Lighter (LIT), a decentralized perpetual contract exchange token used for trading, governance, and staking in DeFi, is attracting market attention among cryptocurrency users, according to data revealed by market analyst Onchain Lens. As per the data posted today by the analyst, a 7-day-old wallet deposited $2 million in USDC into the Lighter’s decentralized perpetual futures exchange to increase the size of its LIT tokens, an indicator of robust conviction in the digital asset’s capability.

Transactions flagged by the analyst show that in the past seven days, the whale deposited $4 million USDC in the Lighter’s trading platform and purchased massive 1,285,010 LIT tokens for $3.8 million at an average price of $2.96. On-chain analysis indicates that the whale’s wallet still has $193,717 USDC, highlighting the trader’s intent to purchase more LIT tokens.

A 7-day-old wallet deposited $2M $USDC into #Lighter to increase its LIT size.

— Onchain Lens (@OnchainLens) January 7, 2026

In the past 7 days, the whale deposited $4M $USDC and bought 1,285,010 $LIT for $3.8M at a price of $2.96 and still has $193,717 $USDC left to buy more.https://t.co/xpT35N9U7C pic.twitter.com/9BswQ8GeoU

What Drives Whale Lighter Accumulation

The whale’s aggressive buying activity shows strong confidence in the LIT cryptocurrency. Several factors recently attracted large investors’ appetite for the Lighter token. The first catalyst is that Lighter is one of the multiple perpetual futures exchanges that have drawn crypto investors’ interest in recent months. Lighter, a newly launched perpetual futures DEX platform launched last year, rolled out its native token on December 30, 2025, a reason why savvy investors are craving to invest in this new digital asset to position themselves for potential future price growth.

By functioning as a DEX perpetual futures exchange, Lighter has garnered investor interest because the platform lets traders speculate without owning assets directly, making it attractive to both institutional and retail investors. The platform allows customers to bet on crypto price movements, normally with high leverage that can generate high returns and great risks.

Just like competitors such as Hyperliquid, Aster, and EdgeX, traders prefer the Lighter decentralized perpetual exchange because the platform delivers rapid executions without users giving up their asset control. Furthermore, the platform also combines transparency, functionalities of CEX (centralized exchanges) like Binance and others, and DeFi self-custody into one interface, making it convenient for crypto traders.

The second factor that draws investor interest into the Lighter trading platform is the recent buyback program that the exchange launched to maximize its token’s long-term value to asset holders.

LIT Price Pump and Token Buyback

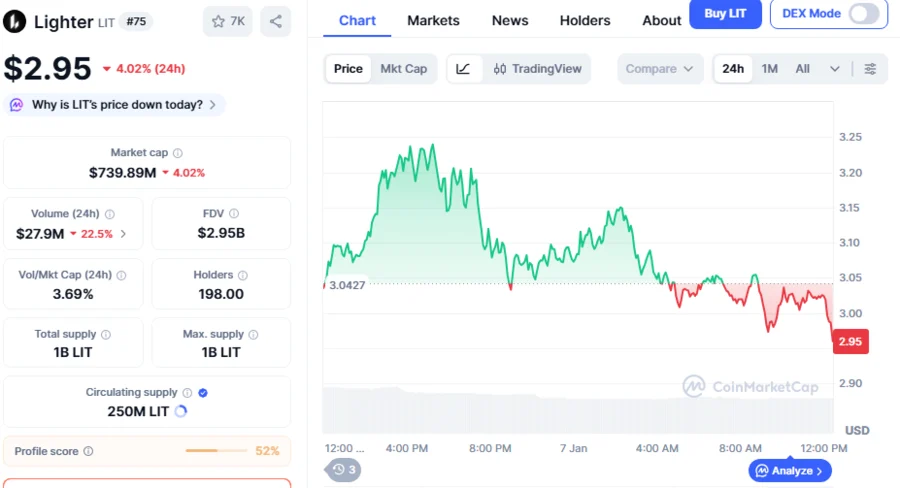

LIT price, which currently trades at $2.95, today is down 0.8% over the past 24 hours, but has been up 11.0% in the last seven days, its first week of trading. The week’s price surge reflects sustained enthusiasm from both big traders and retail investors.

Yesterday, January 6, 2026, Lighter started its scheduled buyback program, using revenues generated from its exchange products to purchase LIT tokens on the public market to reduce token supply, create value for investors, and bolster market confidence.

Normally, transaction fees, protocol services, and other on-chain activities are the key sources of revenue for several crypto projects. By using such sources to buy back its own LIT tokens, Lighter shows its commitment to supporting its token’s future price growth. Lighter appears to imitate a strategy recently deployed by some of its competitors. In September 2025, Hyperliquid launched a similar token buyback mechanism to fuel the growth of its HYPE token.