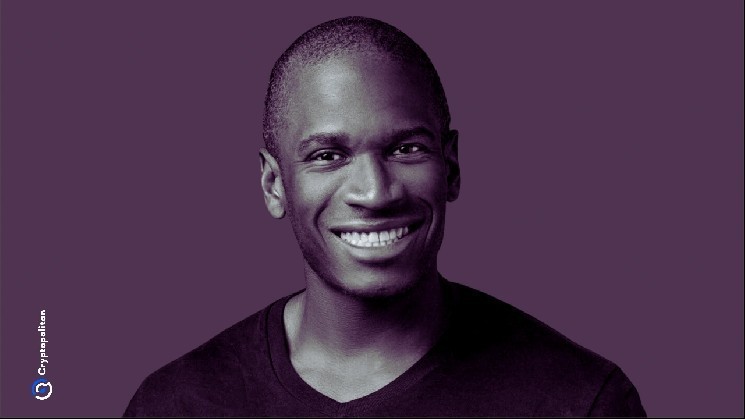

Chief investment officer at Maelstrom Arthur Hayes, who also serves as a founding advisor to Ethena since 2023, responded with excitement to South Korea’s largest cryptocurrency exchange, Upbit’s announcement of new trading support for Ethena’s synthetic stablecoin, $USDe. The executive made a bullish call of Ethena’s $ENA racing to $1 in an expletive-enhanced post.

The development comes as Dubai’s financial regulator excluded $USDe from its approved stablecoin framework.

Hayes, who serves as chief investment officer of his family office Maelstrom and has been a founding advisor to Ethena since 2023, responded to the Upbit announcement on social media platform X, writing, “Giddy up b*tches! it’s time for $ENA = $1.”

The token went up by over 8.3% following the announcement and is currently priced at $0.238.

The listing, which went live at 6 pm Korean Standard Time on January 14, 2026, offers trading pairs against the Korean won, Bitcoin, and Tether’s $USDT across the Ethereum network.

How does Ethena’s $USDe work on Upbit?

It has long been established that $USDe is not a regular stablecoin, as it separates itself from traditional fiat-backed stablecoins like $USDT and $USDC through its delta-neutral structure, which combines spot cryptocurrency collateral with offsetting short positions in perpetual futures contracts.

The stablecoin is the third largest by market capitalization, coming behind $USDT and $USDC, respectively. Last year, an internal glitch in Binance’s platform caused the token to briefly depeg.

According to Upbit’s statement, “$USDe maintains a short position in a derivatives product of the same nominal value while holding cryptocurrency collateral, thereby maintaining stability close to the value of $1.”

Upbit shared the $USDe address that it supports, informing users to check the contract address when depositing or withdrawing $USDe.

Hayes, a long-term believer in the Ethena project, has shown his conviction through sustained accumulation of $ENA over the years. Most recently, on-chain analytics show he purchased 1.22 million $ENA tokens worth approximately $257,500 in late December 2025.

Dubai says no to $USDe

The Upbit listing occurred just a few days after the Dubai Financial Services Authority (DFSA) updated its Crypto Token Regulatory Framework, which took effect on January 12. The latest update reserves the “fiat crypto tokens” designation exclusively for stablecoins backed by fiat currency reserves held in segregated accounts with regulated custodians.

Elizabeth Wallace, associate director for policy and legal at the DFSA, reportedly stated, “Things like algorithmic stablecoins, it’s a little less transparent about how they operate and being able to redeem them.”

As Cryptopolitan reported, Wallace made it known that stablecoins like $USDe would not meet the Dubai International Financial Centre’s definition of a stablecoin, but stopped short of outrightly banning it.

“The token would be considered a crypto token,” she said. The DFSA’s approved list includes only Circle’s $USDC and EURC, along with Ripple’s RLUSD.

To qualify, stablecoins must maintain reserves at least equal to outstanding tokens, denominated in the reference currency, held in highly liquid assets that carry minimal credit risk. The regulator also mandated that the accepted stablecoins publish their reserve information, which is independently verified monthly.

cryptopolitan.com

cryptopolitan.com