The supply of Shiba Inu on exchanges is drying up despite current price uncertainties, suggesting potential reduced immediate selling pressure.

Data shows that the amount of $SHIB tokens on all centralized exchanges has seen a remarkable decline in the past 72 hours. The reason for this supply reduction remains unclear, but it fuels optimistic sentiment among Shiba Inu holders, suggesting accumulation over distribution.

Key Points

- The supply of Shiba Inu on exchanges is drying up despite current price uncertainties, suggesting reduced selling pressure.

- Data shows that 361,380,965,000 $SHIB tokens exited exchanges between January 16 and today, a significant drop worth noting.

- The reserves on all exchanges were 82.642 trillion $SHIB on Friday, but dropped to 82.28 trillion $SHIB, a difference of 361 billion tokens.

- Outflows from exchanges typically suggest that whales are repositioning their holdings to self-custody wallets or other third-party systems.

- This accumulation trend reassures holders, especially considering that the token has corrected by 6.23% in the past 24 hours and 6.76% in the last seven days.

Shiba Inu Exodus from Exchanges

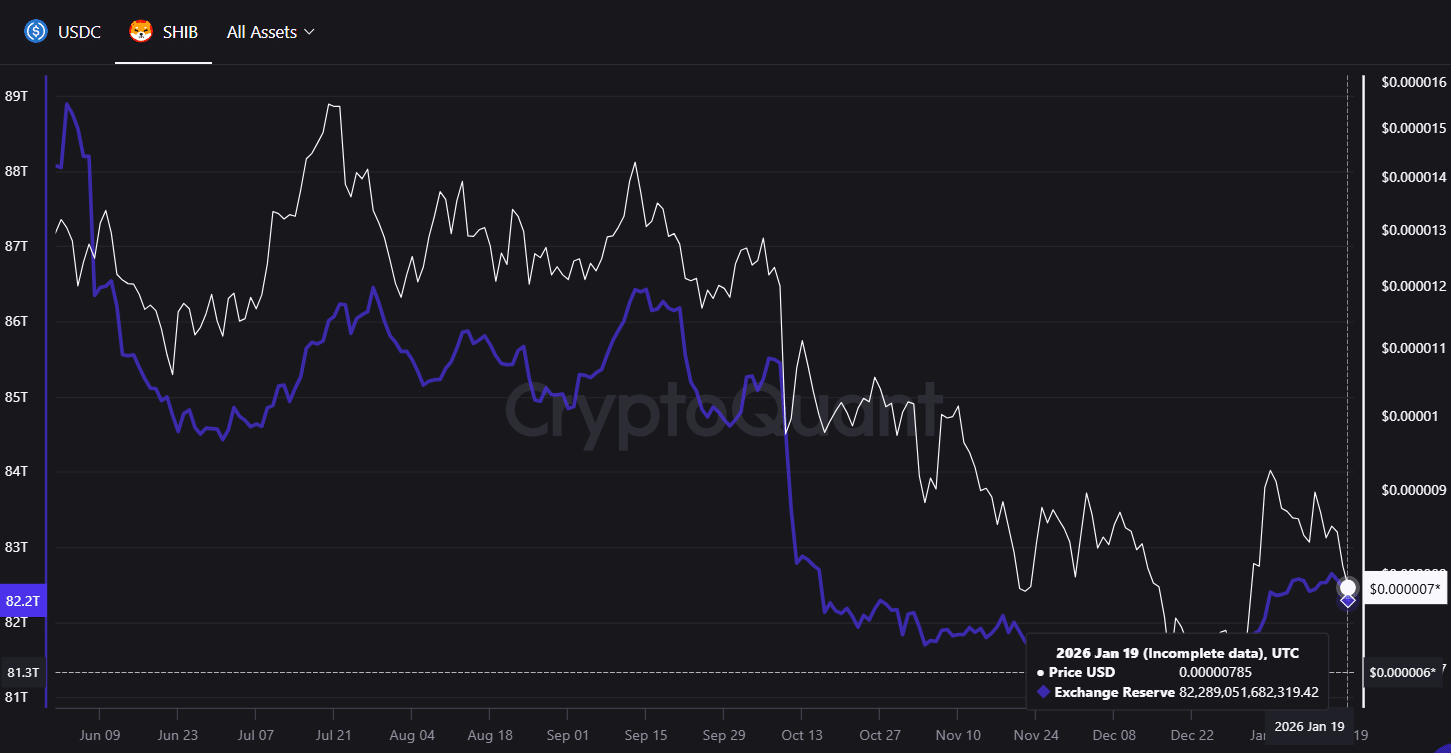

CryptoQuant data shows that 361,380,965,000 $SHIB tokens exited exchanges between January 16 and today, a significant drop worth noting. On Friday, the reserves on all exchanges stood at 82.642 trillion, with the meme coin’s price around $0.00000856.

However, at the time of writing on Monday, this figure has dropped considerably to 82.28 trillion $SHIB, marking a difference of 361 billion tokens. Interestingly, this comes despite a price drop over the weekend, which saw Shiba Inu retrace to $0.00000787.

Meanwhile, Binance recorded a considerable decline in its $SHIB reserve during this period, dropping from 62.53 trillion to 62.42 trillion. Notably, such inflows boost sentiment, especially as prices struggle.

What Does It Mean for Shiba Inu?

Specifically, outflows from exchanges typically suggest that investors are repositioning their holdings to self-custody wallets or other third-party systems. Usually, this means accumulation, as it suggests market users are moving to facilities that encourage long-term holding.

Additionally, it reduces immediate selling pressure. As fewer Shiba Inu tokens are available on exchanges, the amount of supply left for immediate sales reduces. Also, it shows commitment among Shiba Inu investors, as they prefer to hold for the long term rather than sell in the short term.

Remarkably, this accumulation trend reassures holders, especially considering that the token has corrected by 6.23% in the past 24 hours and 6.76% over the last seven days.

Meanwhile, it bears mentioning that exchange outflows alone are not enough to move the price, nor do they suggest that the underlying asset might recover. Hence, caution and due diligence remain key for an optimal investment.

thecryptobasic.com

thecryptobasic.com