River ($RIVER) climbed to a fresh all-time high during early Asian trading hours, extending a rally that has lifted the altcoin’s value by nearly 750% over the past month.

However, the derivatives market is flashing a key warning signal, raising concerns. In addition, some analysts are now forecasting a possible price dip.

$RIVER Token Hits All-Time High

For context, River is a decentralized finance (DeFi) protocol creating a chain-abstraction stablecoin system. It enables users to deploy collateral on one blockchain and access liquidity on another without bridges or wrapped assets.

Its core product is satUSD, an overcollateralized stablecoin minted through an Omni-CDP system. The network’s native token, $RIVER, is used for staking-based governance, yield boosts, fee reductions, and reward distribution.

The altcoin has been experiencing a strong rally since the beginning of 2026, with momentum accelerating this week despite broader market weakness triggered by Trump’s tariffs. Nonetheless, sentiment improved over the past 24 hours following reports of tariff rollbacks, lifting the crypto market overall.

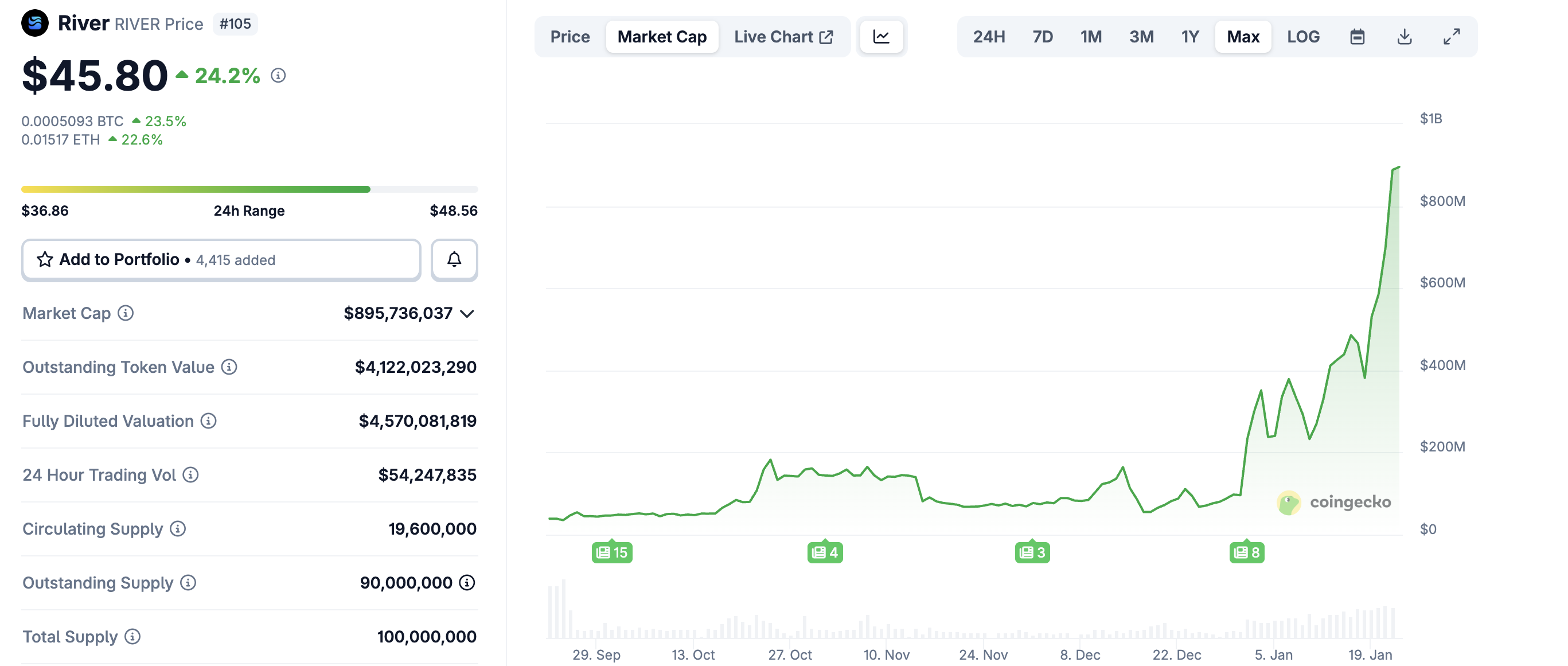

According to CoinGecko, $RIVER posted a new all-time high of $48.56 earlier today. Over the past 24 hours, the token appreciated 24.2%, significantly outperforming the broader market’s roughly 1% gain. At press time, it was trading at $45.8.

Alongside the price rally, the network is advancing on the development front. On Wednesday, River announced it has secured an $8 million strategic investment from Justin Sun.

“This investment supports ecosystem integration on @trondao and the deployment of River’s chain abstraction stablecoin infrastructure,” the team wrote. “River will launch Smart Vault and institutional grade Prime Vault to deliver yield opportunities for stablecoins, TRX, and core ecosystem assets on TRON.”

Derivatives Activity Raises Red Flags

Nonetheless, the price rally has also raised concerns. In a recent post, CoinGlass highlighted that $RIVER’s futures trading volume exceeds spot trading volume by more than 80 times, signaling an extreme imbalance in market structure.

“When futures volume trades 80×+ spot volume, price is no longer discovered by the market It is constructed through leverage, driven by intentionally deployed volatility and repeated liquidation cycles,” the post read.

CoinGlass added that such a move is not organic but rather engineered.

“Best advice: don’t participate. This is how retail gets harvested.”

In a separate thread, the data analytics platform explained how funding rates can be used to engineer price movements. CoinGlass said funding rates reflect imbalances between long and short traders, not future price direction.

By keeping prices suppressed while pushing funding deeply negative, markets can become crowded with short positions, reinforcing the belief that a rebound is inevitable.

“At this stage, many traders go long — not because of demand, but because they expect:+ funding payments a rebound.” the post added.

According to CoinGlass, this expectation creates a trap. A controlled upward move can trigger liquidations and forced short covering, leading to sharp rallies while funding remains negative. Once shorts are flushed, funding normalizes, allowing the same setup to be repeated.

“This process can repeat multiple times: manufacture extreme funding, attract consensus positioning, force liquidation, reset’s price engineering, not price discovery,” CoinGlass stated.

The firm emphasized that funding rates identify where traders are crowded and where liquidation risk is highest. It warned that in engineered markets, the safest trade may often be no trade at all.

In addition, several analysts are forecasting that $RIVER could eventually see a downturn. A market watcher predicted that the token could face a decline similar to that of Aurelia (BEAT).

$RIVER / $USD – Update

— Crypto Tony (@CryptoTony__) January 21, 2026

Waiting for triple figures minimum on my spot bags pic.twitter.com/AkwzxQxt0f

With a strong price rally and a cautious outlook, the coming days will reveal whether $RIVER can sustain its gains or a downtrend will emerge.

The post River ($RIVER) Reaches All-Time High as Derivatives Market Sends Warning Signal appeared first on BeInCrypto.

beincrypto.com

beincrypto.com