Table of Contents

Litecoin, created by Charlie Lee in 2011, started as a quicker and more affordable alternative to Bitcoin, with its Scrypt proof-of-work system allowing 2.5-minute block times and fees often under a cent.

Over the years, it has built a reputation for reliable payments, integrating with services like BitPay and Travala, and adopting upgrades such as Segregated Witness in 2017 for better scalability and MimbleWimble Extension Blocks in 2022 for enhanced privacy.

By mid-2025, Litecoin held a market capitalization exceeding $6 billion and averaged 300,000 daily active addresses, solidifying its place in the cryptocurrency rankings. Yet, as platforms like Ethereum advanced with smart contracts, Litecoin's Layer-1 design, focused on simplicity and security, began to limit its reach into complex Web3 applications. This gap highlighted the need for a Layer-2 solution to expand functionality without altering the core protocol, leading to the development of LitVM.

What is LitVM?

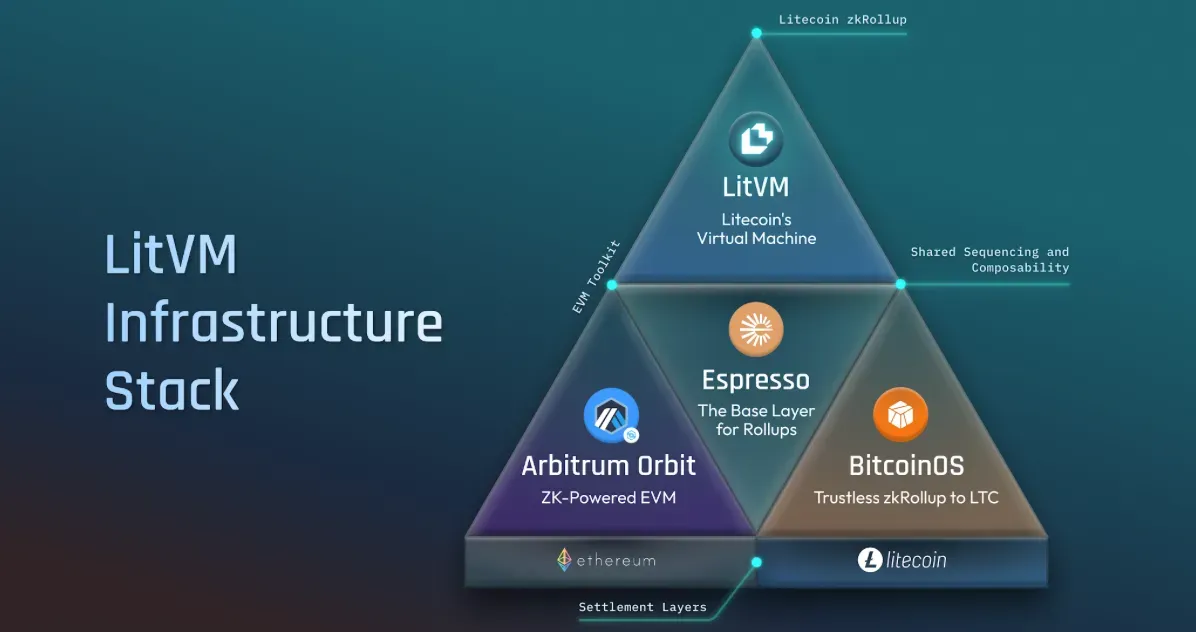

LitVM stands as Litecoin's virtual machine, an Ethereum Virtual Machine (EVM)-compatible Layer-2 chain designed to integrate smart contract capabilities into the Litecoin ecosystem. It operates as a zero-knowledge rollup, processing transactions off-chain for efficiency while anchoring results back to Litecoin's main chain through cryptographic proofs.

This setup supports trustless bridging of Litecoin-native assets, including $LTC, LRC20 tokens, Runes, Ordinals, and upcoming Charms, alongside Bitcoin and Ethereum assets. Developers can build applications in familiar languages like Solidity, tapping into Ethereum's extensive tools while benefiting from Litecoin's low-cost, fast settlements.

Endorsed by the Litecoin Foundation, LitVM focuses on creating demand for $LTC by enabling new sectors such as yield markets, real-world assets, and AI-driven apps, all while maintaining decentralization and interoperability with broader networks.

In essence, it transforms Litecoin from a payment-centric network into a programmable platform that complements Bitcoin's security and Ethereum's innovation.

Understanding the Technical Architecture

LitVM combines several established technologies to deliver high performance and security. It uses Arbitrum Nitro as the foundation for its rollup framework, providing an EVM-compatible environment that handles thousands of transactions per second at sub-cent fees.

This is enhanced by Succinct's zkVM, which adds zero-knowledge proofs to the optimistic rollup base, creating a hybrid system where transactions achieve fast finality with optional cryptographic verification for cross-chain bridging. BitcoinOS, adapted from its Bitcoin origins, enables trustless bridging and programmability, leveraging Litecoin's Scrypt consensus for rapid 2.5-minute settlements.

Espresso's decentralized sequencer further strengthens the setup by distributing block ordering across a network of nodes, ensuring censorship resistance and fair transaction inclusion through the HotShot consensus protocol.

Key components include:

- Scalability mechanisms: Off-chain processing with zkSNARKs for compact proofs verified on Litecoin's Layer-1.

- Interoperability features: Dual settlement on Ethereum for access to its liquidity, combined with bridges to Bitcoin and other chains.

- Privacy integrations: Building on Litecoin's MimbleWimble for shielded transactions in compatible applications.

- Customization options: Use of zkLTC as the native gas token, aligning costs with Litecoin's economy.

This architecture not only preserves Litecoin's proof-of-work integrity but also opens doors to EVM ecosystems, allowing seamless developer migration and asset composability across chains.

What is the Rollout Strategy and Timeline?

LitVM's deployment follows a phased approach to ensure stability and gradual integration with Litecoin's mainnet.

Phase 1, known as "First Lite," involves launching an Arbitrum Orbit rollup settled initially on Ethereum, complete with a trustless Litecoin bridge powered by BitcoinOS's Grail framework. Users can lock $LTC on the base layer to mint zkLTC for use as gas and base assets, enabling immediate smart contract functionality without changes to Litecoin's consensus. Espresso handles decentralized sequencing from day one.

In Phase 2, "Silver Anchor," finalized batches and their zkVM proofs anchor directly to Litecoin via inscribed cryptographic fingerprints, creating a verifiable history secured by Litecoin's accumulated proof-of-work. This step enhances sovereignty, allowing independent verification even if Ethereum faces issues.

Phase 3, "Litecoin Canonization," transitions Litecoin to the primary settlement layer after proven reliability. Through a client upgrade, nodes validate Litecoin headers, phasing out Ethereum dependency and deriving finality from Litecoin's hash power. The entire process requires no hard forks on Litecoin itself.

The timeline began with announcements at the 2025 Litecoin Summit, followed by a planned testnet launch in early 2026. Mainnet activation is expected shortly after, with ongoing community updates via platforms like X, where recent posts highlight ecosystem growth and engagement initiatives.

How Does LitVM Evolve Litecoin's Use Cases?

LitVM extends Litecoin's traditional payment role into a versatile Web3 ecosystem by enabling programmable features. For instance, in decentralized finance, it supports trading $LTC and cross-chain assets on automated market makers, $LTC-backed lending, and yield farming with stablecoins, fostering a DeFi hub with institutional strategies.

Real-world assets gain from tokenization, where commodities like gold or real estate become fractionalized Ordinals or LRC20 tokens, managed by smart contracts and oracles for broader access.

AI integration stands out, allowing autonomous agents to handle wallets, trade, or earn royalties at low costs, while consumer apps simplify Web3 onboarding. Payments evolve with programmable scripts for subscriptions and microtransactions, enhanced by privacy options.

Gaming benefits from low-latency play-to-earn models using $LTC rewards, and NFTs thrive through marketplaces with royalties and cross-chain listings.

Recent data shows Litecoin's on-chain volume surging from $8 billion to over $22 billion daily in 2025, underscoring growing activity that LitVM can amplify. By bridging with Ethereum and Bitcoin, it creates opportunities for developers and users, driving adoption through grants and hackathons.

Conclusion

LitVM marks a significant step for Litecoin, addressing scalability and programmability while upholding its foundational principles. Through its hybrid rollup design and phased rollout, it positions Litecoin as a competitive player in Web3, supporting diverse applications from DeFi to AI.

As testnet plans advance in 2026, the ecosystem could see increased $LTC utility and community involvement, potentially enhancing Litecoin's long-term relevance in digital finance. Readers interested in participating can explore official resources for updates on development and incentives.

Sources:

- LitecoinVM on X: Announcements and ecosystem updates.

- LitVM Website: General information and resources.

- LitVM Blog: "Introducing LitVM: Litecoin's ZK Omnichain" (2025).

- LitVM Blog: "Birth of Sound Money Web3" (2025).

- GlobeNewswire: "Litecoin’s ZK Omnichain LitVM Unveiled at Litecoin Summit" press release (2025).

bsc.news

bsc.news