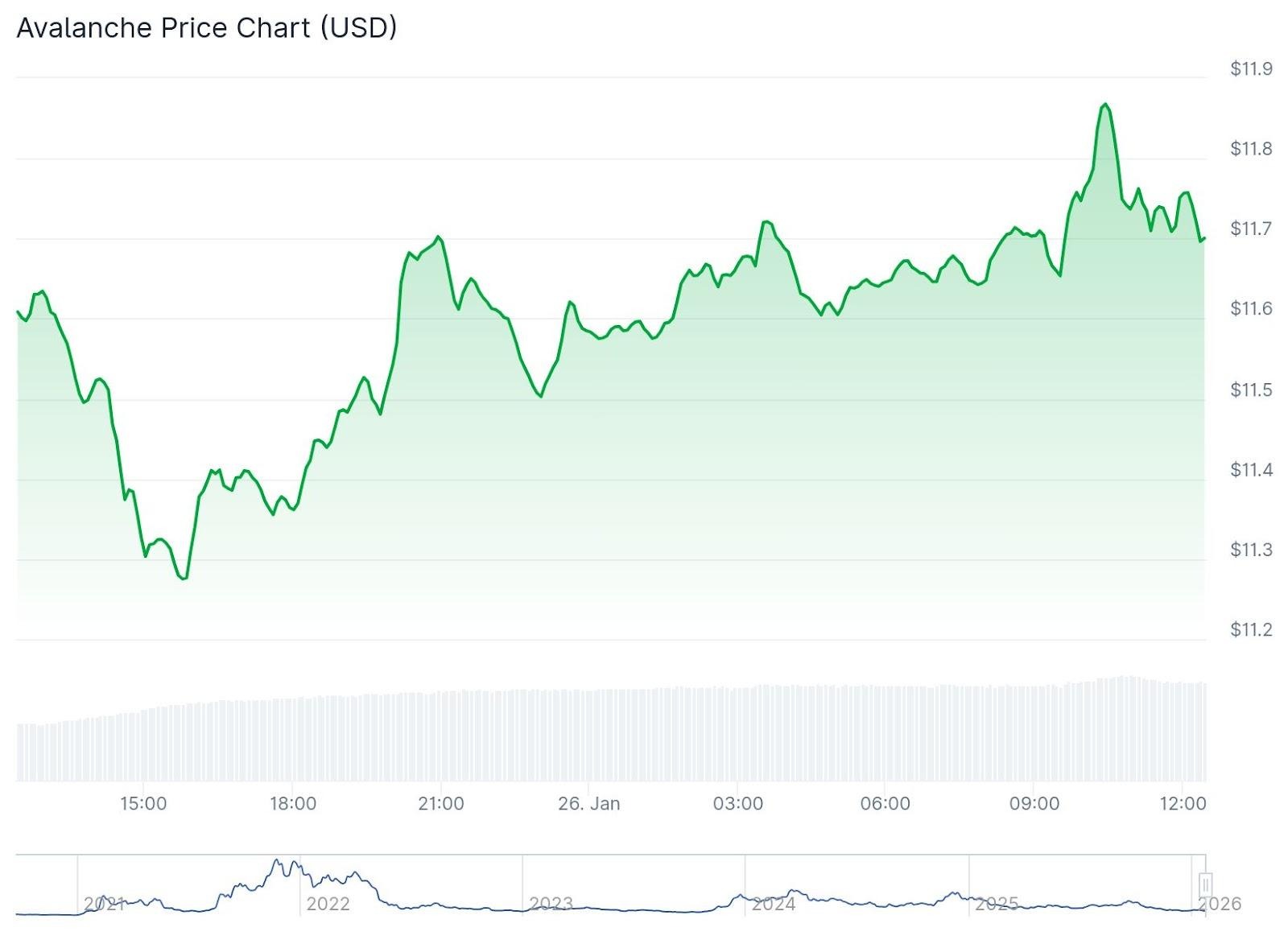

The VanEck Avalanche ETF (ticker: VAVX) aims to provide spot exposure to $AVAX, which is trading at around $11.74 at the time of publishing, up more than 1% on the day.

Notably, the fund may also generate staking rewards by staking a portion of the trust’s holdings, according to the official press release. “The Trust’s investment objective is to reflect the performance of the price of Avalanche (‘$AVAX’) and rewards from staking a portion of the Trust’s $AVAX, less the expenses of the Trust’s operations,” the release reads.

The launch adds to a growing wave of crypto-linked ETFs in the U.S. since the start of 2024. It also comes as asset managers and large institutions push to offer more direct exposure to tokens through traditional finance accounts.

“Avalanche’s architecture is uniquely positioned to bridge the gap between traditional finance and the on-chain economy, focusing on verifiable, real-world utility,” said Kyle DaCruz, Director, Digital Assets Product with VanEck. “We’re excited to launch VAVX to provide investors with a transparent, exchange-traded vehicle to access a network that we believe will drive the next phase of institutional blockchain adoption.”

VanEck said it will waive sponsor fees on VAVX for the first $500 million in assets under management (AUM) or until Feb. 28, 2026, “whichever comes first.” After that, the sponsor fee will be 0.20%. VanEck also warned that $AVAX is highly volatile and investors could lose their entire principal.

VAVX was last trading at $24.25, down 1.3% on the day after opening at $24.58, according to Yahoo Finance.

The investment firm currently offers a range of crypto ETFs and Exchange Traded Products (ETPs), including the VanEck Bitcoin ETF (HODL), VanEck Ethereum ETF (ETHV), and the VanEck Digital Transformation ETF (DAPP).