Circle’s $USDC has overtaken Tether’s $USDT in annual transaction volume for the first time, marking a historic shift in the stablecoin landscape.

For a decade, $USDT has reigned as the undisputed king of stablecoins. It still commands a $187 billion market cap—nearly 2.5 times $USDC’s $75 billion market cap. Yet 2025 revealed a different story beneath the surface: the smaller stablecoin is now moving more money.

$USDC Leads by 39%

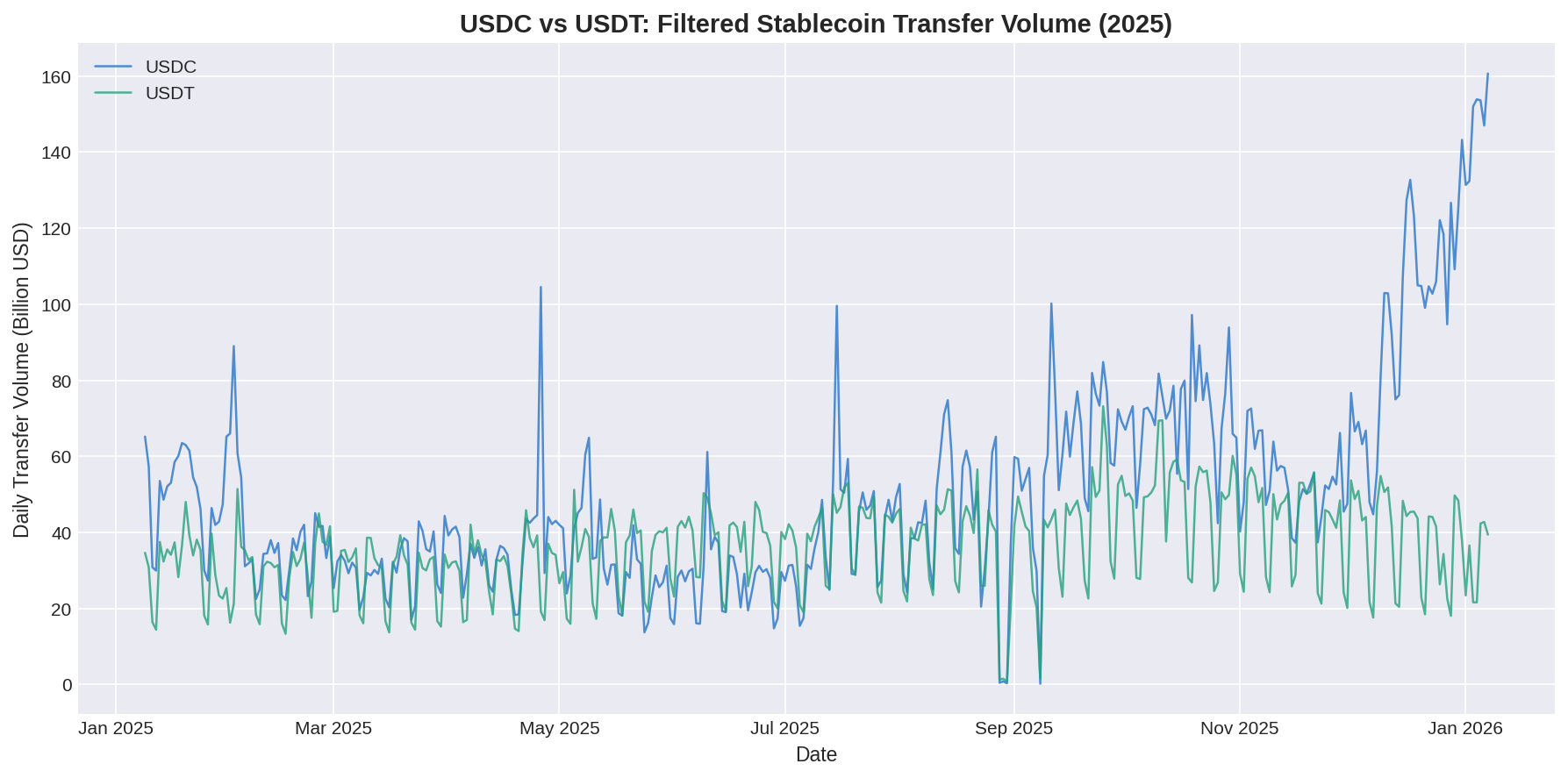

According to data from Artemis Analytics, $USDC processed $18.3 trillion worth of transfers in 2025, compared to $USDT‘s $13.2 trillion—a 39% gap.

Artemis Stablecoin Transfer Volume filters out MEV bot transactions and intra-exchange transfers, isolating the platform’s “organic” on-chain activity. This metric provides an upper bound on actual payments and DeFi usage, rather than raw transaction counts inflated by automated trading. In short, real-world payments, P2P transfers, and DeFi activity count; automated bot trades and exchange wallet reshuffling do not.

Why $USDC Pulled Ahead

The gap comes down to four factors: how DeFi works, where it’s happening, an unexpected catalyst, and regulatory timing.

1. DeFi Turnover

Analysts attribute the gap largely to how each stablecoin is used. $USDC dominates decentralized finance platforms, where traders frequently enter and exit positions. The same dollar gets recycled multiple times through lending protocols and DEX swaps. $USDT, by contrast, serves more as a store of value and payment rail—users tend to hold it in wallets rather than move it constantly.

2. The Solana Factor

Solana’s explosive DeFi growth became $USDC’s primary engine. The stablecoin now accounts for over 70% of all stablecoins on the network, while $USDT remains concentrated on Tron. In Q1 2025 alone, Solana’s total stablecoin supply surged from $5.2 billion to $11.7 billion—a 125% increase driven almost entirely by $USDC inflows.

3. The Trump Token Irony

The January 2025 launch of the $TRUMP memecoin inadvertently supercharged $USDC adoption. The token’s primary liquidity pool on Meteora DEX is paired with $USDC, not $USDT. This meant traders rushing to buy $TRUMP first needed to acquire $USDC, creating a demand spike that rippled across Solana’s DeFi ecosystem.

The irony runs deeper: the Trump family launched its own stablecoin, USD1, through World Liberty Financial in March. Yet the $TRUMP token they inspired ended up boosting a competitor’s stablecoin.

4. Regulatory Tailwinds

The July passage of the Genius Act in the US established clear legal standards for stablecoin issuers. Industry observers note that $USDC’s longstanding emphasis on regulatory compliance and reserve transparency positioned it to benefit most from the new framework. In Europe, $USDC’s MiCA compliance has given it an edge amid delisting pressure on several exchanges facing $USDT.

A Rising Tide

The $USDC surge contributed to record stablecoin activity overall. Total transaction volume reached $33 trillion in 2025, up 72% year over year. Q4 alone saw $11 trillion in flows, accelerating from $8.8 trillion in Q3.

Bloomberg Intelligence projects stablecoin payment flows could reach $56 trillion by 2030, positioning the sector as a major global payment rail alongside traditional networks.

The post $USDC Finally Beats $USDT: Here’s How Solana and Trump Made It Happen appeared first on BeInCrypto.

beincrypto.com

beincrypto.com