Bitwise has secured regulatory approval to launch a Chainlink exchange-traded fund (ETF) in the United States.

The move marks another milestone in the expansion of regulated crypto investment products. The ETF will trade on NYSE Arca under the ticker CLNK, offering investors direct price exposure to Chainlink’s native token, $LINK, through a traditional market structure—without the need to hold or manage the underlying asset.

Key Data Points

- The Bitwise spot Chainlink ETF will trade on NYSE Arca under the ticker CLNK.

- Approval followed the firm’s Form 8-A filing with the U.S. Securities and Exchange Commission, with trading expected to begin this week.

- The fund carries a 0% management fee for its first three months on assets up to $500 million.

- It launched with $2.5 million in seed capital, representing 100,000 shares priced at $25 each.

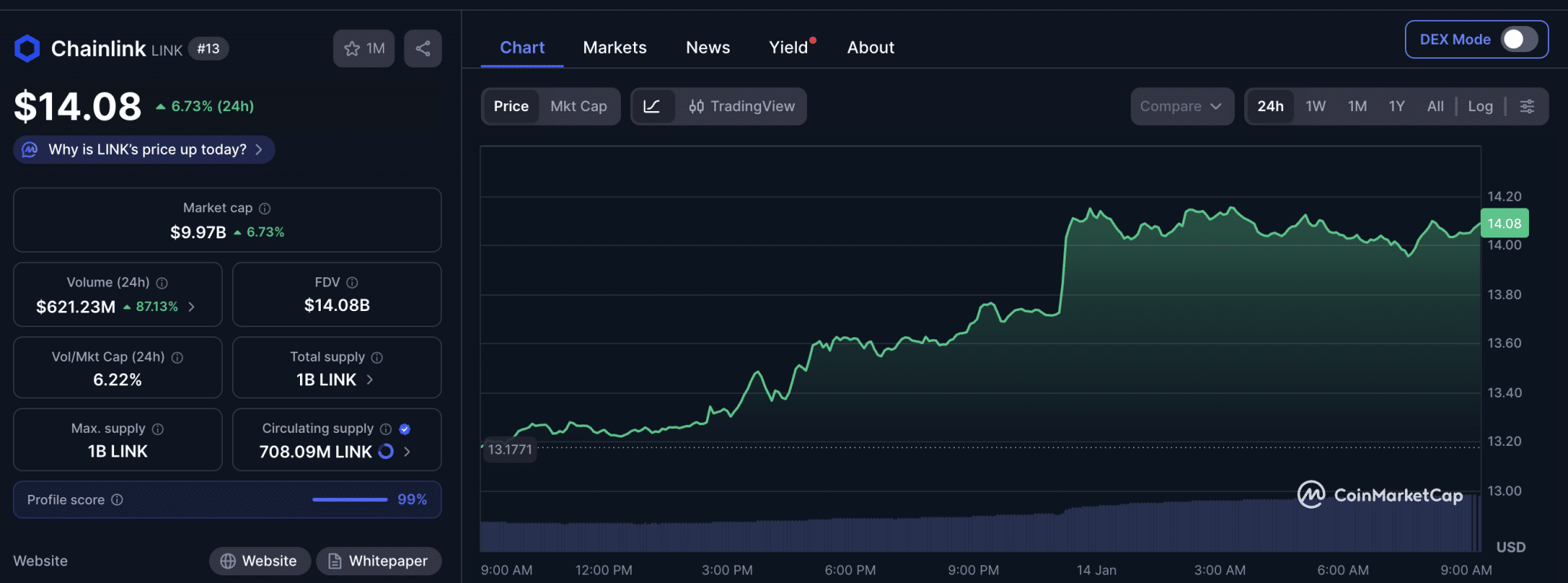

- $LINK rose more than 6% over the past 24 hours, trading near $14, according to CoinMarketCap data.

Regulatory Approval Broadens Investor Access

With regulatory clearance secured, the ETF allows investors to track Chainlink’s price performance without directly owning $LINK. The approval follows Bitwise’s completion of its required Form 8-A registration with the SEC. The firm currently manages approximately $15 billion in crypto-related assets.

This approval builds on the broader acceptance of spot crypto ETFs in the U.S. market. Consequently, investor access is expanding beyond Bitcoin and Ethereum into select altcoins.

Fee Structure and Fund Setup

To encourage early adoption, Bitwise is waiving management fees for the fund’s first three months, or until assets reach $500 million. After the introductory period, the ETF will be subject to a 0.34% per-annum management fee, in line with comparable crypto investment products.

At launch, the fund was seeded with $2.5 million. Coinbase Custody will safeguard the $LINK holdings, while BNY will provide cash custody services, offering institutional-grade infrastructure and risk controls.

Bitwise has also identified staking as a potential future enhancement. While no timeline has been confirmed, the firm has named Attestant Ltd. as its preferred staking provider should the feature be introduced.

Market Reaction to the Announcement

$LINK saw increased market activity immediately following news of the ETF approval. Specifically, the token gained more than 6% within 24 hours, accompanied by a nearly 80% surge in trading volume, signaling renewed trader engagement.

Derivatives metrics supported the move. Futures open interest climbed to approximately $665 million, indicating fresh capital inflows rather than transient speculative activity.

Commenting on the price action, analyst Ali Martinez noted on X that $LINK could advance toward $14.63, which he identified as the upper boundary of the current trading channel. He added that no significant resistance appears to stand in the way before that level.

Positioning Within the $LINK ETF Landscape

The Bitwise fund becomes the second U.S.-listed spot ETF tied to Chainlink. It follows the recent conversion of Grayscale’s Chainlink Trust into a spot ETF, now trading under the ticker GLNK. Since its approval last month, GLNK has accumulated $87.5 million in assets, according to available data.

Taken together, these developments highlight the growing range of regulated, institutional-grade avenues for $LINK exposure in U.S. markets.

thecryptobasic.com

thecryptobasic.com