January has begun with a notable shift in liquidity dynamics in the cryptocurrency market, with more than $670 million in net stablecoin inflows on Binance in just one week.

The return of capital to the world’s largest exchange by trading volume suggests a change in investor positioning. This comes after a challenging December, marked by heightened risk aversion across cryptocurrency markets.

Stablecoin Flows Reflect Shifting Market Confidence

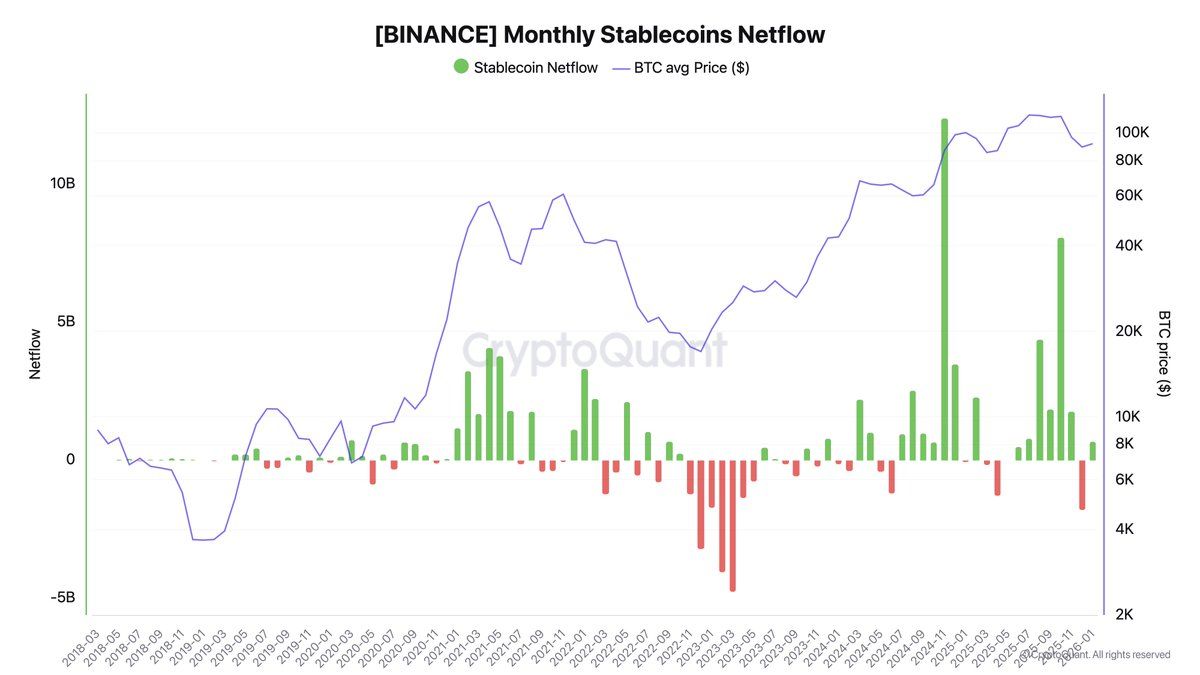

In a recent post, on-chain analyst Darkfost examined how stablecoin movements on Binance evolved over the past few months, offering insight into changing investor behavior. According to the analyst, October proved to be an exceptional period for liquidity. The exchange saw over $8 billion in net stablecoin inflows.

“Such a level is rarely observed, notably due to the crash that occurred on October 10, which created attractive opportunities,” the analyst said.

Nonetheless, the momentum faded in November. Net inflows declined to approximately $1.7 billion. This signaled a slowdown in demand and a more cautious approach from market participants.

The trend reversed entirely in December, when Binance recorded more than $1.8 billion in net stablecoin outflows. Such outflows typically indicate a reduced risk appetite, as investors prioritize capital preservation over taking on new positions.

“Binance itself may also have contributed to these outflows, as weakening demand could have led the exchange to reduce part of its stablecoin holdings in order to adjust its reserve levels,” the post read.

However, the analyst noted that January began on a very different note. Binance experienced more than $670 million in net stablecoin inflows in a week.

Darkfost interprets the renewed liquidity entering Binance as an early sign that investors are beginning to reposition, possibly in anticipation of new trading opportunities.

“When stablecoins flow into exchanges, it generally reflects buying intent or highlights demand that the exchange needs to accommodate,” the analyst stated. “This suggests that interest is gradually returning to the platform with the highest trading volumes, and that part of the liquidity is beginning to reposition in anticipation of new opportunities.”

Beyond the recent inflows, another indicator suggests that sidelined capital may be starting to re-enter the market. In a separate analysis, Darkfost observed that Binance’s Bitcoin-to-stablecoin ratio has begun to trend upward again.

This metric is commonly used to gauge the amount of purchasing capacity available on the exchange, and its recent movement points to potential early stages of liquidity deployment rather than continued sidelining.

“This ratio has started to move higher again. This shift could mark the early stages of a gradual deployment of sidelined liquidity, which would represent a very positive signal for the market,” the analyst remarked.

Solana Ecosystem Sees Record Stablecoin Growth

While Binance’s inflows drew attention, Solana witnessed an even more dramatic jump in stablecoin activity. The network’s stablecoin supply grew by over $900 million in just 24 hours, according to data from The Kobeissi Letter.

This rapid influx outpaced changes on other networks and contrasted with declines on platforms like Tron. Two major developments coincided with this spike in Solana’s stablecoin supply.

Jupiter launched its own stablecoin. Additionally, Morgan Stanley submitted initial filings for three cryptocurrency exchange-traded products, including the Morgan Stanley Solana Trust, marking significant institutional interest in Solana.

An analyst emphasized that the network’s low costs and fast finality allow incoming liquidity to be put to work fast.

“In practical terms, more stablecoins on $SOL means more capital available for trading, settlement, and application activity,” MilkRoad stated.

Thus, the convergence of renewed stablecoin inflows on Binance, rising on-chain stablecoin supply, and overall growth in market cap points to the early stages of capital re-engagement across the cryptocurrency market.

The key question is whether these inflows reflect a sustained shift in market positioning or just short-term tactical adjustments amid ongoing volatility.

The post What $670 Million in Stablecoin Inflows Could Signal for Crypto Markets appeared first on BeInCrypto.

beincrypto.com

beincrypto.com