While leading privacy coins such as Monero ($XMR), Zcash ($ZEC), and Dash ($DASH) have already reached multi-billion-dollar market capitalizations and posted strong gains, capital flows appear to be shifting toward lower-cap privacy coins.

January recorded notable accumulation activity in several mid- to low-cap altcoins. This may reflect whales’ positioning ahead of expectations that the privacy coin narrative will continue to attract capital in 2026.

1. Horizen ($ZEN)

Horizen is a privacy layer protocol built on Base, Ethereum’s Layer 2 network.

Horizen aims to deliver privacy while remaining compliant with regulations. The protocol enables institutions, enterprises, and users to conduct transactions and computations on-chain in a confidential, verifiable, and legally compliant manner.

$ZEN is currently a mid-cap altcoin with a market capitalization of over $226 million. In January, $ZEN rose more than 50%. Despite the rebound, it remains down by more than 90% from its 2021 peak.

$ZEN Holdings">

$ZEN Holdings">

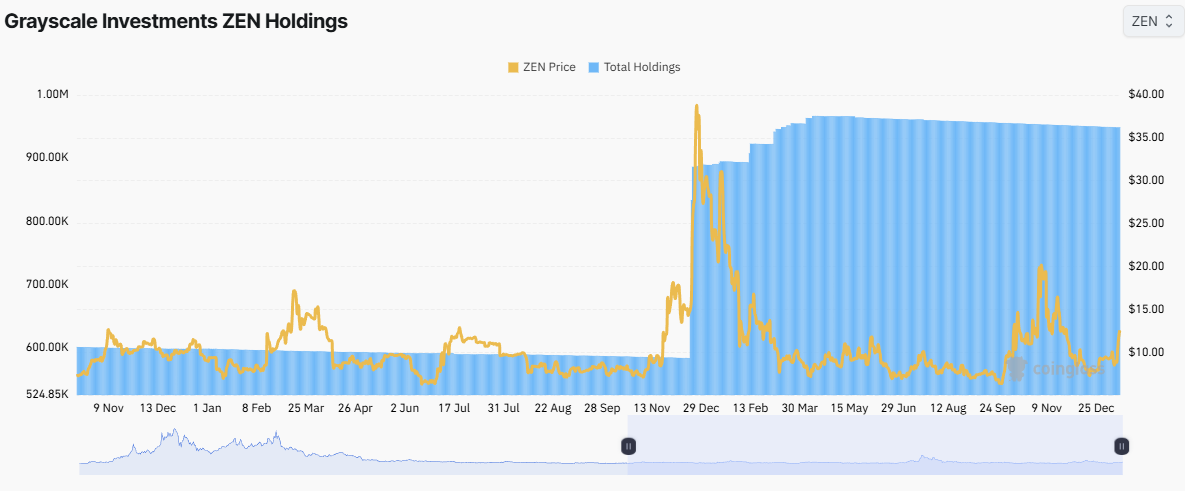

$ZEN is also part of Grayscale’s investment products through the Grayscale Horizen Trust. CoinGlass data shows that Grayscale has increased its $ZEN holdings since late 2024. The firm now holds more than 948,000 $ZEN, equivalent to over 5% of the circulating supply.

Grayscale’s continued accumulation, despite $ZEN falling more than 70% since the end of 2024, signals long-term conviction from Grayscale investors. Previously, Grayscale’s promotion was one of the key factors driving $ZEC’s rally last year.

Some investors believe that following the rallies in Monero ($XMR) and Dash ($DASH), Horizen ($ZEN) could be the next candidate.

“We’ve taken a big position in Horizen ($ZEN). This looks primed for an aggressive pump following big gains from $XMR and $DASH,” The Whale Pod said.

2. Railgun (RAIL)

RAILGUN is an on-chain privacy and security system built directly on blockchains such as Ethereum, BSC, Polygon, and Arbitrum.

Railgun uses zero-knowledge (ZK) cryptography to allow users to transact and interact with DeFi anonymously.

RAIL is the governance token of RAILGUN and currently has a market capitalization of over $165 million. Nansen data shows that over the past 30 days, RAIL balances on exchanges declined by more than 5%. At the same time, balances held by whale wallets increased by over 24%.

A report from Messari, an on-chain analytics platform, stated that in 2025, Railgun processed $2 billion in shielded and unshielded volume. This activity generated $5 million in revenue.

Railgun Quant, a researcher at Messari, noted that at prices below $3, RAIL may be undervalued. The token’s price could potentially double from current levels.

“Even at $3.10, $RAIL is trading at a discount of more than 50% to my RAILGUN valuation model’s base case of $6.26,” Railgun Quant said.

3. Decred ($DCR)

Decred ($DCR) is a Layer 1 blockchain that uses a hybrid Proof-of-Work (PoW) and Proof-of-Stake (PoS) consensus mechanism. The network also supports privacy-preserving transactions.

$DCR currently has a market capitalization of over $479 million. Accumulation trends are evident in the rising share of supply staked since Q4 2025.

Decred data shows that more than 10 million $DCR are now staked. This represents over 62% of the total supply and marks the highest ratio since March 2025.

Amid growing interest in privacy coins, Decred has entered the top 5 privacy coins by market capitalization on CoinGecko. Analysts expect the price to move beyond the current $27.6 level and potentially reach $60.

“$DCR just broke out of accumulation! Inverse head & shoulders confirmed. That shifts the market into markup mode!” analyst AltCryptoTalk predicted.

Experts continue to rate the privacy coin narrative highly for 2026. Large-cap privacy coins with multi-billion-dollar valuations may face pressure to profit-take. Low-cap altcoins carry higher liquidity risks. Mid-cap privacy coins may strike a balance between the two and hold potential to join the billion-dollar market cap club.

The post 3 Mid-cap Privacy Coins Saw Heavy Accumulation by Whales in January. appeared first on BeInCrypto.

beincrypto.com

beincrypto.com