The Sandbox ($SAND) is a blockchain-based metaverse platform where users can create, own, and monetize digital assets. $SAND recorded a 60% price increase in January, even as the broader market corrected and fear sentiment returned.

The following article examines the factors that signal both opportunities and risks for $SAND traders in January.

What Is Driving $SAND’s Price in January?

The Sandbox ($SAND) has climbed above $0.17, rising more than 60% since the start of the year. Its upward momentum closely resembles the recent rally seen in Axie Infinity ($AXS).

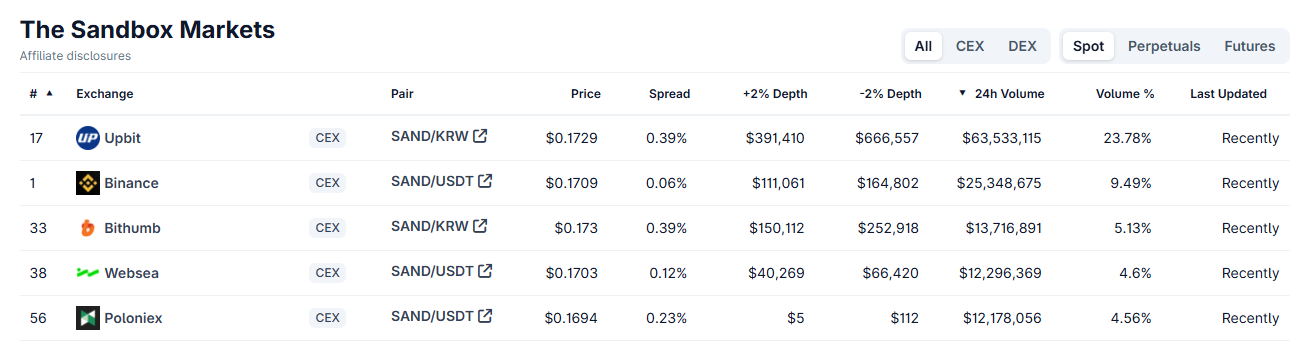

Data shows that traders on Upbit are among the main forces behind this surge.

$SAND trading volume on Upbit accounts for more than 23% of total volume. Prices on Upbit also trade at a premium compared with other exchanges. $AXS experienced a similar Upbit-driven effect, which pushed its price up more than threefold in January.

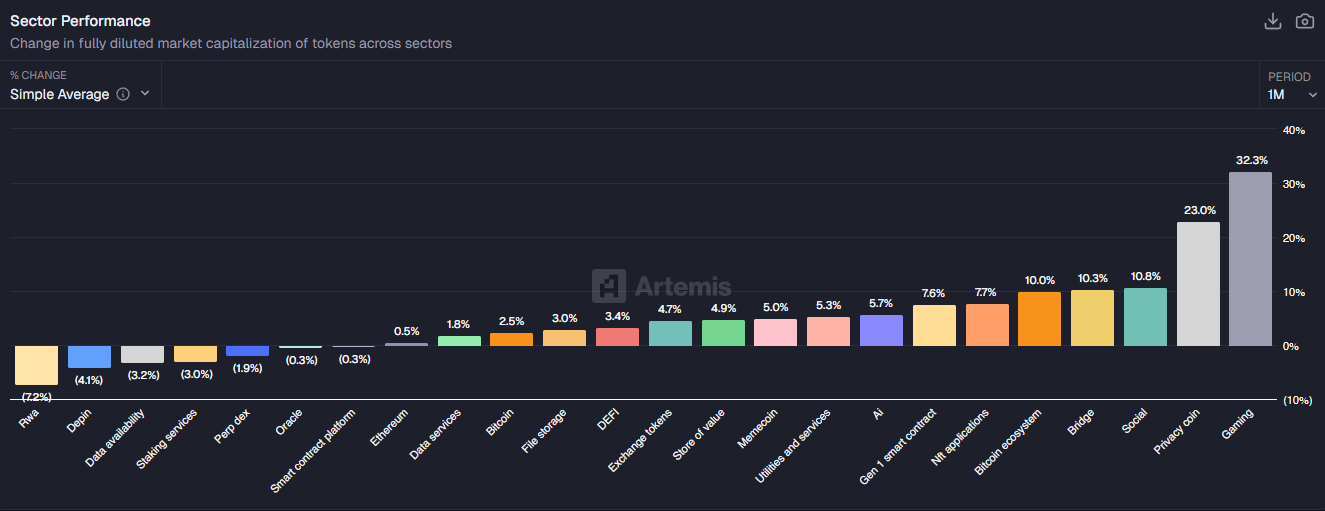

Korean investors appear to be showing renewed interest in the gaming theme. Artemis data indicates that the gaming sector has led overall market performance since the beginning of the year.

With capital continuing to flow into this sector and dynamics similar to those of $AXS, $SAND could extend its rally further. Compared with $AXS’s gain of more than 200%, $SAND’s performance still looks relatively modest.

Analysts expect $SAND to break above the $0.20 resistance zone. Some projections suggest a move toward $1 if GameFi interest continues to build.

What Risks Should Traders Watch?

Although price action has not yet shown clear signs of exhaustion, several concerning signals have emerged.

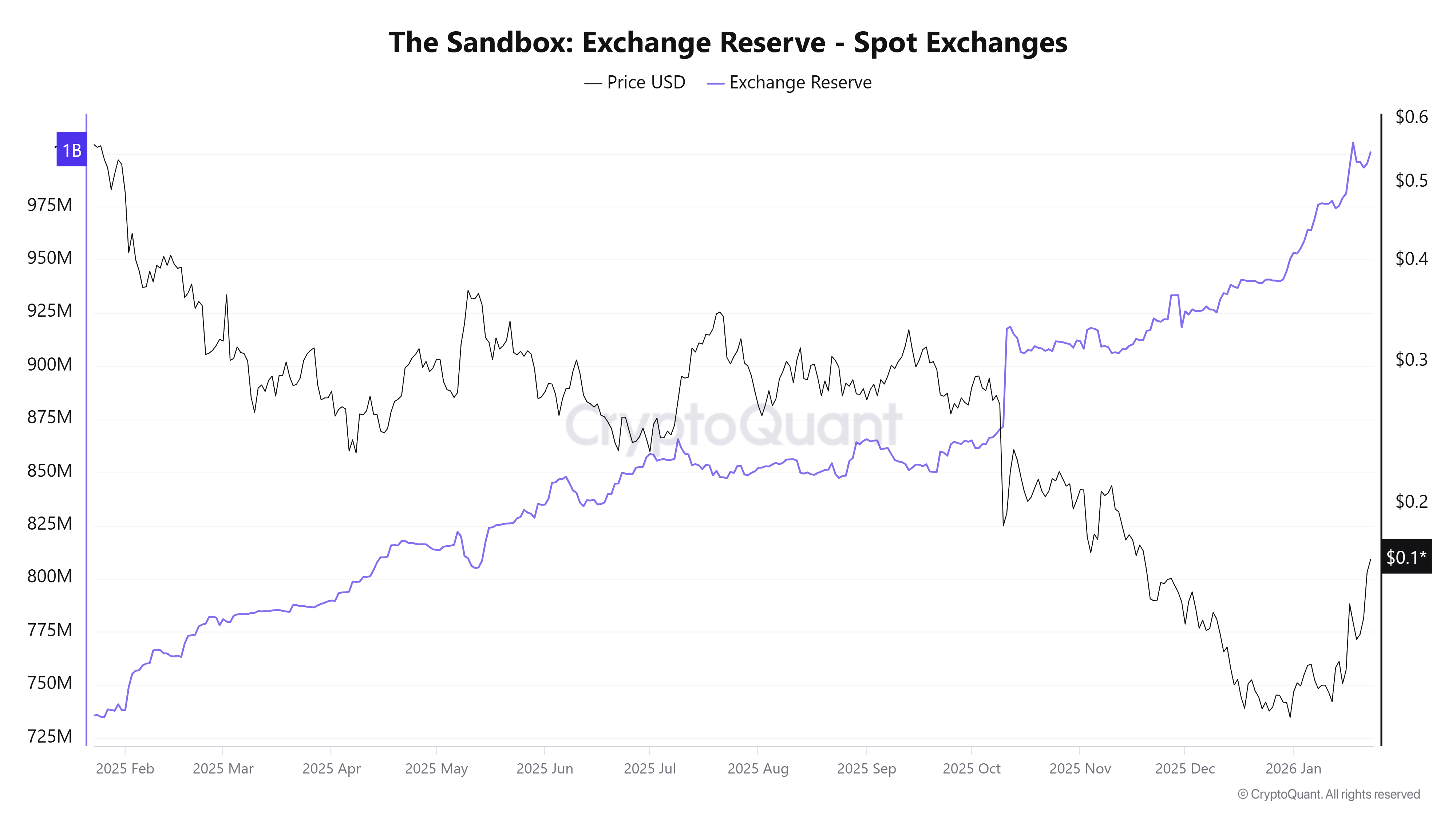

CryptoQuant data shows that $SAND reserves on spot centralized exchanges have reached a one-year high. Around 1 billion $SAND is currently held on exchanges, representing more than 33% of the total supply.

$SAND) Exchange Reserve. Source: CryptoQuant.">

$SAND) Exchange Reserve. Source: CryptoQuant.">

Rising exchange reserves often imply a higher risk of price dumps, as tokens become easier to sell on the open market. This dynamic threatens the current uptrend. It suggests that the $SAND breakout could turn into a trap if new capital inflows are insufficient to absorb selling pressure.

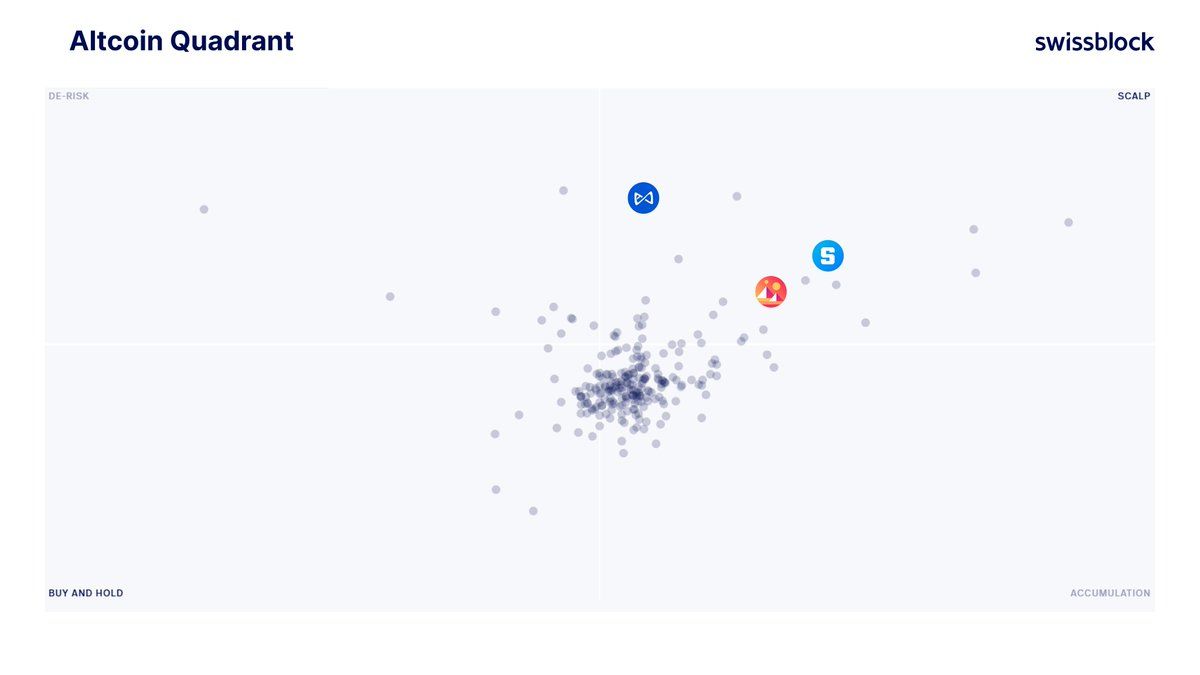

In addition, Altcoin Vector, Swissblock’s institutional altcoin report, notes that the metaverse and gaming narrative—once considered dead—is making a comeback. However, the rebound appears to rely more on speculation than on sustainable growth.

Altcoin Vector’s Altcoin Quadrant shows that most altcoins remain in the “Accumulation” phase. By contrast, metaverse assets such as $AXS and $SAND have jumped directly into the “Scalp” zone, a rare exception.

“Ride the META narrative, but proceed with caution. For a sustained long-term rally, growth must stem from infrastructure and adoption, not just narrative. Without a solid base in core assets, this remains a speculative play,” Altcoin Vector concluded.

The report also explains that small-cap tokens often lead market performance when fast-moving capital seeks short-term profits. A lasting rally requires real infrastructure growth, genuine adoption, and a broader recovery led by Bitcoin and Ethereum.

The post The Sandbox ($SAND) Rallies 60% in January — But a Major Supply Risk Looms appeared first on BeInCrypto.

beincrypto.com

beincrypto.com